Autumn Statement 2022 preview: how you could be paying more tax in 2023

1st November 2022 14:06

by Alice Guy from interactive investor

With a new chancellor and prime minster on the hunt for cash, what tax rises and spending cuts should we expect in the Autumn Statement?

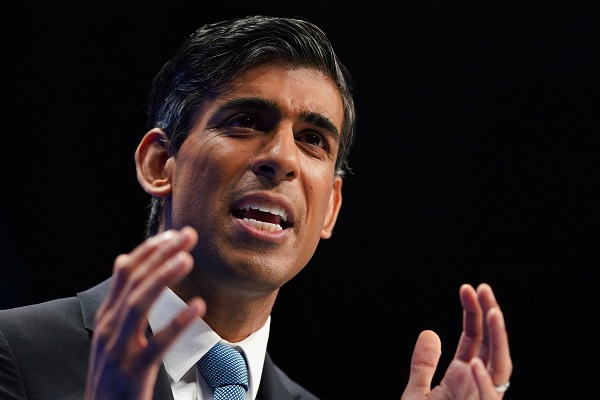

Rishi Sunak has a black hole to plug in government finances and he is on the prowl for cash. While previous tax U-turns will fund some of the missing billions, Sunak has warned that more tax rises and spending cuts will be needed.

Chancellor Jeremy Hunt is understood to be looking for £25 billion of tax rises as well as major reductions in spending by government departments.

All eyes are on the Autumn Statement on 17 November to see where Sunak and Hunt will take aim. With limited options, many are predicting that they could target the state pension as well as freezing income tax and national insurance thresholds.

More money needed

Government insiders today revealed to the Telegraph that, “It is going to be rough.” The source continued that, “The truth is that everybody will need to contribute more in tax if we are to maintain public services.

“After borrowing hundreds of billions of pounds through Covid-19 and implementing massive energy bills support, we won’t be able to fill the fiscal black hole through spending cuts alone.”

They also suggest billions more is needed to help an NHS on its knees after the Covid pandemic. They fear that without more money, waiting lists will grow larger and longer than currently expected.

Tax rises

Fiscal drag

The PM and his chancellor are believed to have ruled out increasing rates of income tax, national insurance and VAT. But Sunak is rumoured to be considering extending fiscal drag and keeping tax thresholds frozen until 2028, rather than 2026 as currently planned. This would mean that more and more taxpayers are dragged into paying basic rate and higher rate tax as their wages rise with inflation.

This policy would not raise any short-term revenue for government coffers, but it would be a sign of intent for the markets and could reassure them that the new PM, a former chancellor himself, has a grip on the finances.

Extending fiscal drag would also have the advantage of pushing the tough political decisions into the future as it would be the government after the next election that makes the final decision.

Pension tax relief

Cutting pension tax relief would give a big boost to the Treasury, but it would also be hugely controversial as it would undermine a key part of the UK pension system.

A little-known fact is that pension tax relief is actually the second tier of the UK state pension system.

Many countries around Europe have a much more generous state pension based on paying in a percentage of your earnings into the state pension over your working life. In contrast, the UK has a fairly small flat-level state pension. This is topped up by your workplace and private pension, which is supplemented by tax relief.

For this reason, cutting pension tax relief will be extremely difficult. It would significantly reduce the pension savings and financial security of millions in the UK.

Unravelling the current system would be a complex task and would likely need a detailed government review.

Other tax rises

With income tax, national insurance and VAT rises ruled out, and pension tax relief difficult to change, it’s likely that other stealth tax rises will be on the cards. Capital gains tax, inheritance tax, stamp duty and corporation tax could all be on the menu as well as other possible wealth taxes.

More will become clear in the coming weeks as the inevitable leaks begin to surface.

Spending cuts

Triple lock

The will-they won’t-they guessing game over the triple lock is bordering on the ridiculous. But it’s important that U-turn fatigue doesn’t distract us from the important issues. The triple lock is still a manifesto commitment and scrapping it would be hugely controversial.

The triple lock was suspended in 2022 but earlier this year, the then chancellor Rishi Sunak, reinstated it for 2023.

Nevertheless, suspending the triple lock looks increasingly likely as rampant inflation and the resulting massive hike in the state pension will be a big hit to government coffers. The state pension costs the taxpayer an eyewatering £100 billion per year, and the government have limited options elsewhere. Government messaging that all across the UK will have to bear some of the pain also suggests the triple lock could be scrapped.

Suspending the triple lock could be popular with younger voters but would cost pensioners £444 per year. It would mean that the full state pension rises to £10,156, rather than £10,600 in April 2023. That’s because rather than increasing by inflation (currently 10.1%) the state pension would instead increase by average wage rises (a lower 5.5%).

State pension age

State pension age changes are also likely to be accelerated next year, saving the government around £5 billion per year.

The government's pensions review, led by Baroness Neville-Rolfe, will report in May 2023, and it is expected to recommend bringing forward the state pension age changes. The review will assess people’s life expectancies compared with their retirement years. It’s based on the principle that most people should only spend one-third of their life in retirement.

A 2017 review suggested bringing forward the age changes to 2037-39, meaning that today’s 50-year-olds would also have to wait until they turn 68 to get their state pension. And at the Tory party conference in September, Liz Truss refused to rule out raising the state pension age.

- State pension age could rise earlier than planned

- State pension age: why changes could leave a hole in your pension

The current state pension age is 66, but will rise to 67 between 2026 and 2028, and again to 68 between 2044 and 2046. That means if you’re 43 or under, you will have to wait until you’re 68 years old to receive the state pension, and if you’re 60 you’ll only get the state pension when you turn 67. If you’re currently just over 43 or 60, you can check the state pension website as your state pension age will depend on your birthday.

Other possible savings

There are also rumours that Rishi could be eyeing public sector pay as he looks for savings. He could offer 2% pay rises across the board rather than raising public sector pay in line with inflation.

This policy could be particularly controversial, especially if the state pension rises with inflation. But if the level of tax rises and spending cuts is as dramatic as expected, a battle with the unions could be the least of the new chancellor’s worries.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.