Assessing the future path for global interest rates

Has there been a structural shift to higher policy rates and yields or will global interest rates head back to their pre-pandemic lows and resume their downward trend? Read our research.

15th September 2023 12:21

by abrdn Research Institute from Aberdeen

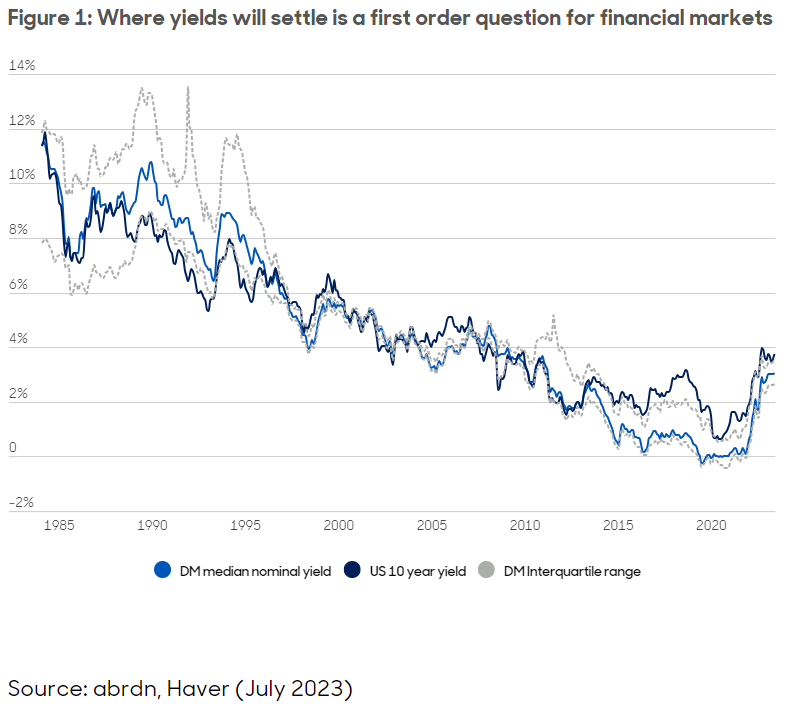

Before the pandemic, global interest rates had been on a gradual downward trend in both developed (DMs) and emerging markets (EMs). Then, in 2022, they started rising sharply in response to a surge in global inflation. A key question is whether there has been a structural shift to higher policy rates and yields or whether global interest rates will head back to their pre-pandemic lows and potentially resume their downward trend.

To answer this question, we explore key influences on long-term interest rates for 29 major economies accounting for almost 90% of the world economy, ranging from demographics through to inequality and the global financial system.

We show why those expecting demographic shifts or ‘greenflation’ to keep interest rates high will likely be proved wrong and how growth prospects often matter more in determining where they will eventually settle than ageing populations, investment trends or inequality.

Star gazing is a necessity for investors

Interest rates are the price of money, and, as such, they influence not just the cost of debt, but also the full spectrum of asset prices. Lower rates raise the discounted value of firms’ revenues, boosting stock prices, for example.

Where policy rates will settle is a matter of fierce debate and in the medium- to long-term will be determined by the forces operating on real equilibrium interest rates (r*).

The equilibrium interest rate is a nebulous theoretical concept. It is closely related to economic growth and is also the interest rate that balances an economy’s supply of savings with the demand for investment. Both are influenced by a wide range of factors operating over differing time horizons.

What drives r*?

Growth and the other factors that influence the interplay of savings and investment balances – such as demographics, technology, inequality, and government fiscal policy – determine r* over the long-term and therefore the level of policy rates and yields.

Stronger potential growth raises the rate of return on investments, spurring demand for funds to invest in physical assets, while expectations of stronger future income growth can support household consumption by reducing the need to save.

Demographics can drive r* via two channels that may push in opposite directions and illustrates why it is necessary to consider the net balance of the forces operating on interest rates.

In an ageing society fewer workers on the one hand, reduce the number of savers and put upward pressure on interest rates, but on the other hand, also push down on potential economic growth. This means the net impact of demographics on r* will reflect the balance of these effects.

Other potential drivers, such as inequality and technology, operate along similar lines. Since high-income households tend to save a larger share of their income, inequality tends to increase aggregate savings, bearing down on r*. Similarly, automation makes low-income workers vulnerable to displacement – potentially also increasing inequality - while highly scalable technology can lead to a concentration of technological behemoths, boosting corporate savings piles.

How will demographics, inequality and the global financial system influence r* going forward?

Whether economies can age gracefully will depend on a complex combination of their growth trajectories, policy choices, and real interest rates.

The interconnected nature of the financial system also overlays a global aspect to interest rates, potentially magnifying strengths and weaknesses via debt dynamics and the sustainability of social welfare models.

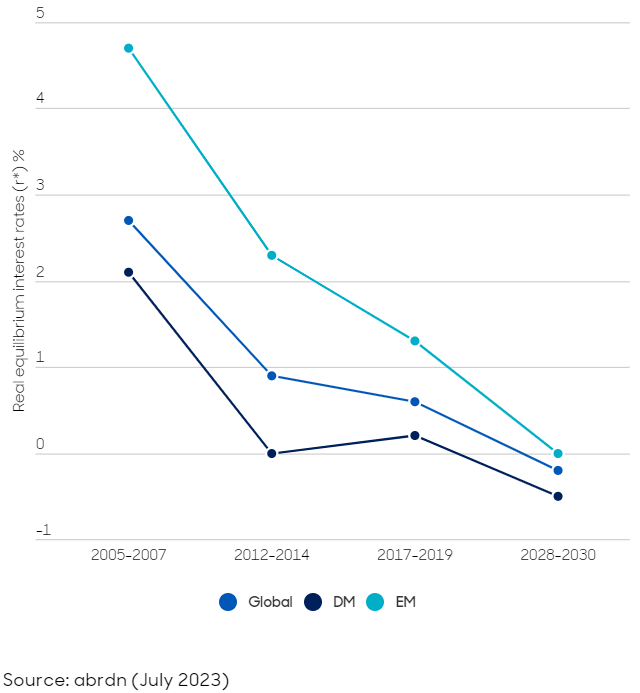

Our research rejects the notion that the Covid shock combined with long-run structural changes, such as aging populations, has ushered in a new era of permanently high global interest rates. In fact, our modelling work suggests that, while real equilibrium interest rates have temporarily moved higher, they will continue declining over the long run. Indeed, they may eventually fall below pre-pandemic lows.

Indeed, while demographic trends are becoming more adverse as populations age, the impact on real equilibrium rates from higher dependency ratios and faster ageing continue to be more than offset in most countries by downward pressure from the slower growth in working age populations.

Additionally, while we have incorporated damage to growth from the Covid shock, we think that the balance of risks from economic scarring, inequality and technology and the potential for lower fertility rates in the long run give further weight to our assessment, suggesting that r* will rarely face upward pressure.

Even if green investment and AI drive more intensive investment and higher potential growth, our modelling suggests that this may only halve the expected drop in global r* and thus, not prove significant enough to stop the downtrend in economies’ r*.

Written by Robert Gilhooly,Senior Emerging Markets Research Economist at abrdn Research Institute,and Michael Langham,Emerging Markets Analyst at abrdn Research Institute.

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.