The Asian century? It’s only just begun

31st May 2023 11:00

by abrdn Research Institute from Aberdeen

Asia’s future looks bright. We set out 5 fundamental reasons why we believe Emerging Asia is set to deliver economic outperformance up to 2050 and beyond.

More than any other region in the world, Emerging Asia has the foundations in place to deliver economic outperformance to 2050 and beyond. Robert Gilhooly, senior economist at abrdn, outlines five reasons why Asia’s future is looking especially bright.

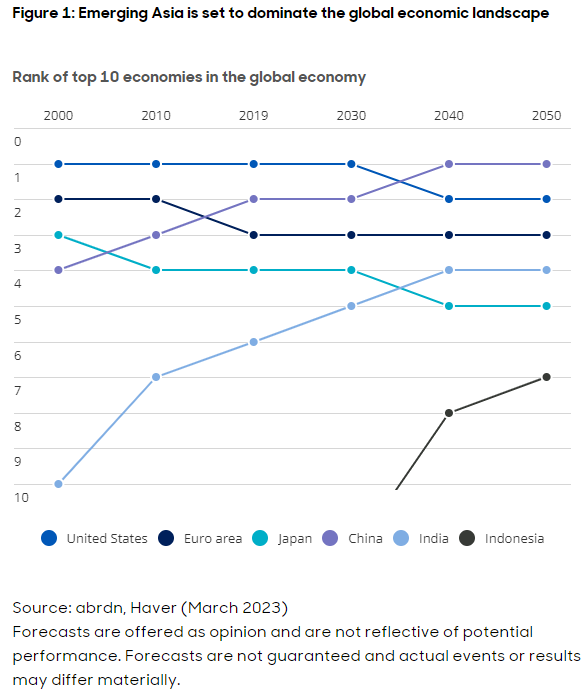

1. By 2050, four of the world’s seven largest economies will be in Asia…

It’s widely reported that China looks set to overtake the US as the world’s largest economy. We anticipate this could happen by around 2035. But India, too, is charging up the league tables and could even take fourth place by the early 2030s. Our projections also suggest Indonesia is set to be the world’s seventh large economy by the mid-2040s.

Including Japan at fifth spot, that means Asia will be dominating the global economy over the second half of this century.

And in ‘developing Asia’, our analysis shows the Philippines, Pakistan, Bangladesh and Vietnam are all looking set to break into the top 25 global economies.

2. …and Emerging Asia could account for 58% of global growth by 2050

Global growth is set to slow from around 2.5% a year to 1.5% a year by 2050 – in part due to less support from population growth in major economies.

But our analysis shows Asia should still be able to outperform, thanks to a more favourable demographic backdrop (of which more below) and the scope for economies to play ‘catch up’ with their more developed peers. For example:

Income levels are still relatively low in many Asian countries

There is still massive potential for workers to move out of agriculture and into more productive manufacturing and service jobs

Many Asian firms have yet to reap the efficiencies of technology and industry-leading processes to boost productivity.

As China and emerging Asian countries power ahead, they could account for around 58% of global growth by 2050. And the whole of Asia could account for almost half (46%) of the global economy – up from 35% today.

3. Much of emerging Asia can still benefit from a demographic dividend

For a number of markets in Asia, one big economic strength is a more favourable demographic backdrop, with proportionately larger populations of working age at a time when many Western markets are contending with a burgeoning elderly population.

In some Asian countries, rates of population growth are still impressive – India and Indonesia are expected to see their populations expand by 253 million and 42 million respectively by 2050. In other Asian markets, population growth is less supportive and demographic profiles are less favourable. But other factors should compensate – namely:

Dependency ratios are set to improve in terms of the ratio of workers to non-workers.

This is primarily the case in India, Indonesia and Malaysia.

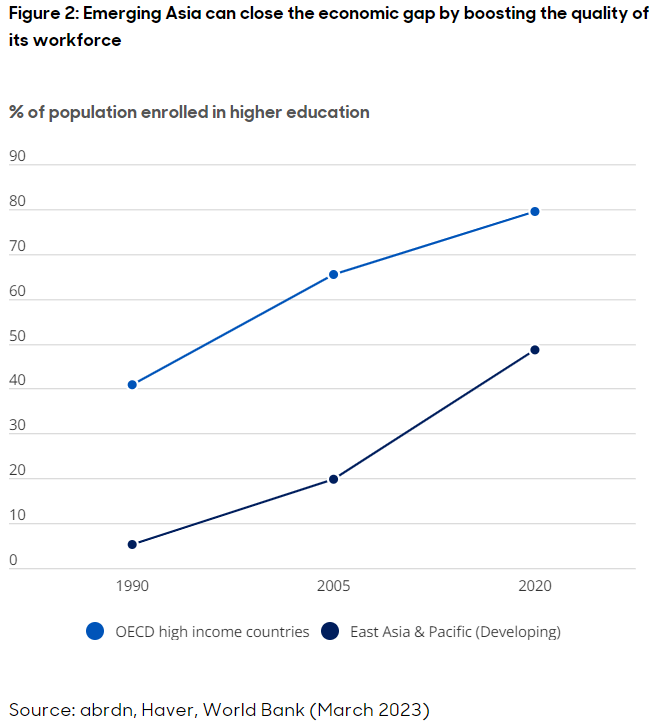

There is scope for an improving quality of workforce

Education and skills levels in developing Asia have scope to catch up with developed markets (see Figure 2). This should provide an offset in those countries that are ageing rapidly, specifically China and Thailand.

4. As consumption grows, Asia is becoming an engine of growth in its own right

In the near term, Asia’s dominance of global manufacturing is certain to continue. Even given pressures in developed markets to reshore jobs, supply chains are too tightly knit to unravel quickly.

But as urbanisation expands and personal incomes rise, Asia is also set to be the biggest consumer of the goods and services that it and the rest of the world makes.

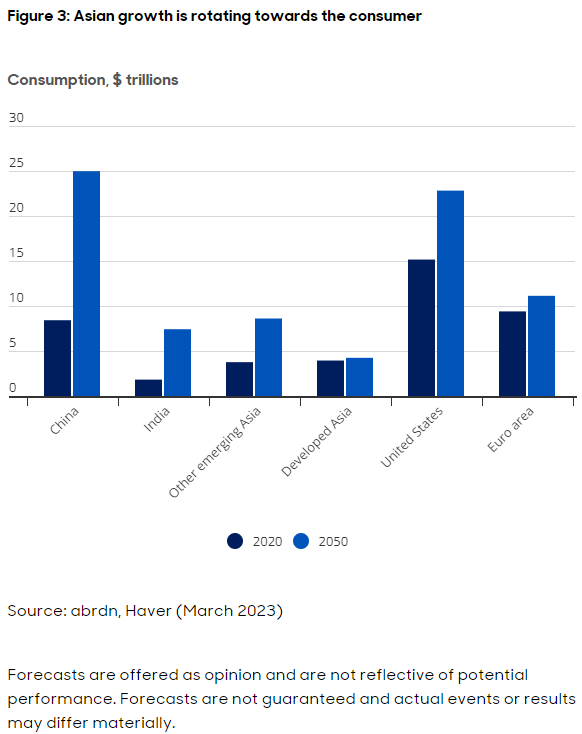

China’s consumer market is already 50% the size of the US’s. By 2050, we predict it could be almost 10% larger at $25 trillion – see Figure 3.

Much will depend on China pivoting from an investment-intensive to a consumption-led growth model. But even if this pivot is gradual, we estimate it will still be the dominant driver of global consumption by the early 2040s.

India’s consumer market is also set to grow fourfold over the next 30 years. Emerging Asia is set to more than double. By comparison, euro area consumption is only expected to grow 18% over the same period.

5. Urbanisation will drive infrastructure demand

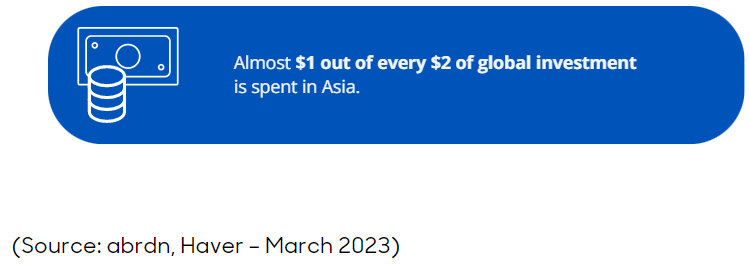

With rapid economic development and in many cases still growing populations, Asia needs more transport, more homes and other buildings, and more public-service infrastructure. All of this infrastructure demand will drive capital expenditure and economic activity.

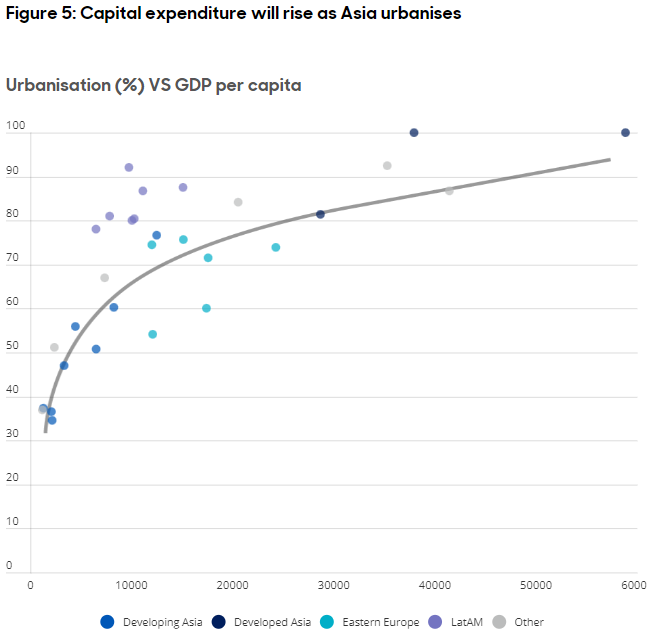

Urbanisation rates provide a good guide to judge how much pent-up infrastructure demand there may be. Figure 5 shows that less-developed countries – especially those in Asia – are only 40-60% urbanised. As urbanisation expands, it should drive construction activity and a concomitant rise in economic activity (GDP) - even in those Asian markets where demographic factors are not so supportive.

Indeed, our calculations suggest that Asia will account for half of all global investment up to 2050 – potentially $390 trillion (2015 USD terms).

But what about Asian asset prices?

Whether emerging Asian economies can deliver this expected outperformance does, of course, still depend on a multitude of factors, such as the strength of government institutions and the ability to navigate political pressures, economic imbalances and other macro risks.

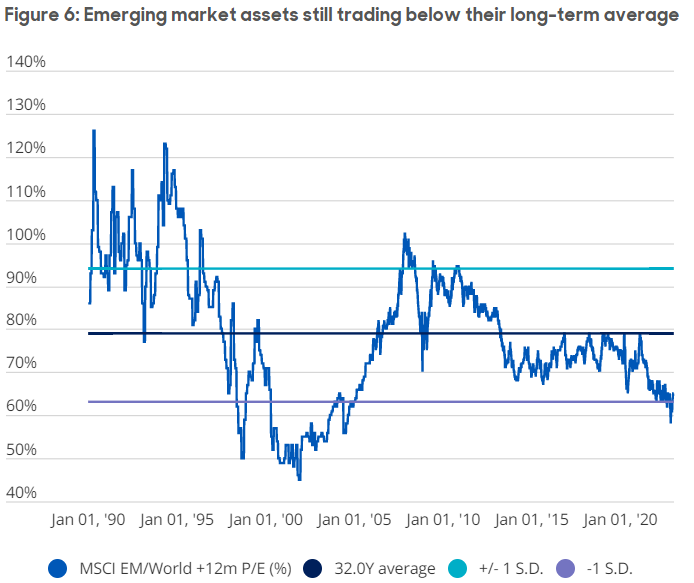

The good news is that these uncertainties are already priced in – as reflected in the discounts in emerging markets assets relative to developed markets (see Figure 6). With forward price-earnings ratios trading below their 30-year averages, the value available in these markets – given the powerful and positive drivers we have outlined here – is clear to see.

In short – Asia’s foundations for outperformance are in place

In any country or region, long-term economic growth requires three things: an increasingly skilled workforce, investment in infrastructure, equipment and technology, and improving productivity.

Emerging Asia has the building blocks for long-term growth.

Asia’s emerging markets – from China to India, to Indonesia and Vietnam – demonstrate all three of these essential building blocks.

Across the region, we see the structural drivers for economic growth to outperform both developed markets and other emerging markets.

The Asian century is only just beginning.

Written by Robert Gilhooly,Senior Emerging Markets Research Economist at abrdn

abrdn's Research Institute produces original research at the intersection of economics, policy and markets.

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.