Asia: do you embrace risk in the region or run from it?

Two Kepler Trust Intelligence analysts argue each side and share investment trust ideas.

31st January 2025 14:00

Asian equities are often considered pretty much the top of the risk spectrum when it comes to investable asset classes, and while the last few years have seen the region undergo more than its fair share of ups and downs, the long-term returns from the region have been remarkable.

However, this opens an intriguing question, should investors embrace the risk, and ride it out in the hope of better returns, or does a more risk-conscious approach that offers downside protection in the inevitable challenging periods, win out?

Our analysts take a side each and look at the prospects for each approach.

Steadiness over speed – Jean-Baptiste Andrieux

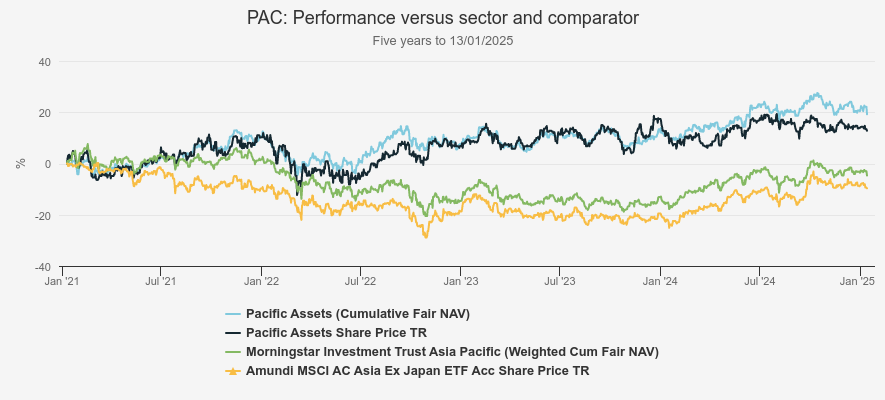

Considering that Asia ex-Japan equities carry more risk than those from developed markets, it may seem logical to embrace these risks and get exposed to the region through an aggressive strategy. After all, if you are investing in a structurally higher-risk market, why not aim for the fence? However, investors may be surprised to see that the best-performing investment trust in the AIC Asia Pacific sector over the past five years has been Pacific Assets Ord (LSE:PAC), a trust with a strong focus on risk management. This has resulted in the lowest beta and down capture ratio in the sector and makes it arguably the least risky option.

FIVE-YEAR PERFORMANCE

Source: Morningstar. Past performance is not a reliable indicator of future results

In terms of investment philosophy, managers David Gait and Douglas Ledingham follow a risk-aware approach, defining risk as the permanent loss of investor capital. This leads them to invest in quality companies with resilient cash flows, strong balance sheets, and conservative accounting. As a result, they may avoid some of the most exciting, high-growth companies in Asia, opting for more predictable growth instead. For example, the trust returned 20.8% during the growth rally of 2020, which was good but not enough to keep up with the performance of its more aggressive sector peers. However, in the bear market of 2022, PAC fell only 2.7%, compared to the sector’s average decline of 12%. This was PAC’s only negative year in absolute terms in over ten years. I believe this demonstrates the key benefit of a defensive strategy: cushioning the impact of a bear market, leaving investors with less ground to recover during the subsequent recovery phase and supporting total returns over the long term.

The managers’ focus on the risks of poor governance has contributed to a low exposure to China, which has been a significant factor behind its good performance in recent years. Regardless of the ongoing challenges in the Chinese economy, the domestic authorities have a history of cracking down on businesses or even entire industries, sometimes at short notice. Although limiting exposure to China and other markets with similar tendencies may result in missed opportunities, I think it is an opportunity cost worth paying, especially when considering the higher probability that the value of your investment could be completely wiped out overnight compared to other markets.

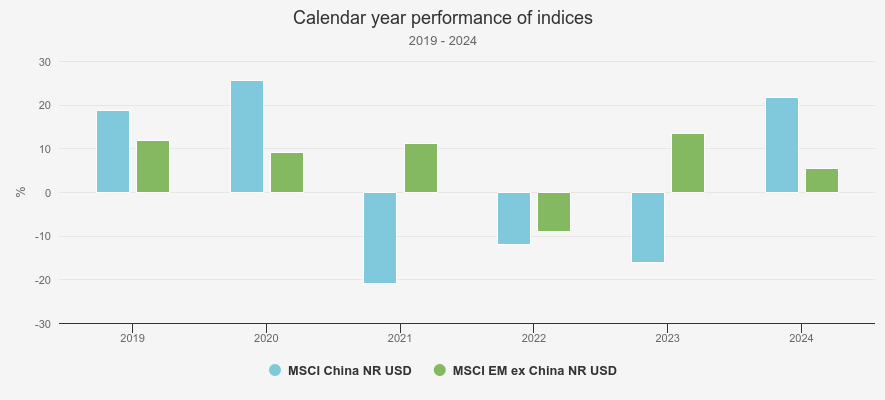

The bar chart below illustrates how sudden regulatory interventions can affect investments. In 2020, Chinese equities outperformed other emerging markets, driven by technology-related stocks such as Tencent Holdings Ltd (SEHK:700), Baidu Inc ADR (NASDAQ:BIDU), and Alibaba Group Holding Ltd ADR (NYSE:BABA). However, most of those gains were erased the following year due to a regulatory crackdown on the Chinese tech sector. Another way to navigate country-specific risk, rather than complete avoidance, is to replace direct exposure with proxy plays. For instance, Ashoka WhiteOak Emerging Markets Ord (LSE:AWEM)holds off-benchmark high-quality stocks that provide similar exposure without the associated risks, which could appeal to investors particularly concerned about country risk. For example, European luxury companies Hermes International SA (EURONEXT:RMS) and Lvmh Moet Hennessy Louis Vuitton SE (EURONEXT:MC) are used as substitutes to make up for the underweight position in Chinese equities.

PERFORMANCE OF INDICES

Source: Morningstar. Past performance is not a reliable indicator of future results.

Certainly, a safety-first approach may result in missing out if the market favours high-growth strategies in the coming years, or if ‘riskier’ countries or poorly governed companies begin to outperform. However, I think the past five years suggest that taking the highest possible risk is not necessarily the most rewarding strategy.

Jean-Baptiste is an investment trust research analyst.

Go for growth – Ryan Lightfoot-Aminoff

Looking at the five-year performance, I concede to my colleague that the best-performing trust has been one that is focussed on downside protection. However, this has been a uniquely tough environment and therefore supportive of more defensive strategies. Arguably, this period has been an exception though and considering it alone may mean investors overlook the growth potential of Asia which is one of the region’s defining characteristics.

Asia, as defined by MSCI, is home to over 3.4 billion people and makes up over a third of global GDP as well as a vast percentage of GDP growth. Not only that, but it is home to a growing number of companies that are critical to the global economy. As such, I believe that investors should be embracing the potentially higher-risk nature of the region in order to capture the growth opportunities this vast and dynamic population offers.

Several Asian countries offer some of the highest rates of GDP growth in the world. For example in 2024, India grew at c. 6.5% and Vietnam at 6.1%. As a result, these countries, and the region as a whole, are seeing a booming ‘middle class’ of increasingly wealthy individuals which is leading to a big increase in consumption and demand. These trends are arguably set to continue, as countries such as India and Vietnam continue to develop, and their populations move up the wealth ladder. By embracing a more risk-tolerant investment approach, investors can arguably capture the upside this growth offers.

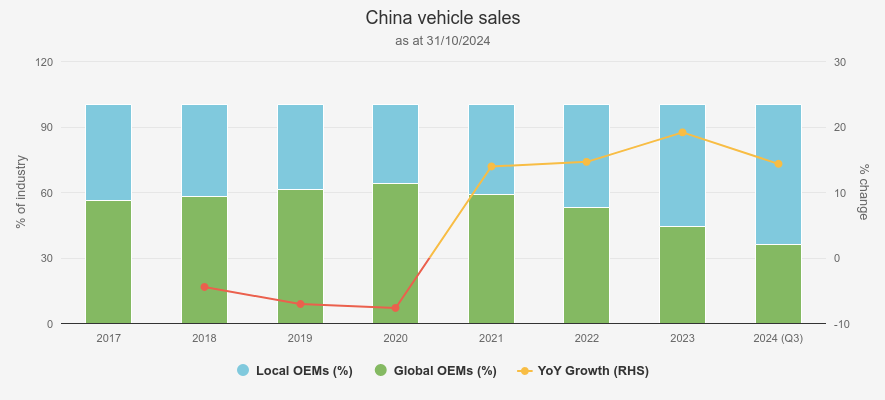

One of the interesting growth themes of the past few years has been the emergence of so-called ‘domestic champions’, local competitors which have begun to take market share from the multinational brands that had previously met the demand of the growing wealth of the region. Domestic champions have the advantage of being closer to their end consumer and therefore having a better understanding of their market and consumer preferences and arguably offer better growth prospects. However, they can often be overlooked by investors if they aren’t willing to embrace their higher risk.

The car industry is one example. VW has recently been surpassed in China by domestic champion BYD, which has been growing rapidly to become the country’s best-selling car brand. This helped domestic car brands take the majority of car sales in China for the first time in 2023, as we show in the chart below. Whilst I take the point that governance risks are higher in China, I think this is a good example of the sort of exciting growth story that taking a conservative approach might lead you to overlook.

SHARE OF VEHICLE SALES IN CHINA

Source: China Association of Automobile Manufacturers.

While BYD Co Ltd Class H (SEHK:1211) itself is now an industry leader and has begun taking market share in developed markets, many of these domestic brands offering exciting growth are companies at the lower end of the market-cap spectrum. Smaller companies are typically considered higher risk but arguably offer considerably better return prospects. Over the past five years, small-caps have outperformed large-caps in Asia, in contrast to most developed markets and broader global indices. This has been aided by strong performance from the likes of Indian companies, although a lower index allocation in China has also helped. Regardless, Asian smaller companies have been a good source of returns and portfolio diversification which would have likely been best captured through a higher-risk approach.

One example is cosmetics firm Proya, a holding in abrdn Asia Focus plc (LSE:AAS). The company was founded in 2006 before first listing on 17/11/2017. It is now China’s fifth-largest beauty and skincare company having enjoyed rapid sales growth from a focus on younger consumers leading to a share price risk of over 520% since launch. In contrast, The Estee Lauder Companies Inc Class A (NYSE:EL), a large multinational peer is down 38% in the same period. This includes a one-day fall of 20% in October 2024 on the back of a sales slump in China. Whilst the two firms are not directly comparable, it goes to show the upside potential of small-caps in Asia and how a growth-focused approach can benefit from them.

From a more holistic point of view, it’s worth considering the broader benefits of having an allocation to a higher-risk Asian strategy in a portfolio. By doing so, it provides significant diversification benefits to some of the more defensive characteristics investors can gain elsewhere. I think this should help create a more balanced portfolio that can perform in a variety of market conditions. The factors that are likely to drive Asian markets could be significantly different to those behind other asset classes, even if the volatility that is involved is higher. Therefore, by embracing the risk of these more volatile asset classes, investors are arguably adding more diversification to a portfolio, as this may be difficult to gain elsewhere.

One trust that offers diversification benefits is Fidelity Asian Values Ord (LSE:FAS). Managers Nitin Bajaj and Ajinkya Dhavale employ a value-disciplined approach to identify potential holdings from primarily the lower end of the market-cap spectrum. The managers have total freedom in how to allocate, leading to significant differences to the benchmark, typified by significant overweights to the likes of China and Indonesia at present, but underweight allocations to India and Taiwan, and therefore a portfolio that looks significantly different to its own benchmark and likely to be driven by completely different factors. As such, the trust could be a strong source of diversification for investors not just in other asset classes, but also other Asian funds.

Looking at more recent performance, I concede to my colleague that the best-performing trust over the past five years has been one that is focussed on downside protection. However, this period has been incredibly tough and therefore supportive of more defensive strategies. Despite this, the growth opportunities within Asia are significant, including the increased prevalence of domestic brands, a dynamic smaller companies sector, and the increasing importance of the region’s tech firms. As such, I believe a higher-risk approach will be best placed to capture the upside potential of the region going forward, especially over the long term.

RyanLightfoot-Aminoff is an investment trust research analyst.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.