Are these analysts still happy with their trust picks for 2020?

When last we updated our investment trust picks in March, collective optimism was thin on the ground.

24th July 2020 15:52

by Callum Stokeld from interactive investor

When last we updated our investment trust picks in March, collective optimism was thin on the ground, but we retained ultimate conviction in our selections.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Callum Stokeld, investment trust research analyst at Kepler Trust Intelligence.

“What a difference a quarter makes”, as Dinah Washington’s accountant used to sing. When last we updated on our investment trust picks for 2020 at the end of March, it is fair to say that collective optimism was thin on the ground. However, we all retained ultimate conviction in our selections (or else had grown so despairing at the market environment that we had settled into a kind of other-worldly fatalism), keeping faith that our initial logic had been ultimately sound.

This has proved a good decision, with widespread rallies in financial markets and strong performance subsequently from the majority of our investment trust picks. All it took was a little optimism and long-termism from us, not to mention untold trillions of stimulus from governments and central banks around the world. It is fair to say that whoever wins this competition at the end of the year will be primarily thanking Jay Powell… Indeed, so strong has been the rally that two of us are actually in profit for 2020, without – even indirectly – enriching Elon Musk (thus meeting your author’s definition of an ethical investment).

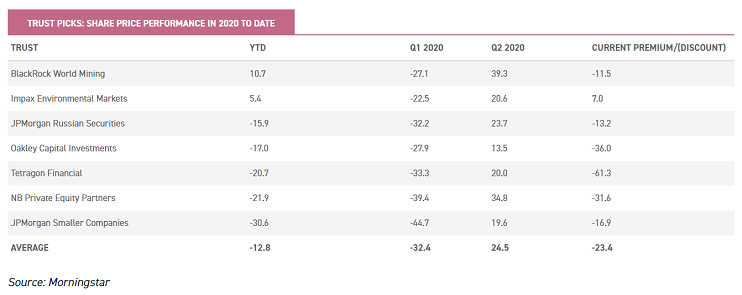

We can see below the contrast between Q1 and Q2 returns. They say understatement is a billion times better than exaggeration, so suffice to say there have been some fairly large divergences between the two quarters! And yet some discount opportunities seem to remain, with an average discount of 23.4% across our picks (albeit skewed somewhat by the massive 61.3% discount on Tetragon (LSE:TFG)).

Markets have rallied, the pubs are open, Aberdeen are on the TV next Saturday, and Atomic Kitten will probably never make another album. All of a sudden things seem pretty good in many respects.

Is this air of optimism dooming us, like Icarus, to try and reach too high? Given massive dispersions amongst sectors, geographies and styles, should we stick to our individual guns, or is it time for some rotation?

BlackRock World Mining | Callum Stokeld

When you select BlackRock World Mining Trust (LSE:BRWM) as your investment pick over a period as short as twelve months, given its investments in commodities and miners you are making a macroeconomic call. Fundamentals of course matter over the long term, but irrespective of supply discipline, returns on equity, or valuations, mining stocks in the near term are, far more than most equities, a reflection of global expectations of the economic outlook.

Over the longer term, these are all important considerations, and in this regard I would note that they all point very positively to the potential for long-term returns. However, in the shorter term – and an outlook for the remainder of 2020 must surely be considered that? – perhaps only well covered dividend yields will serve as an anchor to share prices should perceptions of an economic meltdown reappear.

So here we now are, in what I would say is a general market where macroeconomic perceptions are having a huge impact on all equities and their relative performance. Miners are particularly susceptible to this, and the performance of this sector up to the 2020 year-end is, in my view, more likely to reflect investors’ perceptions of central bank balance sheets than those of Rio Tinto (LSE:RIO) or BHP (LSE:BHP).

I would reiterate our positive outlook for the sector and for BRWM, stated recently here. We are currently in a transitory period where, for example, the US Federal Reserve is allowing its balance sheet to reduce again.

Huge stimulus measures have been undertaken. But, globally, economic rebounds are not going to make up the output gap created by the COVID-19 pandemic related shutdown any time soon – even if we do experience a relatively ‘V-shaped’ recovery.

This is the consolidation period. As USD shortages become acute again later in the year, and fears grow over future USD supply to settle contracts and meet obligations, the authorities will once again be forced to step in.

Mass expansion of the money supply has typically been very bullish for the gold bullion price, which in turn has been bullish for gold miners.

I am wary of the potential for profit-taking in this sector following a phenomenal rally from the March lows. This is not typically a structural allocation for most investors, so this temptation may be strong for some.

However I want to look through this possibility, as I believe the market will ultimately feel compelled to do. Some reports suggest the median free cash flow of gold mining companies has doubled in the past twelve months. The rally in these stocks is not irrational, in our view.

In the meantime, I am encouraged that industrial metals are picking up again. Many of the same dynamics exist within this sector as in the gold mining sector. Supply discipline remains strong, and companies are able to generate free cash flows even at depressed commodity prices.

Yet we have also seen revenue expectations collapse for the materials sector. The lesson from history seems clear in this regard – if the materials sector’s revenues are this weak, there are enough problems in the global economy to demand policy support. I expect the printing presses to accelerate, and I want to stay long a sector on cheap valuations with good company managements where I stand to benefit, and where I can be paid to wait.

As we noted in our most recent research note, BRWM has a well-diversified revenue base. Even though some caution is considered necessary with regard to the dividends generated from its equity holdings, BRWM’s yield is at a sufficient premium to most areas of the equity market that even substantial cuts would still leave its dividend looking attractive on a relative basis.

Impax Environmental Markets | William Heathcoat Amory

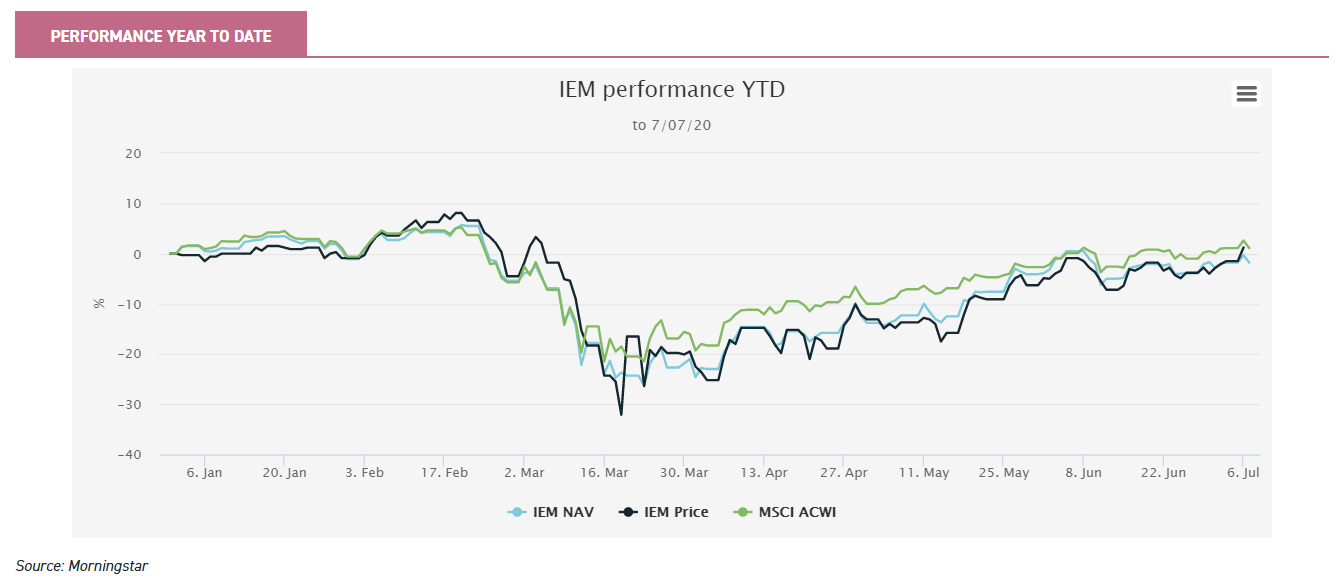

The thesis behind choosing Impax Environmental Markets (LSE:IEM) as my trust for 2020 was that the focus on climate change from investors and governments was set to continue. And in view of narrow discounts across the sector – with the board’s specific commitment to protect shares widening to a material discount – IEM’s share price returns would likely replicate the NAV.

On the latter point my choice has been vindicated, with the share price actually outperforming the NAV so far this year – not something that many trusts can likely claim (discounts have on average widened by 4.7%, according to Morningstar).

Amid widespread calls to “Build Back Better” with the government stimulus response to COVID-19, we think the theme is still set true. Indeed, as we discuss in this article, we believe that the ‘end of carbon’ is set to be a multi-decade theme for investors. Over the short term, however, it is also fair to say that the focus of government attention has largely been elsewhere since mid-February…

IEM has performed well, all things considered. As we noted in our recently updated profile, the trust’s underperformance during February and March was due largely to small and mid-cap exposure; but also to cyclical exposures in locked down industries, especially automotive, as well as being underweight healthcare and the US dollar.

Nevertheless, lessons learned from managing the trust over the past 18 years have enabled the team to hold their nerve in the volatile conditions, and helped IEM to rebound more strongly than the market, leaving it only marginally behind the MSCI ACWI YTD. IEM’s portfolio has a definite growth bias, which will have helped. However the managers are valuation-driven in their stock picking approach, and the market volatility enabled them to initiate positions in several new companies, which previously had valuations that the team considered too rich.

The combination of these new holdings and sticking to fundamentals mean that IEM has bounced back strongly. More impressively, the trust continues to issue shares, and has now had inflows of more than £100m to date. The tiered fee structure should mean that the OCF will continue to edge down, as further shares are issued.

The IEM portfolio represents a global small and mid-cap portfolio, exposed to niche businesses which – through technology and other know-how – will be helping the world economy become more sustainable. I believe the fundamental drivers for the trust remain very much intact.

Oakley Capital Investments | Alice Rigby

Oakley Capital Investments (LSE:OCI) is a focussed private equity trust, run by an experienced private equity team. Historically it has traded at a wider discount than peers but I believed that the trust’s strong performance in latter years, as well as several improvements to corporate governance, would lead the discount to narrow.

Additionally, with the trust exposed to some exciting niche businesses within the consumer, technology and education sectors, I thought there was a decent chance of strong progress on a NAV basis too. We expect more colour with the next NAV announcement as at 30 June, and have published an updated profile ahead of this, which can be found here.

As it turns out, the managers had made number of profitable realisations prior to the crisis, meaning that OCI went into the sell-off with cash on the balance sheet of c. £250m, or 36% of portfolio assets. This fortunate position leaves OCI with a lot of liquidity as Oakley looks to invest funds during a period of significant opportunity.

Notwithstanding OCI’s strong cash position, the COVID-19 crisis left the shares trading on a very wide discount to NAV. Based on Numis’ adjusted 31st December NAV the current discount is 37%. As an expression of how wide the discount is, balance sheet cash equates to 58% of the current share price. Adjusting for cash on the balance sheet, investors today are buying OCI’s investment portfolio on a discount of 57% to the 31 December 2019 valuation.

We believe this represents a value opportunity – even if one takes a relatively pessimistic view on valuations post-COVID. Longer term, Oakley’s track record is strong. For investors who want a focussed private equity portfolio, OCI has delivered excellent returns – especially over the last three years. At the same time, the shares trade on a significantly wider discount than peers. Should the strong relative performance be sustained, we continue to believe that it will only be a matter of time before the discount differential is meaningfully reduced.

JPMorgan Russian Securities | Thomas McMahon

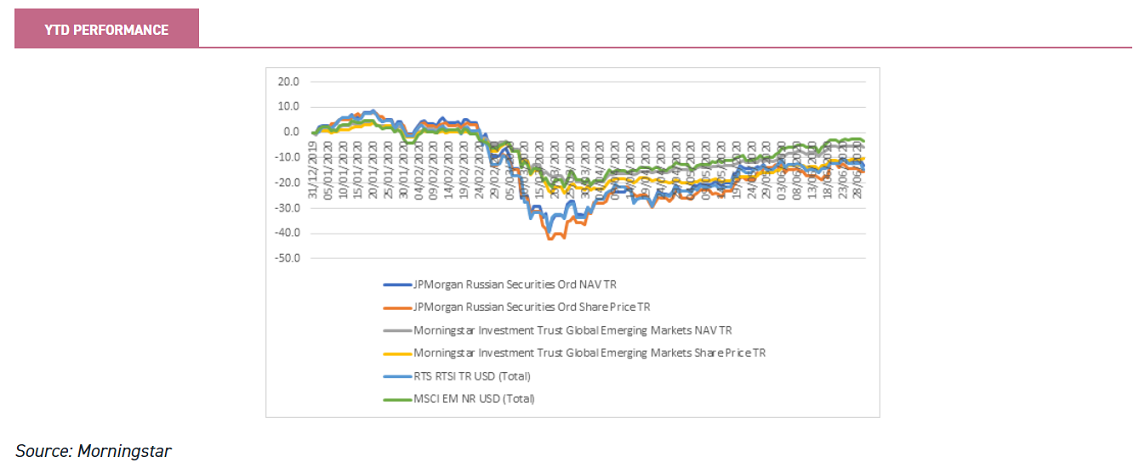

I picked JPMorgan Russian Securities (LSE:JRS) expecting something of a reflationary year. It’s fair to say that, with a high energy component, it would not have been my pick for an economic slump. Nevertheless, it has made a reasonable recovery from the market lows in March. Year to date JRS is down c. 10% in NAV TR terms and c. 5% more in share price terms following modest discount widening. Crude oil is down around 33% in 2020, with the Russian rouble down around 13% to the dollar. The average emerging markets trust has done better, largely due to the weighting to China.

It seems likely that the oil price will remain weak while economies reset following the lockdowns – and there is also the possibility of severe disruption over the winter if a second wave emerges. However, come the eventual recovery, the energy component should make this a high beta play on a recovery.

In the meantime, the high degree of exposure to Russia’s biggest gold miners could do well; both because of risk aversion and if the high levels of QE implemented as a response to the crisis raise fears of inflation.

However, Russia’s domestic economy looks like it will remain weak in the short term in my view. The planned state investment plan has been delayed as the earmarked funds are being used to fight the impact of the pandemic.

Nevertheless, the huge surplus in Russia’s National Wealth Fund at the start of the year has at least meant the country has freedom to respond to the crisis fiscally, and should prevent it having to take on excessive debt to do so (unlike the poor old UK). The combination of cheap valuations on the Russian market, cheap currency and cheap oil mean JRS could do very well in a global recovery; but unfortunately this doesn’t look like happening soon.

Tetragon Financial Group | Pascal Dowling

General George Custer, of Little Bighorn fame, once said “I would rather have a good education and no money, than to have a fortune and be ignorant.”

I have a mediocre education and, after an absolute drubbing this year for my ‘pick for 2020’ Tetragon Financial, as I return to review the performance of my ‘hot tip’ I find I also have no money. But faint heart never won fair lady (though these days that’s probably illegal to even say) and it is with that in mind that I choose to stick with my convictions as we enter the second half of this most desolate of years.

When I chose this trust for my 2020 ‘pick’ I said the wide discount it sat on, combined with the trust’s strong long-term performance track record, was a key reason for its attractiveness. At that point it was trading on 47.7% below par, despite at that time being – in NAV terms – one of the best performing trusts in any sector (ranking sixth out of 347 trusts over ten years to 31 December 2019, according to Morningstar data).

TFG’s long-term track record remains strong, and in NAV terms the trust has not done badly this year – it is about halfway down the pack versus the 400-odd trusts in the UK – but it has had a torrid time in share price terms. The trust’s discount has fallen dramatically, to the point where in early June it was the widest of any trust in any sector, though it has since regained some ground and is now (as at 16 July) merely the eighth widest in any sector.

At the current level of -61.3% the market appears to think there is a serious problem hiding in the portfolio which has not yet been reflected in the NAV. However, as William Heathcoat Amory explains in this note on the trust written in June, by examining the underlying assets of other investment trusts investing in similar assets and looking at their discounts it is possible – in a very approximate fashion – to ascribe a comparative discount to TFG based on its proportionate exposure to those assets.

While this is by no means a precise measure, William’s guesstimate using this measure puts TFG on a comparable discount of 28%, a significantly tighter margin. Unless the market is right, and something is hiding in there that can account for the gaping discount the trust currently trades on, this analysis offers some hope of a recovery in the trust’s share price relative to its NAV.

Tetragon invests in a diversified portfolio of alternative assets aiming to provide steady returns across various credit, equity, interest rate, inflation and real estate cycles; and this lack of correlation to equities is another point in its favour, in my view, at a time when volatility could return if we see a second spike in COVID-19.

NB Private Equity Partners | Henrietta Torrance

NB Private Equity (LSE:NBPE) is unique in the listed private equity sector, in that the portfolio consists primarily of co-investments – on a largely fee-free basis – with other private equity managers.

As a result, the portfolio can be seen as a good representation of the top tier of US and global private equity deals.

I picked the trust on the basis that the portfolio is composed largely of 2016, 2017, and 2018 investments, which should be moving into realisation territory and providing the engine for growth.

At the time, it had one of the highest dividends (paid from capital) in the sector, and one of the widest discounts.

Having initially widened dramatically during March 2020, the share price has recovered, leaving NBPE on a 34% discount to NAV.

This remains wide relative to many peers and the trust’s recent history. That said, while NBPE will publish monthly NAV estimates, the impact from COVID-19 may take until June’s quarterly report to be better reflected in the NAV.

Having initially warned that the dividend may be under threat, more recently the board announced a quarterly payment in line with its previous policy. We believe this is likely a reflection of realisation proceeds coming through, and a recognition by equity market investors that the world isn’t ending tomorrow.

In drawing down $250m of its $300m credit facility in March, NBPE has taken steps to ensure it does not face a financing squeeze. NBPE’s ordinary shares are the most highly geared in its peer group, and this metric will be marginally increased by the continued payment of the dividend, but NB is more in control of its investing activities than its peers are.

This means that, in our view, the fact that the trust has the highest gearing among its peers doesn’t necessarily mean it is the most risky. That said, it will be more exposed (all things being equal) to short term valuation chances. The shares trade on a discount of 30.9% (source: Numis), which makes them attractive.

Likely catalysts for a re-rating will be updated valuations and the potential for a resumption of buybacks.

JPMorgan Smaller Companies | William Sobczak

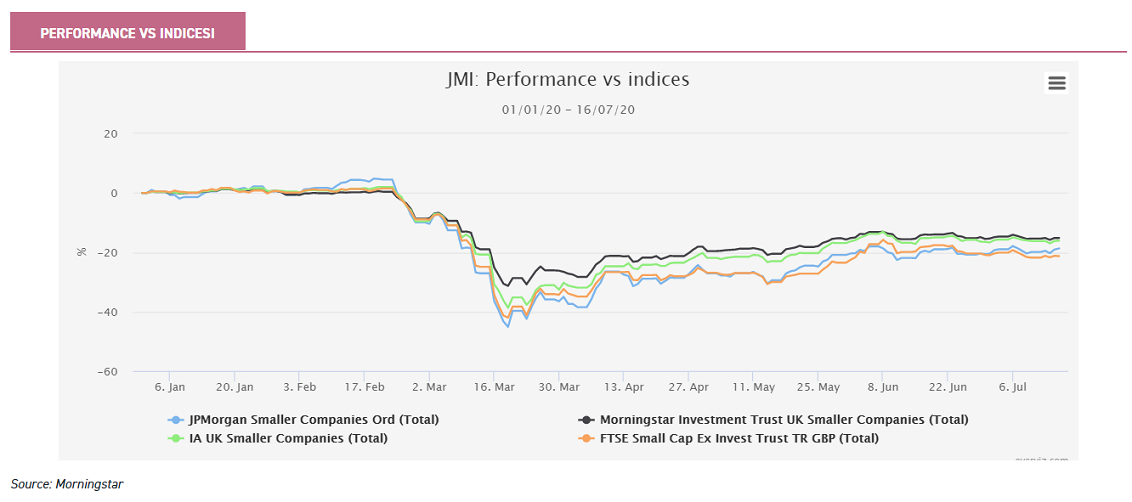

JPMorgan Smaller Companies (LSE:JMI) offers access to fast-growing, innovative smaller companies domiciled in the UK. The past few years have seen international investors abandon the area, largely due to the referendum, leaving strong companies languishing – even though they would be demanding premium ratings if they were in the US.

The election of a Conservative government in December 2019 saw the discount narrow considerably, and the trust ended last year as one of the strongest performing trusts across the investment trust universe.

However, I believed that there was still room to run, and that should there be a result that the market interpreted favourably from the Brexit negotiations a second ‘relief rally’ could ensue.

This would have moved the trust from its narrow discount to a premium, while also benefitting a huge number of the (undervalued) underlying companies.

COVID-19 has thrown a spanner in the works, however, and JMI has seen its discount widen from 3.9% at the start of the year to the current level of 16%. Year to date the trust has lost 18.7% of its total NAV; however I still believe the trust sits in a stronger position than most.

Due to the quality bias of the managers, the type of company that the trust holds should perform well regardless of the wider macroeconomic conditions. An example is the largest holding in the portfolio, Games Workshop (LSE:GAW).

Over 2020, GAW has seen its share price increase by more than 40%, despite sitting in the consumer goods sector (an area people might have thought to avoid during the pandemic).

Even pre-lockdown, the management of GAW had been adapting to an increasingly digital retail environment, leaving them well placed to expand their already leading position in their market niche.

Although the managers of JMI have supported some holdings through equity fund raising over this period, the emphasis they place on strong balance sheets in their analysis has meant most of their holdings have been resilient even to the massive economic challenges seen in 2020.

As shown in the table at the start of the article, the trust’s performance has already started to turn around; however the discount remains wide. As such, I see this moment in time as an attractive entry point into a trust with an exceptional long-term track record.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.