Are Shopify shares at the bottom of a trough?

Our overseas investing expert wonders whether this is an opportunity to buy a rival to Amazon.

11th November 2020 10:32

by Rodney Hobson from interactive investor

Our overseas investing expert wonders whether this is an opportunity to buy a rival to Amazon.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

It’s not just vaccine makers that stand to gain from the coronavirus crisis. interactive Investor customers have been taking notice recently of an unlikely beneficiary whose shares have surprisingly slipped back just when better times look to be on their way.

Shopify (NYSE:SHOP) is a serious rival to the mighty Amazon (NASDAQ:AMZN) and, despite being only a fraction of the size of its ubiquitous rival, it could do well in this David v Goliath contest, not through a knockout blow but by finding a lucrative niche.

Amazon has been able to outmuscle would-be rivals, but it has attracted criticism for allegedly restrictive practices, high charges and low tax payments. A cheaper, more flexible rival has a genuine opportunity to sneak in under Amazon’s radar. Amazon has a reputation for setting up in competition against companies that sell successfully on its site; Shopify may succumb to that temptation eventually but at least, for the foreseeable future, it has enough on its plate helping its clients to conduct their businesses in peace.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Investing in the US stock market: a beginner’s guide

Shopify offers an e-commerce platform for small and medium-sized businesses, the very companies that do not have the financial muscle or IT expertise to do it for themselves on a standalone basis.

These companies had been left behind in the online sales revolution, but many have found over the past few months that they need to find new ways to sell their products and services as the pandemic has altered consumer behaviour and reduced footfall in stores.

The need to adapt is quickly sorting out winners and losers. Shopify provides that option while giving clients a clear overview of their business and customers.

There are two offerings. Subscription services is the smaller segment but arguably the one with the greater growth potential. It allows business owners to carry out e-commerce, not only on Shopify’s website, but also on social networks, including Facebook, and in physical stores such as kiosks and pop-up stores. It even helps clients to sell on Amazon.

Merchant solutions provides add-on services including shipping products and processing payments.

A trading update for the third quarter reflected the flight to online sales during lockdowns. Shopify helped to shift goods and services worth $30.9 billion, more than double the $14.8 billion figure for the second quarter. Shopify’s own income rose from $391 million to $767 million.

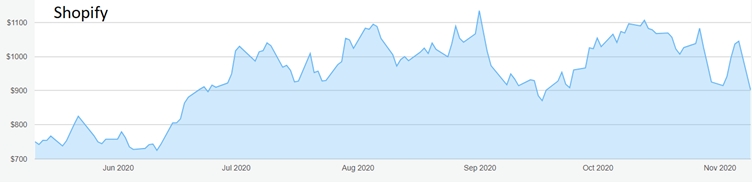

Source: interactive investor. Past performance is not a guide to future performance.

Negative cash flow has turned to a positive figure. That is important, because all cash is being ploughed back into the business to develop new services or increase marketing spend. As with other tech giants, the early days are all about improving visibility and growing revenue rather than rewarding shareholders.

It is admittedly possible that the move to trading online will slow down substantially when the Covid-19 pandemic is over. News of a vaccine possibly being available in spring – or even next month – will prove this one way or the other. The initial impact has been a severe blow to Shopify’s share price. However, as many consumers who previously indulged in no or limited online shopping have caught the bug, this phenomenon is not going to go into reverse. Rather it is going to grow.

- International Biotechnology Trust: star stocks and Covid vaccine race

- Stockwatch: where next for vaccine heroes’ share prices?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The shares are not cheap. They have risen from $350 in March to top $1,100 over the summer, but they have slipped back lately, despite the great third-quarter figures, to stand below $900, where they found support in September.

Hobson’s choice: It will be some time before shareholders enjoy the spectacular gains seen during the summer months, but the latest dip does represent a buying opportunity for those who invest for long-term capital growth rather than income. We could be at the bottom of the latest trough. Buy up to $950.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.