Apple becomes world’s first $3 trillion company

4th January 2022 10:30

by Lee Wild from interactive investor

What a start to 2022! The iPhone maker kicked off the new year with a near-3% surge in share price to take its valuation past the big number for the first time.

Having spent a few weeks threatening to do it, Apple (NASDAQ:AAPL) waited until the first trading day of 2022 before finally becoming the first company to be valued at $3 trillion.

During a strong start to the new year for stocks broadly, the iPhone maker’s shares rallied around 3% to a high of $182.88, briefly surpassing the price needed to achieve the magic number by two cents.

Covid cases may have surged around the world, but traders continue to back the US economy and corporate profits to keep underpinning stock prices. That’s despite the ongoing threat of high inflation and interest rate rises through 2022.

It’s been an amazing ride for loyal Apple shareholders. Ten years ago, you could still have bought the shares for less than $15. In August 2018 they were worth around $57, taking the valuation above $1 trillion for the first time. Just two years later the business was worth over $2 trillion.

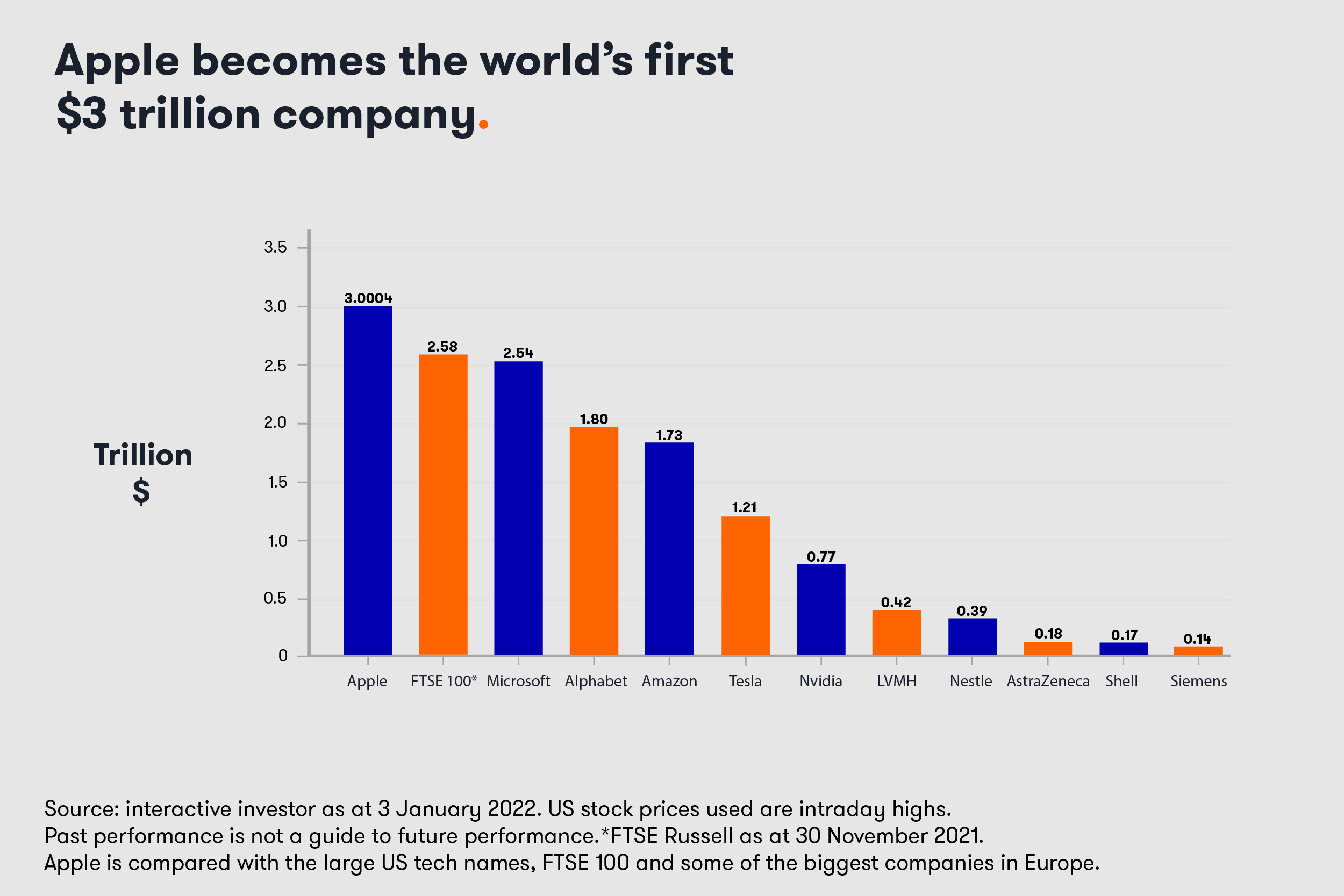

The significance of Apple’s meteoric rise is illustrated by the graphic below.

Most interestingly, the US company is now worth more than all the FTSE 100 companies put together. According to the London Stock Exchange, the blue-chip index was capitalised at £1.91 trillion, or $2.58 trillion, at the end of November.

As the graphic above shows, UK-listed companies don’t even get close to the American titans. The closest at the moment is AstraZeneca (LSE:AZN), currently valued at around £132 billion, and Royal Dutch Shell (LSE:RDSB) at £129 billion.

interactive investor customers have long understood the potential value of Apple, which regularly appears in our most-bought tables. In fact, it was the third most-bought international stock of 2021.

- US stock market outlook 2022: more record highs for Wall Street?

- 20 most-bought US stocks of 2021

- Terry Smith buys Amazon for Fundsmith Equity

Can Apple become the first $4 billion company? Of course it can. Wall Street analysts certainly think the stock can go even higher.

JP Morgan hiked its price target before Christmas. Analysts at the bank think the stock could be worth $210 compared with $180 previously. Do that and the company would be worth over $3.4 trillion.

Morgan Stanley had already slapped a $200 target on the shares, up from $164. Analysts there are cautious on IT Hardware in 2022, but believe Apple “should benefit from a flight to quality especially as upside from new product categories gets priced-in.”

“Near-term, iPhone supply and App Store are surprising to the upside and drive our December quarter estimates higher.”

According to analysts at Wedbush Securities, the re-rating has hinged on both Apple’s Services business, which the broker reckons is worth $1.5 trillion on its own, and a strong product cycle at the hardware business as the iPhone 13 selling fast.

- Bill Ackman: hot sectors and the economy in 2022

- Subscribe to the ii YouTube channel for our latest New Year share tips and fund manager interviews

All of Apple’s product categories posted annual growth when fourth-quarter earnings were announced at the end of October, with revenue up 29% on the year before – a record for the September quarter. Services and Mac revenue also reached new all-time highs.

“The combination of our record sales performance, unmatched customer loyalty, and strength of our ecosystem drove our active installed base of devices to a new all-time high,” explained chief financial officer Luca Maestri.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.