Anpario: Gearing up for growth

25th May 2018 17:07

by Richard Beddard from interactive investor

It seems like , a manufacturer of animal feed additives, has been gearing up for growth for a decade. Perhaps it's started to happen.

Anpario makes additives for animal feeds, which improve the health of poultry, pigs and cows. The additives make animals more productive, which is a technical term for meatier.

Acidifiers to zinc-oxide, an A-Z of growth promotion

Some of Anpario's products are acidifiers, they kill pathogens like salmonella in the animal gut. Toxin binders render mould and other feed contaminants indigestible. Enzymes improve digestion. Omega 3 not only improves animal bone strength and fertility, it benefits the humans that eat the animals. If you've eaten an egg enriched with Omega 3, Anpario says it was probably laid by a hen fed with its Optomega-50 product.

The formulations are proprietary, and don't damage human health, unlike antibiotics used as growth promoters, formaldehyde, a carcinogenic substance used to cleanse animal feed of salmonella and e-coli, and zinc-oxide, used in pig feed, also to combat e-coli.

In many cases it's not just the active ingredient that makes the product work, but the carrier matrix that ensures the additives are digested slowly and remain effective along the full length of the gut.

Feed additives is an attractive market to be in because the world is growing wealthier, more people are eating meat, and the intensification of meat production requires better animal healthcare. With mixed success, regulators are tightening up on some of the harmful alternatives to natural additives.

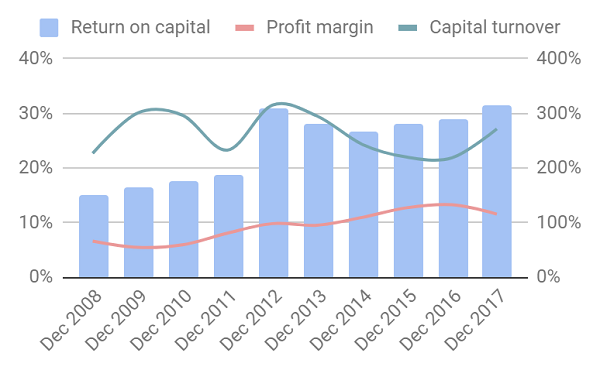

Although Anpario's small, revenue was not quite £30 million in the year to December 2017, in terms of profitability, it's perfectly formed:

Source: interactive investor Past performance is not a guide to future performance

We should distinguish between the period before 2012 and the period after. In 2006, 2009 and 2012 Anpario acquired the three business from which it currently derives profit, Agil, Optivite, and Meriden, so it's only from 2012 that we're looking at the business in its current form.

A return on capital of between 25% and 30% tells us Anpario is very healthy. Rising profit margins are good too. They're the result of a focus on its most profitable products, feed additives. In recent years, Anpario has sold off Vitrition, an organic animal feed supplier, and ceased manufacturing other firms' products.

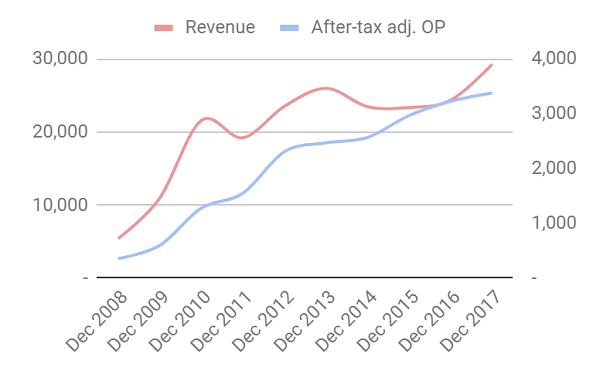

The changes in its business make the trend in revenue and profit more difficult to interpret. On the face of it revenue grew rapidly until 2012 and then stalled until 2017, although profit growth continued at a reduced rate:

Source: interactive investor Past performance is not a guide to future performance

In practice, revenue before 2012 was mostly added by acquisitions. Post 2012, revenue growth in additives was hidden by lost revenue from the lower margin business Anpario shed.

Anpario has been growing revenue modestly, but a year ago chief executive Richard Edwards told me the company was implementing its strategy more boldly, and the result is etched in the company's performance for the full-year.

Revenue growth resumed

Look carefully at the charts above and you will notice the 20% revenue upswing that has resulted from Anpario's new found boldness. But operating profit margins declined and the growth in profit was a more muted 5%. In some sense, the company is sacrificing profitability for growth. I think it's a good sense.

Although operating margins declined, gross margin increased. In other words Anpario managed to increase revenue by more than the cost of raw materials and manufacturing. Lump in other costs to support growth, principally more sales people and management, and operating margins declined.

The distinction between gross and operating margins may be important if the 36% growth in sales and administrative costs (25% at constant currency) is effectively an investment in future growth. It may take time for Anpario's increasing number of overseas offices to reach their full earning potential, but the cost is felt immediately in new hirings.

During the year to December 2017, Anpario bought its Australian distributor and set up a sales subsidiary in Thailand.

Going for bold

Hitherto, Anpario has focused its strategy on the world's biggest meat producers by setting up sales offices in China, Brazil, and the USA as part of a wider strategy targeting the Asia Pacific Region and the Americas.

In the year to December 2016 it brought its disparate brands together under the Anpario moniker, and it started to intensify its efforts to sell directly to end users, often giant industrial scale farmers, or 'integrators', that mix their own feed or the veterinarians and feed mills that supply them.

Dealing with distributors suited Anpario when the company was much smaller, as it didn't have the resources to set up its own sales operations around the world, but now it can be a source of frustration. Sometimes distributors don't have the financial resources to stock enough product to supply the big customers Anpario is gunning for. Sometimes, despite Anpario's efforts to educate, they aren't technically equipped to sell the science.

Potential toxins

In most of its markets, Anpario is up against big competitors. For example, the market leader in toxin binders is Biomin, and though Anpario says its proprietary formulation is as good if not better than Biomin's, it either has to sell the science or sell more cheaply to gain market share. In practice, I think it's doing both, which is the cost of being a challenger.

While the US is providing a model for growth, the company now earns 10% of its profit from just 7% of its sales there, not all markets are like the US. China is an attractive market because it's becoming more prosperous and more people are eating meat, but there are many many small farmers and although they're still learning about animal nutrition and are more open to new ideas, it's harder to deal directly with them than America's huge integrators.

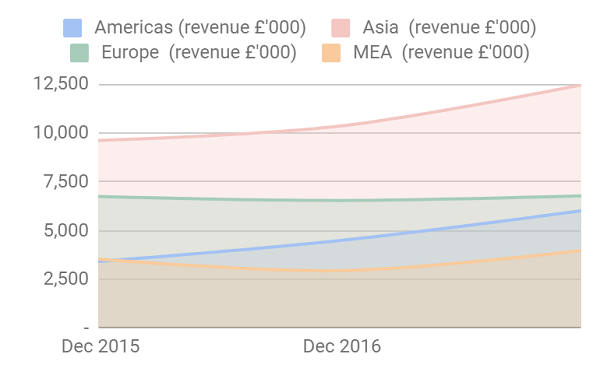

Anpario is also locked in a legal dispute with a former distributor over the trademark for Orego-Stim. It appears to be winning, but it's another example of how business in China may not always be straightforward. The company is growing fastest in its principal target markets though, Asia and the Americas (MEA is Middle East and Africa):

Source: interactive investor Past performance is not a guide to future performance

Rules against antibiotic use are also hard to police. In Europe a few antibiotic growth promoters have been banned, but farmers are using therapeutic antibiotics, designed to treat disease, in small doses instead.

Board impresses

Richard Edwards kickstarted Anpario in 2006 when he became chief-executive of a loss-making firm developing pheromones to encourage fish to feed. He made Anpario's first acquisition, Agil, and as executive vice-chairman he was instrumental in the acquisitions of Optivite and Meriden. He stepped back into the chief executive role in 2016. We've spoken on the 'phone and traded emails, productively (from my point of view).

The other executive director is Karen Prior, who's been with Anpario since 2009, and they're supported and challenged by two non-executive directors with good credentials in closely related industries. Peter Lawrence is founder and chairman of ECO Animal Health, which makes a veterinary antibiotic, and Richard Wood was one of the architects of Genus, the animal genetics firm.

I visited Anpario a few years ago. The head office opens into the labs, which open directly onto the factory floor, right next to the warehouse. Judging by the banter between David Bullen, the CEO then, and the people in the adjacent buildings, it's a good place to work.

Scoring Anpario

As usual, I score each category from 0 to 2 except valuation, which is scored from -2 to 2:

[2/2] How well does it make money?

Anpario has been run conservatively for profit, and has become very profitable.

[2/2] How will it make more money?

Cash-rich Anpario can grow organically and by acquisition by employing more sales people or acquiring distributors to get closer to customers.

[1/2] What could go wrong?

The early signs are good, but Anpario has yet to prove it can dramatically lift sales without sacrificing profitability.

[2/2] Will all stakeholders benefit?

Anpario has a small but impressive board who have created value at other firms in related industries.

[-1/2] Are the shares inexpensive?

Traders are even more bullish than me. The share price values the firm at about 29 times profit in the year to December 2017, adjusted for cash.

A total score of [6/10] means I'm out. I'd love to own shares in Anpario but the price is a bit too high.

Contact Richard Beddard by email: richard@beddard.net or on Twitter.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.