Andrew Pitts’ trust tips: short-term pain, but long-term gain

25th July 2022 10:17

by Andrew Pitts from interactive investor

It has been a painful period for the adventurous and conservative portfolios. But as Andrew Pitts points out, trusts have bounced back from previous setbacks.

Andrew Pitts’ trust tips (adventurous and conservative portfolios) were first introduced by Money Observer more than 20 years ago. Their performance began to be monitored as portfolios in August 2014. In July 2020, Andrew took over the portfolios. The trust tips are made by Andrew and not interactive investor.

Each portfolio contains 10 trusts split equally between geographic regions or strategies. There is an editorial update of the portfolios every quarter. The annual review of the portfolios takes place in July.

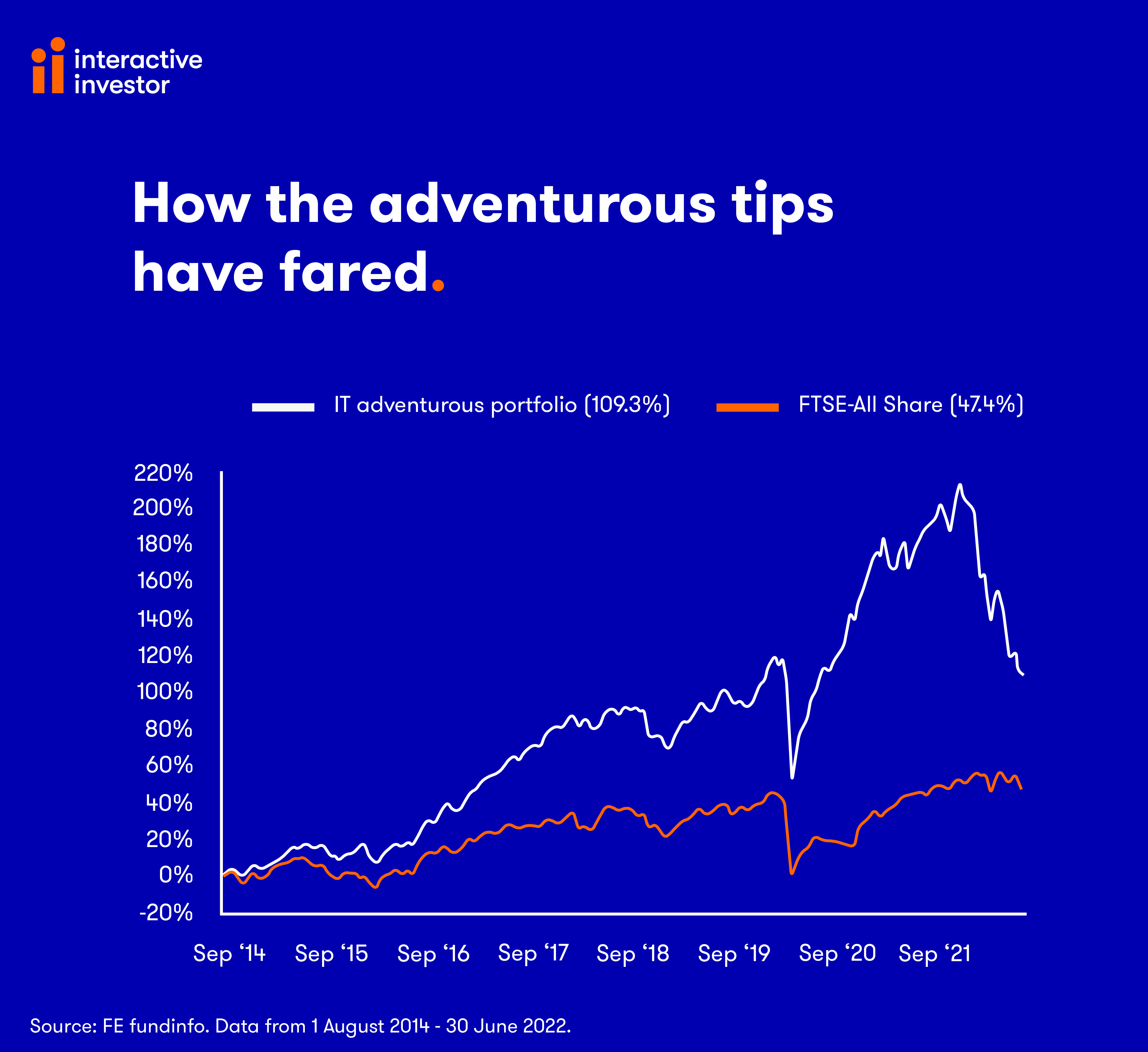

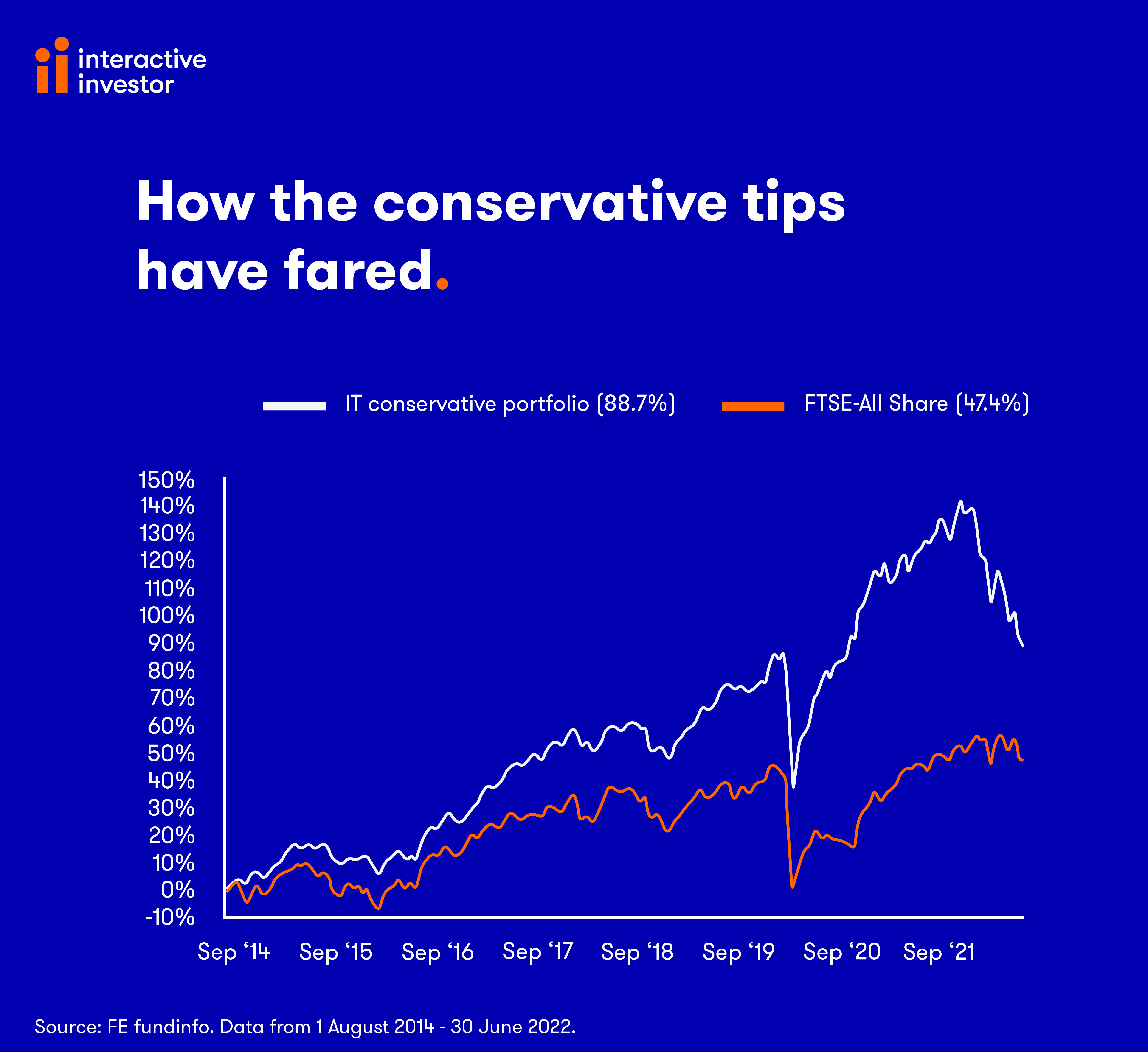

Investment trusts collectively suffered their worst first six months of the year for three decades, according to analysis by Winterflood Securities. Both the adventurous and the conservative portfolios were not immune and, as most of their constituents are highly or solely invested in growth-focused equities, some suffered very steep falls.

The adventurous portfolio fared the worst over the year under review: the 10 constituents were down a collective -26.9%, with the past six months to 30 June seeing the portfolio take a particularly heavy battering. It was down -31.3% and four constituents lost more than 40%.

It will be of little consolation to investors that the conservative selections fared less badly: a -16.2% loss (-21.6% in the past six months) is still a bitter pill to swallow.

Both portfolios significantly underperformed the FTSE All-Share and FTSE All-World benchmark indices, as the table below shows. Over longer periods, however, portfolio performance stacks up well (although the three-year numbers have taken quite a hit).

Both portfolios suffered outsized losses over the year

| % total return after: | ||||||

| 3 mths | 6 mths | 1 yr | 3 yrs | 5 yrs | Return since Aug 14 | |

| Adventurous portfolio | -18.8 | -31.3 | -26.9 | 6.6 | 28.6 | 109.3 |

| Conservative portfolio | -12.5 | -21.6 | -16.2 | 10.2 | 30.3 | 88.7 |

| Benchmark indices | ||||||

| FTSE All-Share Index | -5.0 | -4.6 | 1.6 | 7.4 | 17.8 | 47.4 |

| FTSE All-World Index | -8.4 | -10.7 | -4.0 | 25.7 | 49.7 | 128.0 |

Notes: performance of the portfolios as at 30 June 2022, before deduction of underlying trading charges. Data source: FE Analytics. Past performance is not a guide to future performance.

It may help to bear in mind that we have been here before. Three instances that spring to mind are the global financial crisis of 2009, the European sovereign debt crisis of 2011 and the initial reaction to the Covid pandemic in 2020. Markets went into free fall and in all three events investment trusts tended to fall further but subsequently bounced back stronger.

The major difference in 2022 is an end to the so-called Great Moderation, featuring three decades of relatively low and stable interest rates and inflation, and reliable global economic growth. The next few years will undeniably continue to be challenging for stock markets and by association funds and trusts.

- Discount Delver: the 10 cheapest trusts on 22 July 2022

- Recessions are becoming more likely – here’s how to invest

- Funds Fan: winners and losers so far in 2022, and why small-caps outperform

The fight to ensure that inflation does not become entrenched means global interest rates will continue to climb for at least another six to 12 months, with economic prospects further dampened by energy prices that will remain elevated, while war rages in Ukraine.

Both portfolios will remain on the sick ward should the going continue to be tough for stock markets this year and into 2023, which seems likely, particularly as the cautious and adventurous portfolios are designed with long-term investors in mind.

Past performance is not a guide to future performance.

However, that does not mean that major surgery needs to be performed at this stage, for example by tilting to trusts that favour cyclically defensive companies.

Still, surgery is an option for the future, particularly among conservative portfolio members if the world looks likely to enter a prolonged period of ‘stagflation’, where inflation becomes entrenched and economies fall into recession and/or anaemic growth.

I would rather wait to see how far central banks are prepared to go to tackle inflation before doing any radical changes. A series of sharp rate rises could do the trick – especially as recession seems inevitable in any case. There is a strong argument for getting rate rises over and done with as fast as possible, to quench the inflationary fires, and then to rekindle economic activity by reducing rates later in 2023 or early 2024.

In the meantime, both portfolios will continue to include trusts that invest for the long term, generally by seeking out quality companies with profitable prospects and exciting business models.

Past performance is not a guide to future performance.

There are significant differences between the two portfolios, chiefly the implied levels of risk: the conservative selections will generally have more diversified portfolios and invest in larger companies, for example, or will not have high levels of gearing, compared with the adventurous choices. Such differences are reflected in the recent performance differentials.

I have separately revealed my picks for the year ahead for the conservative and adventurous portfolios, and provided a performance breakdown for all constituents over various time periods.

- Andrew Pitts' 10 conservative investment trust tips: July 2022

- Andrew Pitts' 10 adventurous investment trust tips: July 2022

Andrew Pitts was editor of Money Observer from 1998 to 2015.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.