The Analyst: using the yield curve to pick the right bond

Owning bonds within your investment portfolio can be a sensible move, but it might not always be easy to pick the right one. Analyst Dzmitry Lipski explains the benefits of understanding the yield curve.

27th February 2025 13:50

by Dzmitry Lipski from interactive investor

For investors looking to add bonds or bond funds to their portfolio, the yield curve can serve as an important indicator.

It shows that bond yields have equal credit quality but different maturity dates such as US Treasuries or UK gilts.

- Invest with ii: How Bonds & Gilts work | Free Regular Investing | Open a Stocks & Shares ISA

Understanding the yield curve can help investors anticipate future bond returns, as well as the direction of interest rates and the broader economy.

Understanding the yield curve

The yield curve tracks bond yields across different maturities, ranging from one month to 30 years, offering insight into the cost of borrowing over time. Its slope helps predict interest rate changes and overall economic activity. Yields on bonds of different maturities behave independently of each other, with short-term rates and long-term yields often moving in opposite directions. By comparing long- and short-term bond yields, the yield curve describes future trends in bond returns.

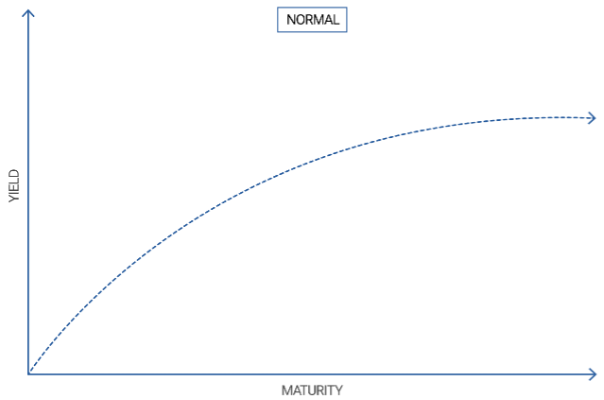

A normal yield curve slopes upward, indicating that long-term yields are higher than short-term bond yields. This reflects investor expectations of higher compensation for risks such as inflation and economic uncertainty.

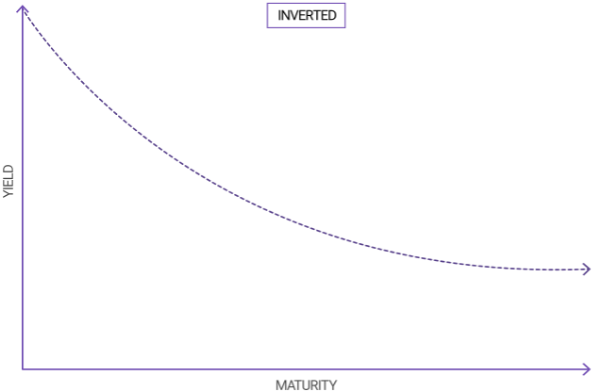

In contrast, an inverted yield curve - where short-term yields exceed long-term yields - suggests expectations of slower economic growth and potential recession, given that investors are willing to accept less income to lend for longer. Future inflation expectations are a big driver behind the shape of the yield curve.

The ‘normalising’ yield curve

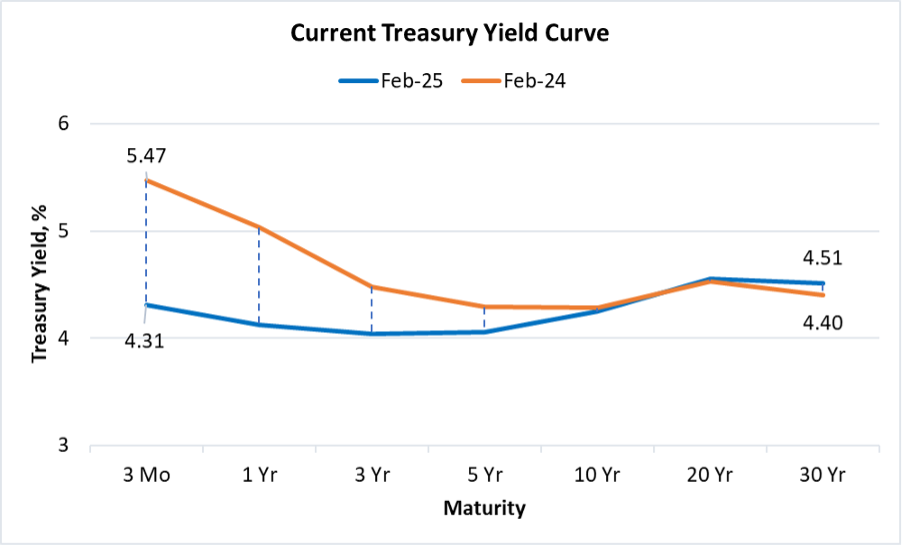

From early 2022 to mid-2023, US central bank the Federal Reserve raised the federal funds rate to more than 5%, causing the yield curve to invert. After holding rates at elevated levels (above 5%) for more than a year, the Fed initiated rate cuts from September and December 2024. As a result, short-term Treasury yields declined, while long-term yields increased, gradually restoring the curve’s normal upward slope.

While the yield curve is returning to normal, it remains relatively flat compared to a typical bond market, suggesting a continued uncertain outlook about the economy. Over the past year, the yield on the US 3-month Treasury bill has declined from 5.47% in February 2024 to 4.31%. Meanwhile, the yield on the US 10-year Treasury note has remained close to 4.3%.

Source: US Department of the Treasury.

How investors can use the yield curve

The yield on the front end of the curve (short-term bonds) reflects expectations of future Fed policy moves. For instance, as the Fed raised rates from 0% to a range of 5.25–5.5% starting in March 2022, short-term bond yields moved accordingly. When the Fed begins cutting rates, short-term yields are expected to decline in anticipation of further easing.

Investors can identify opportunities based on yield curve movements. If the economy slows and the Fed cuts rates, long-duration bonds may outperform as declining rates push bond prices higher. As such, investors may benefit from adding duration - the sensitivity of a bond to changes in interest rates - to their portfolios.

- Fund Battle: which are the best money market funds?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

In general, longer-dated bonds with low coupons will have longer durations. The longer the bond’s maturity, the more time there is for interest rates to change and impact the bond’s price. On the other hand, bonds with shorter maturity dates or higher coupons will have shorter durations, as they are less sensitive to changing interest rates.

Comparing bond yields across different maturities can help investors take a tactical bond duration allocation. When the yield curve is normal, higher yields on long-term bonds may justify the additional risk. Conversely, when the curve inverts, short-term bonds might offer better risk-adjusted returns.

Alternatively, investors can extend duration using a so-called barbell approach by allocating 50% to cash or money market investments and 50% to medium or long-duration bonds.

Bonds remain attractive

Looking ahead, analysts anticipate further steepening of the yield curve as the Fed cuts rates, which will push yields on the short end of the curve lower until the central bank reaches its “terminal” rate - the end of the easing cycle.

At its December 2024 meeting, the Federal Reserve lowered interest rates by 25 basis points while maintaining a cautious outlook for 2025. Economic data has been consistently strong and inflation remains persistently above the target range. Additionally, potential shifts in government policies on tariffs and deregulation introduce further uncertainty about the future trajectory of monetary policy.

- Bond Watch: UK inflation rises with peak yet to come

- Benstead on Bonds: reforms could be a game changer for retail investors

As short-term yields decline, investors who previously favoured money markets and short-dated bonds may decide to explore longer-term bond opportunities further along the yield curve.

With long-term yields expected to remain elevated, bonds have become more attractive, offering higher returns, primarily through attractive coupon payments rather than capital appreciation. Investors might want to consider medium-term bonds (three to seven years) to capture favourable yields while benefiting from portfolio diversification.

Overall, bonds should continue to provide investors with diversification benefits, acting as a buffer against equity market volatility, while offering stable income and being relatively low risk, particularly during periods of economic uncertainty like the present time.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.