Analyst has a nibble at these four funds

28th January 2019 12:44

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Spotting an opportunity, the Saltydog analyst is putting his cash to work in these tech and UK funds.

A positive start to the year

After a difficult end to last year most stock market indices are up so far in 2019, even though they have dropped a little in the last few days.

When markets have fallen, but then start to go up again, it's difficult to tell if it's just a temporary reaction (a 'dead cat bounce') or the start of a more sustained recovery.

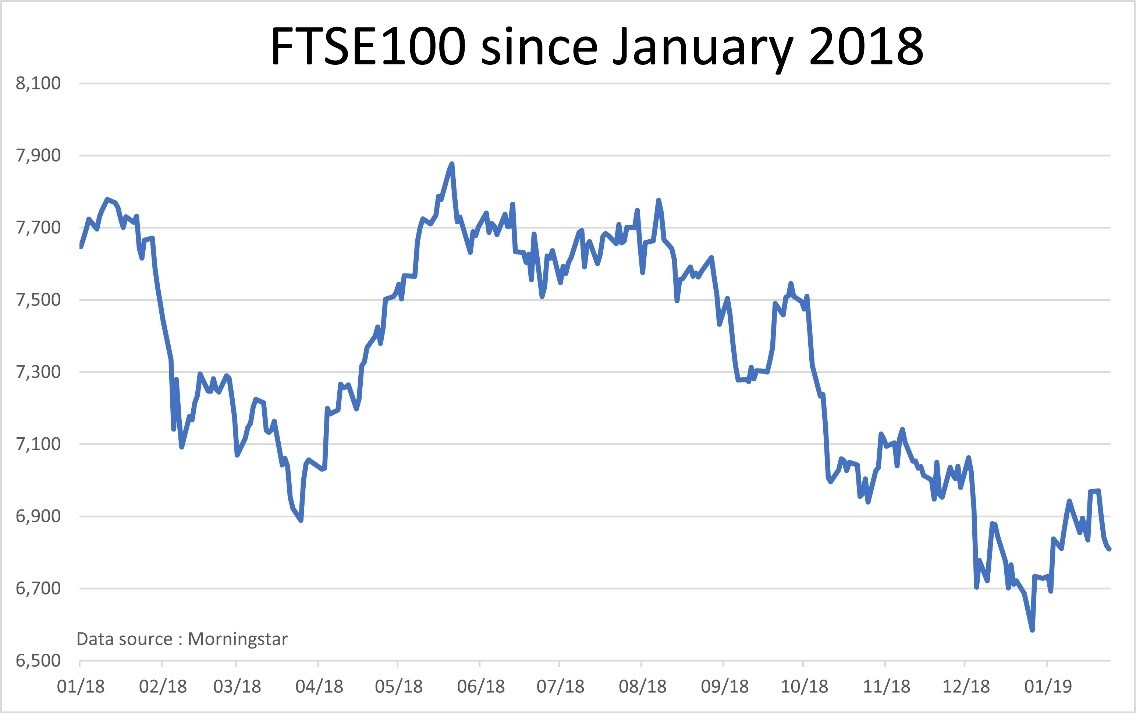

Here's a graph showing the FTSE 100 index since the beginning of last year.

As you can see there have been several occasions when the index has started to go up, but then fallen back again. Unfortunately, we've no way of telling what will happen this time.

What we do tend to do is make a small investment in something that's doing particularly well, and that then gives us a couple of options. If it starts to go down, we can always sell and move on - if we're quick we won't lose too much. If it starts to do well, then we can add to our holding and maximise the possible gains.

We've recently done this with the Jupiter India. We invested in November and in one portfolio it's up 0.9%, and in the other it's down 0.4%. It's now dropped out of our numbers and has struggled over the last few weeks - time to sell up and move on.

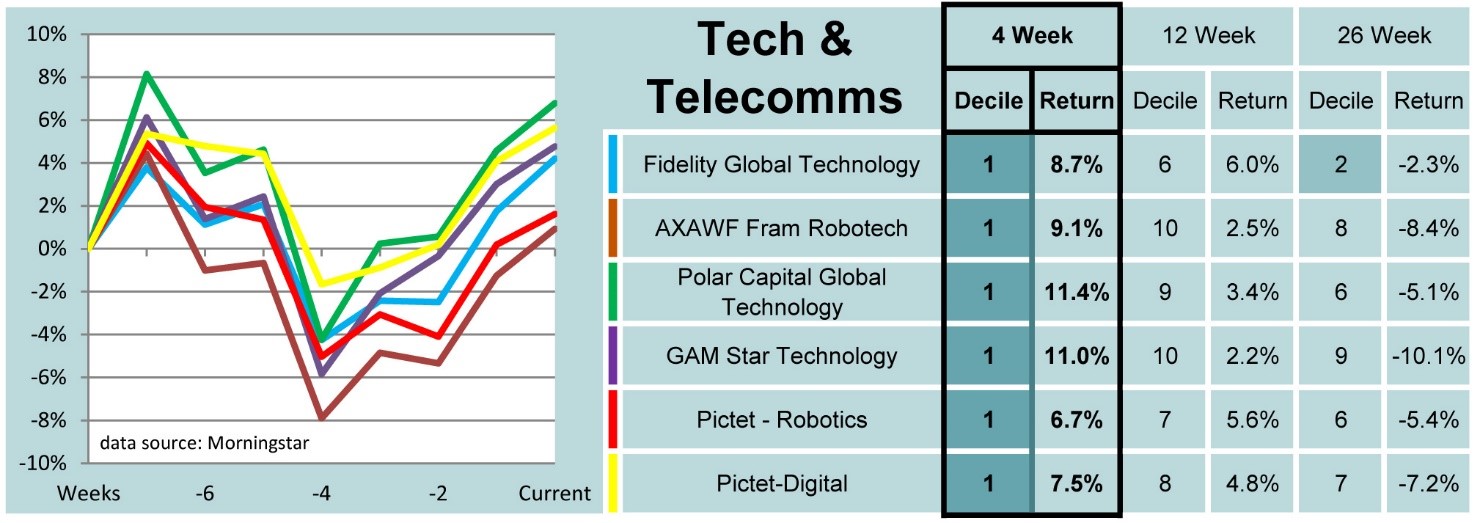

In last week's analysis the best performing sector over the previous four weeks was Technology and Telecommunications. We saw the funds in this sector do well at the beginning of last year, but then lose most of those gains in the final quarter of last year. Maybe the sell-off was overdone and there's an opportunity for a recovery in this sector. We're not getting carried away but are making a couple of small investments.

There are a handful of funds to pick from, but in the end we chose the Fidelity Global Technology fund and the Polar Capital Global Technology fund. The Fidelity fund is currently at the top of our four-week data table, and leads over 12 weeks. It's also one of the best performing funds in this sector over 26 weeks. The Polar Capital fund has the best return over four weeks, but has been less consistent and hasn't done so well over 12 and 26 weeks.

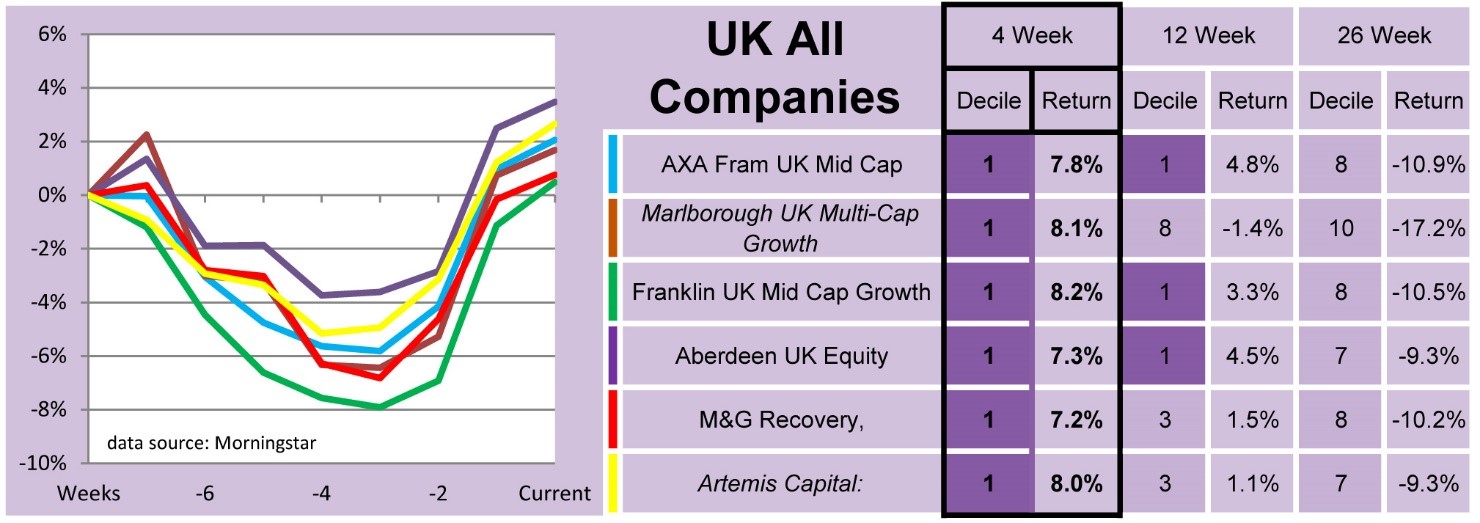

Over the last fortnight we've also seen the UK equity sectors start to perform well.

In the 'Steady as She Goes' Group the UK All Companies sector is now at the top of the table followed by the UK Smaller Companies sector.

With all the uncertainty over Brexit there are plenty of things that could affect these sectors, but on the other hand if they've survived the recent turmoil then perhaps they've hit rock-bottom and are on the way up. We've made a couple of small investments. One is from the four-week data table – the AXA Framlington UK Mid Cap fund.

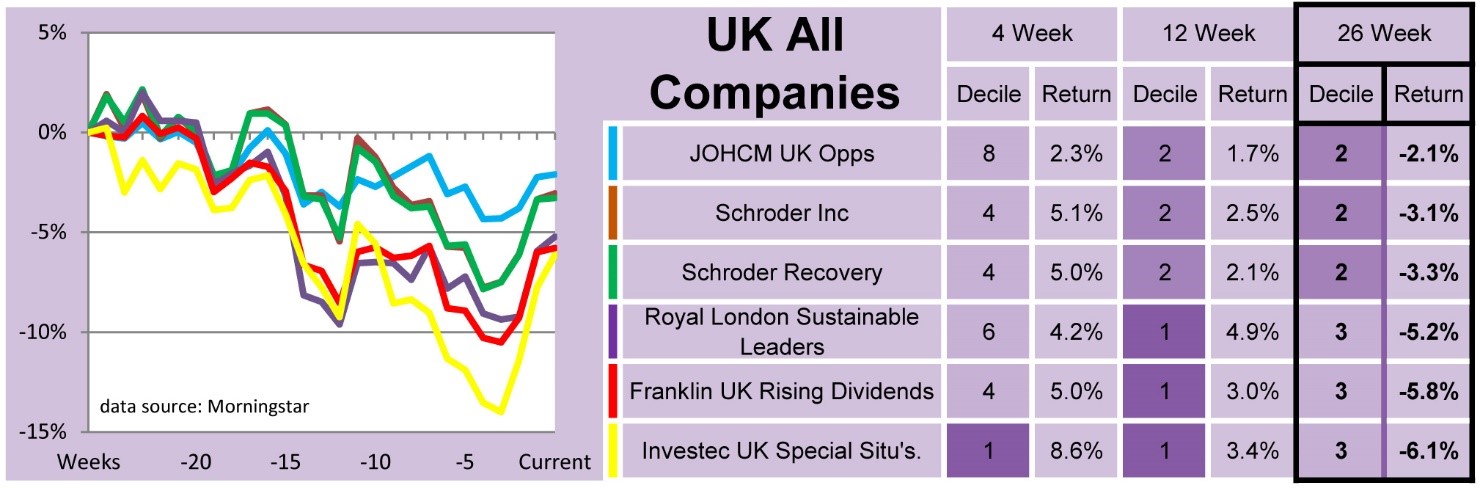

The other is from the 26-week data table – the Investec UK Special Situations fund.

Since the beginning of the year we have also seen sterling start to strengthen. It briefly dropped below $1.25 but is now over $1.31 – a rise of 5%. This will have had a negative effect on funds investing overseas and, if the trend continues, could be another reason to favour the UK equity sectors.

For more information about Saltydog Investor, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.