Analysis: the possibility of a melt-up in financial markets is real

We consider two strategies to cope with markets which, could ‘melt-up’ followed swiftly by a melt-down.

3rd July 2020 15:59

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

We consider two strategies to cope with markets which, boosted by massive government support, may be witnessing the start of a ‘melt-up’ which may be followed swiftly by a melt-down...

Oh the humanity...

Callum Stokeld, investment trust research analyst at Kepler Trust Intelligence.

"There are two kinds of forecasters: those that don't know, and those that don't know they don't know"

(John Kenneth Galbraith)

"There are only three certainties in this world: death, taxes, and being misquoted after you die"

(Benjamin Franklin, allegedly)

J.K Galbraith’s comment has always seemed to me possibly the most egregiously misused quote in financial markets. It is seemingly a statement of the obvious, but what it is surely saying is that the future is inherently uncertain.

To state that markets are discounting mechanisms is also not controversial, because it is making the same point.

Nobody knows the future, not even readers of trustintelligence.co.uk, by definition the brightest and most discerning segment of society (and probably the best-looking too). But when participating in the market we make an assessment of probabilities and then try to measure those against the assessment by the wider market.

In this piece, we assess whether there may be a higher probability than the market currently assumes that later in 2020 we will see an equity market melt-up, ripping prices higher; and that this will not be a rational move, thus adding subsequent downside risks.

We have looked at some alternative sources of returns which we believe could broadly participate in such a rally while at the same time ultimately serving as an (at least partial) hedge for portfolios.

‘Buy and hold’ is ingrained in the minds of most of us because of recency bias. Yet, among others, Christopher Cole of Artemis Capital has highlighted how anomalous this current epoch has been in generating consistent long-term asset price returns.

Over time there have been numerous sustained periods in which a typical 60/40 portfolio has delivered poor or even negative long-term returns.

With a significant proportion of global government issuance currently exhibiting negative yields, and UK gilts and US Treasuries not far behind, there is incredible duration risk in just allocating blankly to bonds; and this risk is likely also present (to a lesser extent) in your equity book if you invest in high-quality or high growth names.

Perhaps it is no surprise then that Terry Smith of Fundsmith recently moved a proportion of his assets from bonds to a long/short equity fund.

How we got here

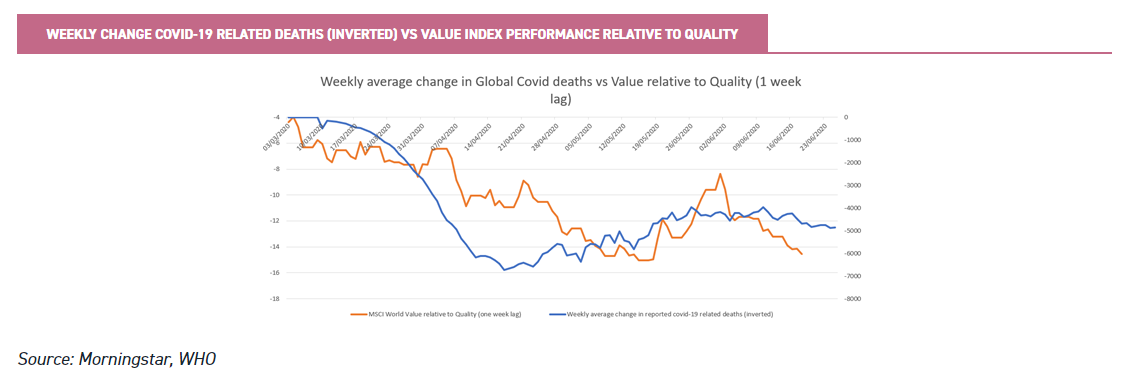

Some evidence of a rational underpinning of the market rally can perhaps be seen in the rotation between short-term market leadership of low-leverage ‘quality’ stocks, followed by typically more leveraged ‘value’ stocks.

In the latter case insolvency risks that had previously been accounted for suddenly diminished, in the near term, as a result of government and central bank intervention. Perhaps more pertinently, market leadership on the basis of first balance sheet strength – and then the lack thereof – seems to have somewhat lagged the path of COVID-19 related deaths; and thus also lagged the expected normalisation rate of the economy and the implied solvency risk from an extended balance sheet.

What is risk? Downside, volatility, missing out, a board game?

The rapidity of the equity market sell-off seen in Q1 2020, and the subsequent rebound, have naturally led many to reconsider the meaning of ‘risk’.

Tacitly, most of us commonly understand ‘risk’ to mean potential downside or the volatility of returns.

Despite some disparagement of the latter definition of ‘risk’, we would argue it is surely not irrelevant for a portfolio from which realisations are regularly made to provide income, such as a pension in drawdown.

From that standpoint, after all, it is hard to perceive ‘risk’ as being to do with generating better returns than expected.

The world we live in seems designed to encourage cognitive biases. Many of us involved in financial markets have become aware of the term ‘fear of missing out’ as a seemingly glib explanation for performance chasing; but the term has been investigated across a range of subject areas and found to exert a (variable) psychiatric impact on all of us.

Fear of missing out can easily lead to poor allocation decisions. With deference to the objections to the term expressed by Clifford Asness, we note that sentiment surveys of professional managers consistently indicate the presence of ‘cash on the sidelines’.

No professional investor really wants to be Tony Dye, and it seems reasonable to assume that as the cycle extends it will require increasingly shallow pullbacks for investors to put more capital to work in the market.

The wisdom or madness of crowds?

"When I see a bubble forming, I rush in to buy, adding fuel to the fire..."

(George Soros)

Francis Galton first observed in 1906 that the aggregate average wisdom of a crowd tended to exceed that of any individual.

Yet, as highlighted even earlier (in 1852) by Charles Mackay in Extraordinary Popular Delusions and the Madness of Crowds, illogical manias can enter the zeitgeist and affect the crowd’s judgement.

It is on judging and balancing the likelihood of either of these scenarios that George Soros has predicated much of his success; seeking to follow trends so long as there remains a rational driver, before exiting when the herd becomes irrational and he has identified an inflection point.

So, is the rally illogical at this time, and should you just sit it out? After all, manias tend to have limited lifespans. We think it is probably not an irrational mania yet.

Swap one risk for a later one

Let us suggest that the initial sell-off and subsequent rally were primarily predicated on a liquidity squeeze in the global financial system and its resolution.

As global trade volumes and expectations collapsed, the global financial system found itself short of US dollars (the BIS estimates that over 80% of trades globally involve USD, providing a constant flow of USD across the globe).

On Thursday 19 March 2020 the US Federal Reserve opened new swap lines to several emerging market central banks, as well as expanding its existing facilities.

This action eased the incipient USD squeeze and – we would suggest – was probably the single policy decision that had the most effect in reversing the fall in financial markets (which duly bottomed out on the following Monday).

By removing short-term liquidity concerns, the Fed also alleviated short-term solvency concerns, as foreign firms were then able to access US dollars to meet their obligations and settle contracts.

The measure also gave room to overseas authorities to provide more direct economic support themselves: numerous emerging economies have subsequently been able to conduct QE operations and expand fiscal stimulus without devastating their exchange rate.

Swap lines are not the solution themselves, but they are THE essential component of any global solution.

Swap lines need to be unwound at the end of their maturity period, or else extended or rolled over. In the case of the most recent provisions, these will need to be rolled over six months after their issuance (around three months from now, in September 2020).

Whatever the shape of the recovery at that time, global trade will almost certainly not have reached its previous levels, yet financial obligations have risen considerably.

Unwinding swap lines will simply not be feasible, but the market will likely increasingly discount the tail-risk possibility that they are unwound. Without swap line provisions, the other stimulus measures introduced by everyone bar the US suddenly look more precarious.

We mention this to highlight that it is eminently possible that, without swap lines, all other support measures combined will not be sufficient to support the global economy.

However, swap lines give the authorities the ability to provide stimulation with less risk of a dollar surge, which would trigger a mass global tightening of liquidity and increase solvency risks. Thus, gently rallying markets are probably fundamentally rooted in reason so long as the swaps remain in place.

And yet

There is reason to think that the most vulnerable area to the global macro cycle is, at this time, the Eurozone. The euro is the most significant component of the trade-weighted USD, and the ECB has availed itself of swap lines to a very significant extent.

Expansion of the money supply into the real economy will remain a challenge given that the principal mechanisms for achieving money growth in Europe – including highly levered banks – remain vulnerable.

Whilst the ECB has a permanent swap-line arrangement in place with the Fed, the Eurozone economy’s exposure to global trade volumes as a marginal driver of growth leaves it vulnerable to secondary effects from emerging markets.

What if the region most vulnerable to a global slowdown also had the most systemic risk of domestic slowdown?

For this reason, if no other, swap lines will have to be rolled.

When they are rolled, suddenly the value of massive balance sheet expansion and fiscal stimulus will once again seem less vulnerable.

Extending, expanding and/or rolling these swap lines will be like an interest rate cut for the globe.

Let us remember that it was the Fed’s decision to cut rates in July 1927, to alleviate tight money conditions elsewhere in the world, that accelerated the strong market of the 1920s into a mania.

Similarly, its decision to cut rates in October 1998 accelerated the tech bubble. Like Pavlov’s dog, markets and participants have been conditioned to buy on rate cuts and will bid stocks higher – without thinking.

The rally from this year’s lows can be seen as a reasonable reassessment of solvency risk, even though undoubtedly it also contained pockets of irrationality – such as significant rallies in the shares of companies which had actually declared bankruptcy.

A further rally on the expectation that stimulus measures are permanent may not seem irrational, because it simply follows what most of us have consistently experienced in recent years.

However, bidding valuations higher suggests either an improved outlook for future cash flows, or that the current value of those future cash flows has fallen.

Given where rates are at this time, significant further reductions in discount rates seem likely to be reasonably limited.

Suggesting the outlook for corporate cash flows has improved en masse – simply on the grounds that financing conditions have stayed easy and government largesse is being extended – is not really rational, given our experience of governments propping up firms that would otherwise be insolvent, by ensuring they can refinance at lower rates in perpetuity.

All this does is create zombie companies, as witnessed in Japan over several decades and in the West after the financial crisis.

The rally as markets bid up the value of existing, unprecedentedly large fiscal and monetary stimulus measures will thus likely be irrational.

As professionals feel compelled to enter the market with their remaining cash, successful retail investors – flush with success – will add to margin accounts and further bid up the stock market.

The market will seemingly take on an ‘exponential’ trend (to use everyone’s favourite adjective).

Do not be Isaac Newton

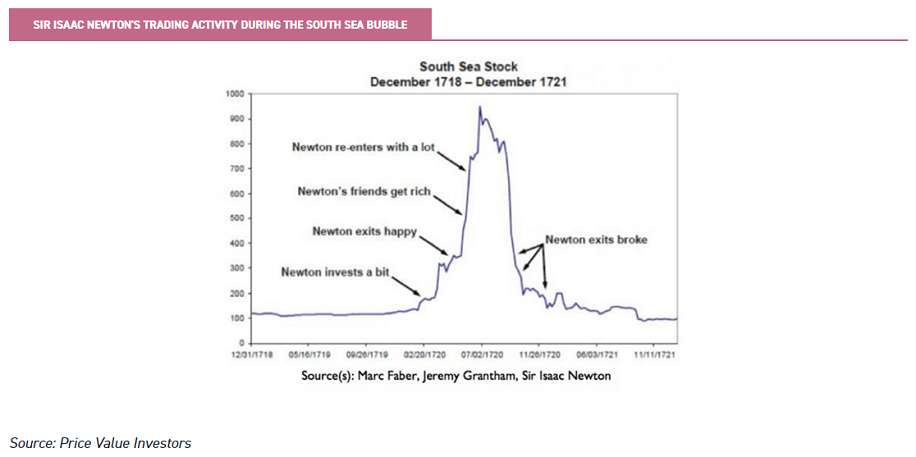

Not only has gravity already been well established as a theory but even one of the greatest minds in history was not immune to unfortunate trading activity amidst rampant price speculation.

During the South Sea Bubble, having profited handsomely and sold his initial stake in the titular South Sea company, Newton felt himself compelled to re-enter the stock. Financial disaster promptly ensued.

Source: Price Value Investors

Sir Isaac is not alone in history. More latterly, Julian Robertson, having enjoyed an outstanding hedge fund career, finally capitulated to the mania of the tech bubble in March 2000 just as the NASDAQ topped.

Stanley Druckenmiller, possessor of one of the most outstanding investment track records in history, had similarly capitulated in late 1999.

Both expected the bubble to burst, but believed its duration was liable to be too long to sit out. Both, at least, were able to curtail their losses.

For most of us, it will be easier to just participate than to sit the whole thing out, which also reduces our risk of mistiming a re-entry if the rally turns out to be well founded.

What is your goolie chit?

In the First World War, British airmen flying over what was Mesopotamia were issued with a ‘goolie chit’ which stated, in four different local languages, a message to the effect:

“This man is a British pilot. If you return him, with his testicles, to the nearest British base you will receive a reward”.

We have outlined above why we think there is a possibility that equities could move sharply and irrationally higher. So perhaps we should be asking ourselves, in essence, where is our goolie chit? What can we do to ensure that – even if we take a bit of a beating in such an environment and its denouement – we will come out the other side more or less whole?

Timing the market is notoriously challenging (and improbably unlikely to succeed). But neither is it easy to sit on the sidelines waiting for a buying opportunity that may never come. Instead, we suggest looking for assets that can perform in the upside and be set up well in the subsequent market environment.

There is no magical formula which will match all circumstances, nor is there any clear and definite path ahead of us. Still, let us consider some possible options beyond a simple 60/40 portfolio.

Volatility linked investments

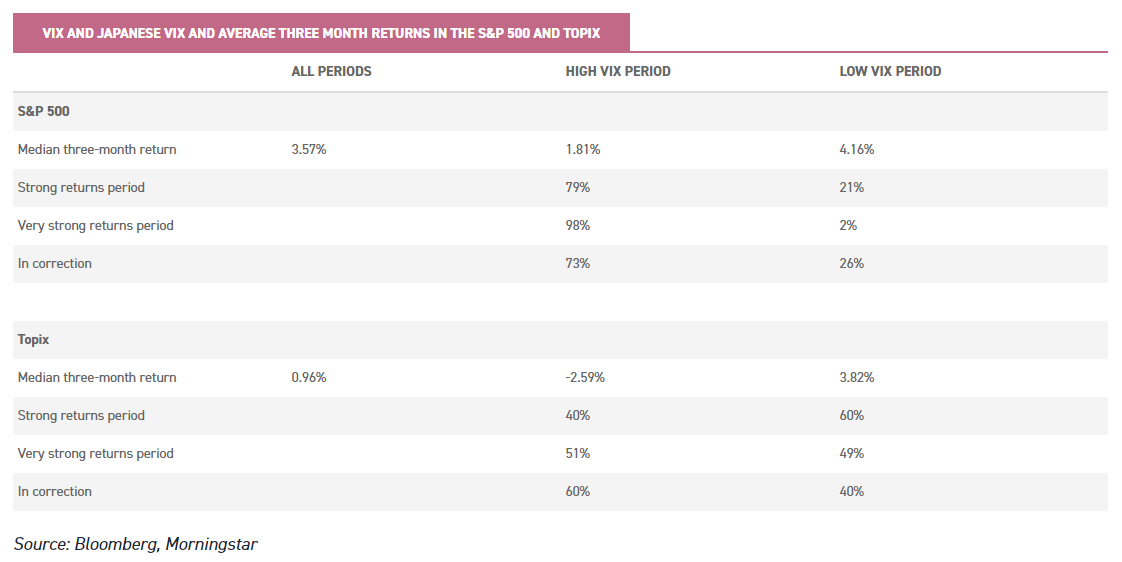

Volatility is often disparaged as a measure of risk. After all, volatility will rise mechanically if we see markets surge suddenly. Downside is, however, typically associated with volatility, and around 73% of days when the S&P 500 has been in correction (a drawdown from the previous peak of over 10%) have occurred in periods of heightened volatility.

And yet, despite this, US markets often see their strongest returns in periods where volatility is elevated. In the table below, we can see median three month returns for the S&P in periods where the VIX volatility index is elevated, and in those where it is subdued.

Lower VIX periods generally perform stronger. However, periods of stronger returns (defined here as over one standard deviation above the median) actually tend to occur more commonly when VIX has been elevated over the same period.

Very strong periods (two standard deviations above median) nearly always occur in a high VIX environment.

The same effect is not observed in the Japanese market, but it remains clear that elevated volatility is by no means certain to lead to poor returns.

[We have taken this data as far back as is available to us, which is from 09/02/1995 for the S&P 500, and 05/01/1998 for the Topix].

Volatility does not necessarily mean falling markets. But falling markets more often experience above-average volatility.

So, perhaps VIX offers the potential to participate in a rally as well as in a risk-off phase? Being able to actually access this vehicle, however, is a different matter.

VIX is a range-bound representation of risk, which is priced off the market value of call and put options. Some strategies, such as Ruffer Investment Trust (RICA) access VIX through buying call options on the VIX itself.

As we noted in our most recent update on RICA, in the recent crisis this strategy produced returns of 100x on the capital invested in them.

With volatility remaining elevated, however, Ruffer’s view (which we would share) is that there is limited value in these options. Furthermore, as call and put options are themselves priced off implied volatility, the elevated implied volatility market suggests there is likely more money in writing options than holding them.

The managers of Dunedin Income Growth (LSE:DIG) and Manchester & London (LSE:MNL) note, for example, that writing covered calls is netting significantly improved income streams for them at this time.

Perhaps a simpler, relatively uncorrelated strategy which could benefit from a VIX spike and a market breakout in either direction are sister trusts BH Macro (LSE:BHMG) and BH Global (LSE:BHGG).

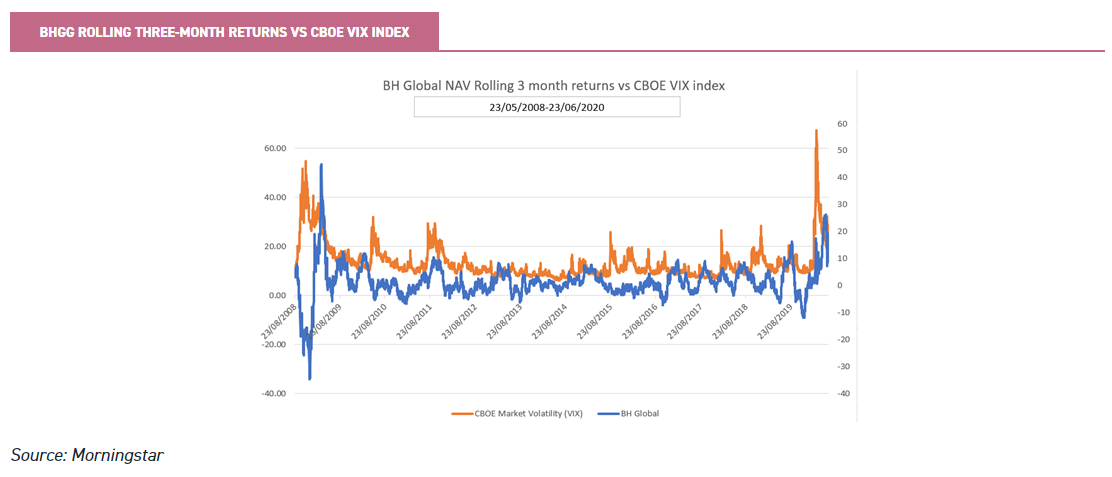

Although it is not always clear how the traders at Brevan Howard are positioned at any one time, they have significant flexibility and willingness to change these two trusts’ exposure to different market and economic conditions. Volatility spikes create greater opportunities for generating returns, as can be seen in the graph below, where we see that BHGG’s three month returns tend to coincide with periods where volatility is moving higher.

In periods when VIX has spiked above 20, BH Global has generated median three month NAV returns of c. 5% when the S&P 500 is positive over the same period; and around 7.8% when the market is negative.

Clearly, volatility is a more important driver of returns for these two trusts than market directionality, reflecting the fact that both employ macro hedge fund strategies.

Relative returns to the market are more-or-less flat in periods of elevated volatility (with median three month relative returns of -0.9%).

As noted above, BHGG is relatively opaque, and there is no guarantee it would benefit from a VIX spike. The discount can also be volatile, and in any subsequent mass liquidation following a rally the share price may suffer even if NAV holds up well (such as occurred in Q1 2020, when the two trusts’ discounts widened considerably, despite NAVs performing strongly).

Historically, however, both BHMG and BHGG have proved to be effective hedges on many occasions; and the flexibility of their strategies and the increased opportunities afforded to them to profit in a rising volatility environment mean they could at least partially participate in any market rally.

"Gold is money. Everything else is credit..."

(J.P. Morgan)

"Show me the incentive and I'll show you the outcome..."

(Charlie Munger)

We noted above the risk that a melt-up rally may well follow on from easier monetary conditions across the world.

In the past decade we have seen mass monetary expansion feeding into asset price inflation, but not particularly into consumer price inflation, as the velocity of money collapsed. We will be discussing in a future piece the potential for a revival in inflation.

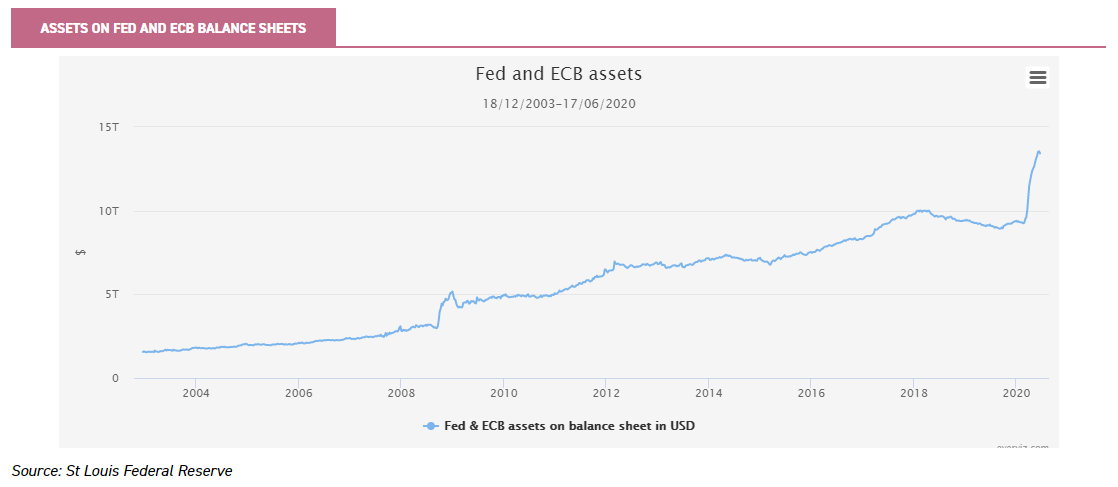

Here we simply note that the recent expansion of the money supply has been so great that, to avoid causing inflation, the collapse in velocity from already depressed levels would have to be greater than anything seen previously.

As Russell Napier recently noted,6 at this point you either believe the ECB will hit or exceed their inflation target for the Eurozone in the not-too-distant future; or you have to assume the end of the Eurozone – a shock which would surely see gold, the ultimate safe haven for several thousand years, actively sought out.

En masse across the globe, governments are also embarking on huge fiscal stimulus programmes. Implicit – and in some cases fairly explicit – acknowledgements that monetary policy is being undertaken more-or-less directly to support these programmes (and to cap any rise in interest costs) have become increasingly common.

Having discovered in ‘wartime’ (as many have termed the response to the COVID-19 pandemic) that they can effectively monetise debt, governments are unlikely to be willing in ‘peacetime’ to abandon such an obliging service – from which they observe little risk.

Similar dynamics were seen in the US during and after the Second World War.

Gold performs well in periods where ‘real’ (inflation-adjusted) interest rates decline, as the opportunity costs of holding a non-yielding asset fall.

Gold miners are, of course, operationally leveraged to the price of gold, and in recent years have exerted great capital discipline in expanding their production.

The industry on average has a cost of extraction significantly below the current spot price, with the largest gold company in the world (Barrick Gold (NYSE:GOLD)) only undertaking new projects when they believe they can generate an internal rate of return of 15% p.a. or greater on a gold spot price of $1,200 an ounce. With many costs relatively fixed, profitability can rise steeply with a rising gold price.

These are some of the arguments for gold and miners on their own, but will they rally with the market if we see a melt-up?

As ever, we cannot know, but if a rally is predicated on policy support and the expansion of stimulus, it would be a fairly logical follow-through.

Gold miners will certainly be likely to be hit if and when the market subsequently pulled back, as sell-offs are generalised and not discerning. But assuming bullion holds up, they would likely be among the first and strongest recoveries.

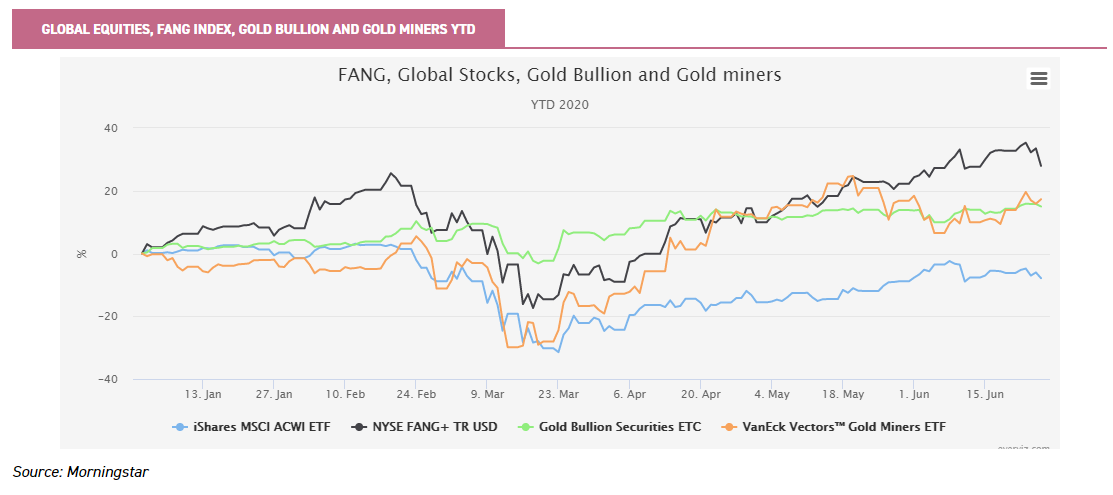

This was what we saw in March 2020, where gold miners reached their low point on 16/03/2020 (when the Fed announced further QE measures, and the day before it announced that it had expanded swap lines, as noted above).

This was a full week before the wider stock market and before even the celebrated FANG index. The bounce back has been stronger too, with gold miners experiencing a greater rally since their trough than either the FANG index or the wider stock market (around 67% in the Gold Miners ETF highlighted below) – even as they have trailed off in recent weeks.

The performance of gold bullion, meanwhile, suffered somewhat in the teeth of the worst of the sell-off, but still held up well.

History, despite what Marx averred, does not tend to repeat itself, and it would be dangerous to assume that we will see a repeat of the above pattern in any sell-off and recovery.

But the recent performance of gold and miners is certainly not irrational, reflecting as it does the vast recent expansion of the global money supply.

Bitcoin, like gold a ‘currency’ where the expansion in supply is constrained, has been similarly rallying.

A generalised market melt-up seems likely to carry miners with it, if (as we deem likely) it occurs via the extension and expansion of stimulus.

Markets may remain irrational longer than you can remain solvent, but there is a great mass of money constantly searching for a home, and any pullback concurrent to a market sell-off may well prove to be far more transitory than any sell-off see in wider stock markets, contrary to what we have often experienced in the past.

At the same time, gold miners will likely remain extremely volatile, and bullion will probably not keep pace with a market rally in our view.

Investors with a strong stomach for short-term fluctuations can take on direct exposure to the sector through the Golden Prospect Precious Metals (LSE:GPM) investment trust, but at only £34 million market cap this portfolio may be relatively illiquid for larger allocations.

BlackRock World Mining (BRWM) offers a slightly more diversified, but still significant, exposure to gold miners (with c. 31% in gold, and a further 4.9% in silver and diamonds as of 30/04/2020).

With the rest of its portfolio held across equity and debentures in companies involved in industrial metals, BRWM should remain strongly exposed to rising markets predicated on expectations of stimulus expansion and easier monetary conditions.

Supply discipline in the gold mining sector has been equally true in industrial metals, and the value of metals in general has been rallying strongly in recent months.

Forward profit margins for the global materials sector have fallen drastically as global economic activity collapsed, but have started to tick up again in recent weeks. Similar occurrences (albeit from slightly lower bases) in 2009 and 2015/16 preceded major absolute and relative rallies in metals miners (Source: Yardeni).

The manager of the Keystone Investment trust (KIT), a UK equity trust, has also noted this trend and been significantly increasing his exposure to gold miners in recent months (as we discussed in our previous update in May 2020).

While wider stock market direction will remain a more important driver of returns for this trust, its significant weight to gold miners has been a contributor to superior NAV upside capture relative to the wider AIC UK All Companies sector average since 23/03/2020.

The board recently approved an increase in permissible exposure to overseas stocks within the trust to 20%, intended to allow the manager to increase his weighting to this area.

Other trusts, such as Ruffer Investment Company (RICA)also hold gold bullion and miners within a wider portfolio. As we noted in our last update, while RICA’s primary feature is likely to be resilience in periods of market turmoil, the materialisation (or expectation) of increased inflationary expectations could lead to substantial upside.

Mass expectations of stimulus extension may fuel an increasing view across the market level towards just such a position. And while RICA should not (by design) keep up with a rapidly rising market, it may well offer absolute upside while at the same time retaining resilience.

Conclusion

The magnitude of the economic shock from the COVID-19 pandemic has been met with an unprecedentedly huge degree of support measures.

However, seemingly aware that the essential glue which holds the global financial system together (USD liquidity and availability) will be threatened by the expiry of support measures later in 2020, markets have not yet moved to an exuberant condition.

Should these measures be extended (as they almost certainly will be), the possibility of a melt-up in financial markets is real, in our view, as the support offered to financial markets is repriced positively.

The ‘risk’ of significant and rapid upside is one of many influences on investment allocation decisions. Fear of missing out in any such rally will always be palpable, and as the strength and duration of any such fears grow so will the likely subsequent downside risk.

Merely participating in a rally and exiting at the appropriate time is not a realistic goal. Traditional diversification (via a 60/40 portfolio) may well be of limited efficacy this time, in our view.

Rebalancing as a risk management tool is predicated on the assumption of financial markets which, ultimately, mean-revert around a rising trend on a more or less continuous basis. But the most recent investment epoch has been an aberration in its experience of just such conditions.

Nonetheless, there remain positions which can participate, match or perhaps even exceed the market upside induced by such conditions; yet which should retain ultimately resilient characteristics as the mania fades and broader markets retrench.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.