America’s biggest oil companies are a buy again

Shares haven’t been this cheap for a while following recent mixed results, which could be an opportunity for investors to pick up a bargain. But this might not be for everyone. Overseas investing expert Rodney Hobson explains why.

1st November 2023 10:13

by Rodney Hobson from interactive investor

A new dimension has been introduced into the oil sector. It is once again consolidating and once again the strongest players will come out on top. That means American giants Chevron Corp (NYSE:CVX) and Exxon Mobil Corp (NYSE:XOM), whose latest quarterly results combined lower profits with optimistic outlooks.

While the world is supposedly running down its reliance on fossil fuels, Chevron has agreed to expand its oil assets by buying smaller rival Hess in a $53 billion all-share deal. Hess owns the biggest oil discovery of the past 10 years, the Stabroek area 120 miles off the coast of Guyana. It also has interests in the Gulf of Mexico and southeast Asia, in shale deposits in North Dakota and has a 30% stake in extensive oil fields operated by Exxon.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Other recent deals include buying PDC Energy, with fields in Colorado and Texas, for $6.3 billion and taking a majority stake in ACES Delta, which is developing an energy storage project in Utah.

For its part, Exxon is paying $60 billion for fracking specialist Pioneer, also an all-share deal. Earlier this summer it agreed another all-share acquisition, $4.9 billion for US carbon dioxide pipeline network owner and operator Denbury.

Both Chevron and Exxon insist they are committed to helping build a low-carbon energy environment, but the reality that they both recognise is that oil and gas are here to stay for the foreseeable future. Their shares trade at a premium to those of their British and European rivals, leaving the Americans in the driving seat in seeking oil and gas takeovers, which at $254 billion so far this year have already reached their highest level since 2014.

Meanwhile, Chevron has reported that total revenue was $54.1 billion in the third quarter, down 19% on a year earlier when oil prices were higher, but better than analysts had expected. More worryingly, net income slumped 42% year on year to $6.5 billion as upstream and downstream operations both fell back heavily. That’s partly because of the strength of the US currency reducing some overseas earnings when translated back into dollars.

Source: interactive investor. Past performance is not a guide to future performance.

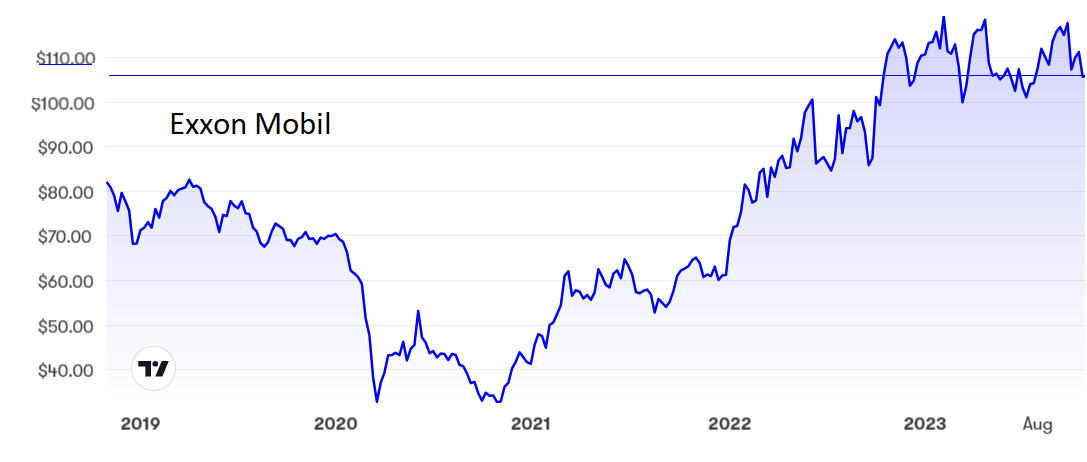

Exxon fared less well, reporting quarterly revenue down 19% to $90.8 billion and, although total costs were reduced by 11%, net income was less than half that earned in the same quarter last year at $9.1 billion.

Both companies are staking their futures on acquiring more oil and gas acreage in the belief that the world is losing its will to tackle climate change by reducing emissions. Investors who feel this is misplaced will want to stay well clear. In the meantime, both companies are generating cash and will benefit from the continuing high price of crude oil, which currently stands above $80 a barrel.

Chevron shares had a good run after collapsing to $60 in March 2021 in the depths of the pandemic slump, and actually trebled to a peak of $188 nearly a year ago. But they have fallen back this year to $146, where the price/earnings (PE) ratio reflects the uncertainties of the world economy at 10.7 but the yield looks reasonably tempting at 4.1%.

Exxon shares have followed a similar pattern with a low around $33 and a high just shy of $120 before easing back to $106, where the PE is 10.5 and the yield 3.4%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: Investors who regard this sector as unethical will be strengthened in that belief as ramping up oil production takes precedence over diversifying into greener energy. For others, the recent fall in share prices makes Chevron and Exxon a buy again. Both shares should find a floor just a little below current levels.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.