All change for trusts after sector overhaul

Following changes to sector classifications, we identify where trusts stand in their new peer groups.

23rd August 2019 15:45

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Following changes to sector classifications, we identify where trusts stand in their new peer groups.

All change: a closer look at the AIC's revised sectors

We examine the AIC's revised sector classifications and discuss whether further improvements could be made...

William Sobczak, analyst at Kepler Trust Intelligence.

This spring the Association of Investment Companies (AIC) overhauled its sector classifications, adding 13 new sectors and renaming 15 others. This decision was made in an attempt to more accurately reflect the shape of the industry, and help offer investors greater clarity when comparing peers.

Several of the changes came in the alternative asset spaces and these are very welcome. Alternative assets have been an area of increased popularity in recent years, making a rationalisation of the sector definitions valuable. The amount of money invested by investment companies in alternative assets has grown by 92% over the past five years, rising from £39.5 billion in 2014 to £75.9 billion in 2019 (as of 8 May 2019). There have also been significant, and sensible, changes to the way Asia-focused trusts have been classified.

In this research we take a look at these new sectors and the broader changes which have taken place, identifying the trusts which now stand out in their new peer groups. We also explain where we think the sector classification system may still be leading investors astray, and consider the case for a slightly different set of divisions.

Asia

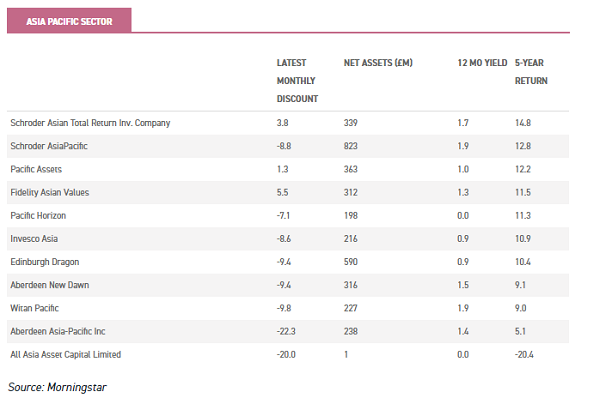

Asian equities were previously split into Asia Pacific ex-Japan and Asia Pacific inc-Japan sectors, however this region has now been divided into Asia Pacific (i.e. growth), Asia Pacific Income and Asia Pacific Smaller Companies. We see these changes as possibly the most sensible, as the smaller companies and income companies have their own distinct characteristics which made the old sector somewhat of a mishmash.

Investors will usually be looking for either a growth or income too so the fact that income trusts have outperformed growth trusts in Asia over specific periods might be interesting, but not relevant to the investment decision in many cases.

These different drivers in performance mean that new trusts stand out in performance terms relative to peers. Within the new growth focused Asia Pacific sector, Schroder Asian Total Return Investment Company (LSE:ATR) is the strongest performer with NAV total returns of 14.8% p.a over the past five years. This is little surprise given the stellar record from managers Robin Parbrook and King Fuei Lee who take a highly active, benchmark-agnostic approach, which they view as crucial in Asian markets. Schroder Asia Pacific and Pacific Assets (LSE:PAC) have also delivered strong returns of 12.83% p.a and 12.15% p.a respectively over the same time period. Below one can see the new sector.

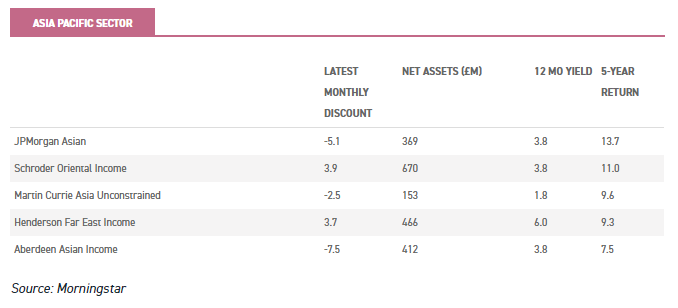

With the outperformance of growth over value in recent years, the Asia Pacific Income trusts didn't look so attractive when placed alongside the growth trusts, but this was a false comparison which disregarded their differing objectives. For example, the three strongest performing trusts in the Asia Pacific Income sector are JPMorgan Asian (LSE:JAI), Schroder Oriental Income (LSE:SOI) and Martin Currie Asia Unconstrained (LSE:MCP).

Of the three, only JPMorgan Asian would sit in the top half for NAV total returns in the old 'catch-all' sector. The trust is run by Ayaz Ebrahim, Richard Titherington and Robert Lloyd, who focus on a company's earnings growth and dividends to determine returns in the long run. The process is heavy on fundamental research and designed to look through macro-economic issues, which has been important over the past few years of political and macro-economic turmoil. The 4% dividend is paid from capital when needed, with the managers focusing on total return, hence its greater correlation to the growth sector.

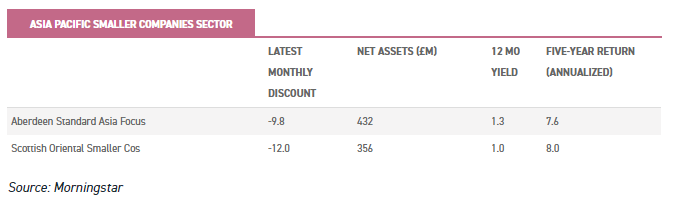

It is a similar story for the Asia Pacific Smaller Companies sector, which now has just two constituents. Both trusts, Aberdeen Standard Asia Focus (LSE:AAS) and Scottish Oriental Smaller Companies (LSE:SST) have single digit NAV total returns per annum which would have left them in the bottom quartile in the old combined sector.

However, this has been a period in which smaller companies have underperformed large caps in the Asian region (the money has been chasing the large China stocks for the most part), and so a comparison is unfair, and their performance is better considered apart from the all-cap or large-cap trusts. We have published notes on both trusts in recent months.

We think the inclusion of inc Japan with ex Japan trusts is justified. There are a number of different benchmarks and mandates in the Asia Pacific sector, with some managers investing in Australasia and others not, as well as the Japan issue. Arguably Korea is as developed as Japan or Australia, and that sits in the universe of all the trusts (although Fundsmith Emerging Equities Trust (LSE:FEET) refuses to invest in it on those grounds). In the Asia Pacific sector, Witan Pacific (LSE:WPC), Pacific Assets (LSE:PAC) and Invesco Asia (LSE:IAT) were the only companies with exposure to Japan, with an average weight of 13.44%, and all sit below the average total NAV returns for the rest of the sector.

Property

Real estate funds have seen a meteoric rise in new launches recently; close to half of the property trusts with AIC membership were launched within the last five years. This is likely due to the continued low interest rate environment leading investors to look for yielding assets in alternatives, as well as the fixed income market looking expensive in recent years.

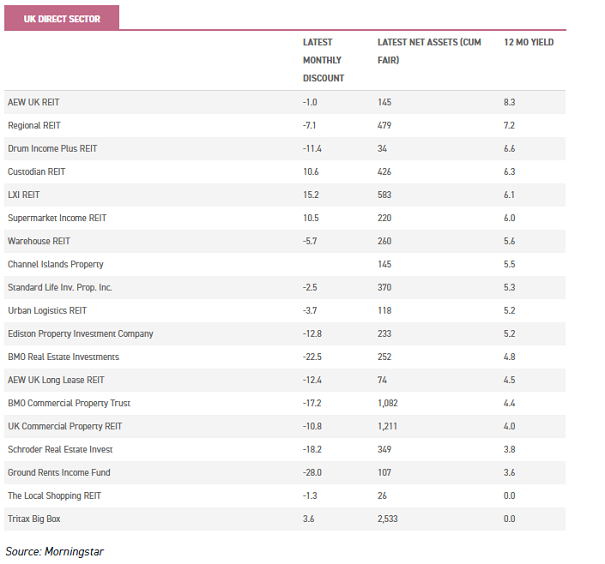

Within the UK, Property Direct – UK and Property Specialist have been reorganised into Property – UK Commercial, Property – UK Healthcare and Property – UK Residential sectors.

The UK Direct sector was previous made up of nine constituents, with the average discount across the sector sitting at 5.7% (as at April 29 2019). The sector was made up of mainstream commercial property investment trusts, which in our view made more sense than the new arrangement which brings in more specialised trusts and brings the total to 19.

For example the sector now includes the likes of Ground Rents Income Fund (LSE:GRIO), The Local Shopping REIT (LSE:LSR) and Supermarket Income REIT (LSE:SUPR), alongside the more mainstream trusts like F&C Commercial Property and Standard Life Property Income (LSE:SLI).

This has increased the yield of the overall sector, which now sits at 5.2%. However, in our view the more specialised trusts should really be considered alone.

The extra risks that come with investing in a specialised sector need to be taken into account in any investment decision, and while the wind may be behind a certain sector at any one time, making it look like an alternative to a mainstream commercial investment, when the wind changes the idiosyncratic risk profile could hurt.

We think retail (The Local Shopping REIT (LSE:LSR), Supermarket Income REIT (LSE:SUPR), arguably Ediston Property Investment Company (LSE:EPIC) and logistics (Warehouse REIT (LSE:WHR), Urban Logistics REIT (LSE:SHED), Tritax Big Box (LSE:BBOX)) might be better off in their own sectors. Including them here is like including a China trust in the Asia Pacific sector, in our view.

Within the new sector, the strongest performing trusts over five-years include TriTax Big Box generating returns of (91.5%), Standard Life Investments Property Income. (76.5%) and Schroder Real Estate Invest (LSE:SREI) (73.1%) in NAV total return terms.

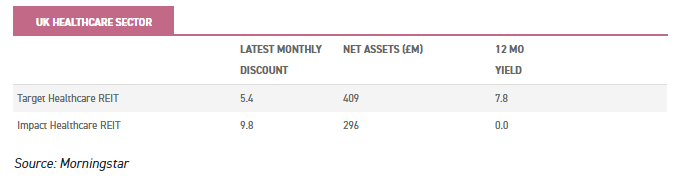

The UK Healthcare sector on the other hand has diminished to just two trusts, Impact Healthcare REIT (LSE:IHR) and Target Healthcare REIT (LSE:THRL).

Only Target Healthcare REIT has performance figures longer than three years, making the average returns data uninteresting. Previously these companies sat in the sector specialist sector, which was comprised of a wide range of companies including student housing, social housing and health care.

There was an argument to be made for that disparate sector, as all the trusts had an income focus so might be looked at by the same investors looking for alternative income strategies.

However, any such comparison would have been made across infrastructure and other sectors too, so the argument was quite weak and the narrower focus of the new sectors is far more useful in our view, allowing easier comparison in the specialist areas.

It is worth noting that there are some companies that are not AIC members in the healthcare sector which should also be considered by investors seeking to access this space, for example the strongest performing healthcare trust Primary Health Properties (LSE:PHP).

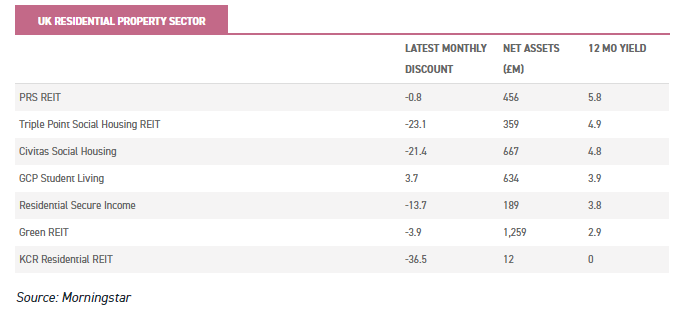

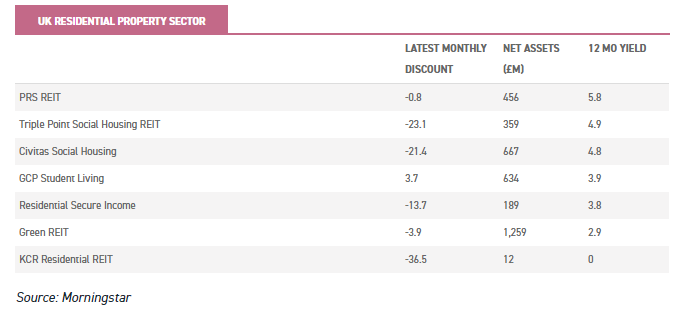

The final new property sector, UK residential, is comprised of five companies. In our view, it could perhaps be divided more usefully once more into three social housing sector companies and two oddities investing in student housing (DIGS) and private residential properties (PRS).

The current UK Residential sector will continue to display large discrepancies of returns for companies with vastly different business models and risks.

This is reflected in the differences in discounts and premiums across the new sector, with GCP Student Living (1.7%) and PRS REIT (-2.5%) trading close to par and Residential Secure Income (LSE:RESI) (11.4%) ,Civitas Social Housing (LSE:CSH) (-24.9%) and Triple Point Social Housing REIT (LSE:SOHO)(-26.2%) trading at discounts close to a quarter less than their NAV, thanks to regulatory issues in the sector. We will be issuing an updated note on RESI in the coming weeks with our thoughts on this – in our view, RESI has been unfairly tarred by the same brush.

Growth Capital

An interesting new sector which has been formed from the overhaul is one for companies which invest in unquoted shares. This however does not include those that take large ownership stakes or take control of businesses like those in the private equity sector.

The sector includes four constituents: Adamas Finance Asia, Merian Chrysalis Investment Company (LSE:MERI), Schiehallion (LSE:MNTN) and Woodford Patient Capital Trust (LSE:WPCT).

Similar to the property sectors, most are relatively new trusts, with Adamas Finance Asia comfortably the longest running at ten years.

We have seen a rise in funds investing in unquoted companies over the past few years as it is now easier for start-up companies to obtain capital from numerous sources, and so they do not need to list on a public exchange until a later part of their life.

This means that those companies which do invest in unquoted companies potentially have an edge over peers.

In our view, given these market dynamics we could see investors seeking to allocate more to unquoted companies and so this sector is a useful addition.

The most recent to launch was Schiehallion, managed by Baillie Gifford, in March of 2019, which raised just over £364 million. The trust invests in rapidly growing technology-backed 'disruptors' worth at least £500 million, hoping to identify 'unicorns' or private companies valued at over $1 billion.

Debt

Another alternative sector to be divided has been the debt sector, which has been split into the 'Debt – Direct Lending', 'Debt – Loans & Bonds' and 'Debt – Structured Finance' sectors.

This is an area that does have a few complexities, and the division of sectors was aimed at increasing the clarity for investors. It makes a lot of sense in our view, particularly splitting out the Debt – Loans & Bonds sector, which houses those which invest in the more conventional fixed income instruments focused on by most investors.

This is reflected in the discount and yield of the sector, currently sitting at -3.78% and 4.45% respectively. In comparison the two riskier and more specialist sectors, Direct Lending and Structured Finance, offer higher yields (7.7% and 5.83%) and greater discounts (8.84% and 4.54%).

Within the new Debt – Loans & Bonds sector, one trust we think looks interesting at the moment is Alcentra Eur Floating Rate Income (LSE:AEFS). AEFS invests in the European loans market, with all investments hedged back into sterling. It offers a yield of 4.6% from an asset class with low volatility and a history of low default levels in downturns.

The trust is currently trading on a discount of 3.8% with protection in the form of a liquidity event to be held this December and every quarter thereafter, which limits the potential on the downside. We have published a full note this week.

Direct lending is a relatively new asset-class, and can be further sub-divided into two main type of strategy. Understanding the new sector therefore means understanding this split, and arguably means there could be a further sub-division.

The first involves lending directly to companies, as for example SQN Secured Income (LSE:SSIF) does. This trust lends to small and medium-sized businesses, targeting a 7p dividend paid monthly and a total return of 8% net of costs.

The manager, Dawn Kendall, and her team scour the books of the borrowing company and make direct loans either on a cash-flow or project financing basis.

The company was previously named the SME Loan Fund and invested through platforms but, since the management contract was taken on by SQN Asset management in 2017, has been revamped totally.. We published a note on the trust in January.

The second type of trust in the sector invests in platforms, usually peer-to-peer platforms. This is a business model which was very fashionable in 2014 / 2015.

However, some major players have run into trouble, such as Funding Circle (LSE:FCH), and some trusts have shifted from platform lending to direct lending as a result, such as the aforementioned SQN Secured Income. Given that a number of the trusts have a mixture of platform and direct investments, we can understand the AIC drawing the sector boundaries the way it has.

One interesting trust still in this platform lending space is VPC Specialty Lending Investments (LSE:VSL). The trust is trading on an interesting discount of almost 17% following some technical pressures (Neil Woodford selling his substantial stake) and, we believe, the market not fully recognising the change in its portfolio.

It is now out of peer-to-peer lending, but lends to the platforms, backed by the assets on their books (i.e. their loans). This "lender to lender" approach is approached in a highly diligent and conservative fashion, with monthly reviews of the assets of the platforms it lends to and the ability to demand more cash or seize control of the assets should there be a shortfall. The trust's dividend yield is 10.4%, and with a continuation vote due in June looks like a value opportunity. We will be publishing a full note in the coming weeks.

The Debt- Structured Finance sector contains a disparate collection of specialist trusts including those focusing on CLOs, RMBS', ABS' and a host of other acronyms. Analysis of these trusts should focus on a stock-specific level in our view, as there are few which can be directly compared to each other.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.