AIM's Cohort gets 8 out of 10 and is rated a 'buy'

28th September 2018 15:04

by Richard Beddard from interactive investor

Cohort has grown its profit while its biggest customer cuts spending. It may struggle to maintain an unblemished record in 2019, but long-term it has a winning culture, argues analyst Richard Beddard.

Cohort is kind of hamstrung. As warfare and security become more technological there is a need for its products, services and skills but the company’s biggest customer, the Ministry of Defence, is short of cash and switching priorities. From the outside, at least, it is a chaotic and disconcerting situation. Good job then, Cohort executives are very experienced.

As usual I'm scoring Cohort to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 2

This chart below showing flat revenue, and flattening profit growth in recent years, obscures the drama within Cohort:

In fact, Cohort, which is a group of fairly autonomous businesses closed down SCS, a training consultancy, in 2016 because the Ministry of Defence was conducting more training in-house. Not all of the revenue from SCS has been lost, Cohort shuffled some of the businesses into its other firms, but they too are feeling the pinch, particularly SEA, which does a lot of consultancy work, because the MoD has also shelved or delayed research programmes.

Revenue would have declined significantly were it not for the acquisition of EID in 2016, a Portuguese manufacturer of naval and tactical communications systems. Cohort owns 80% of EID, and the rest belongs to the Portuguese government.

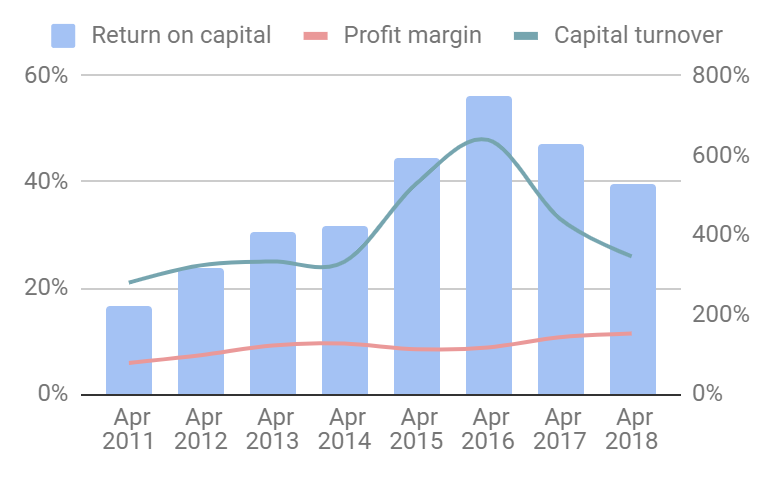

Despite the ructions, Cohort remains highly profitable:

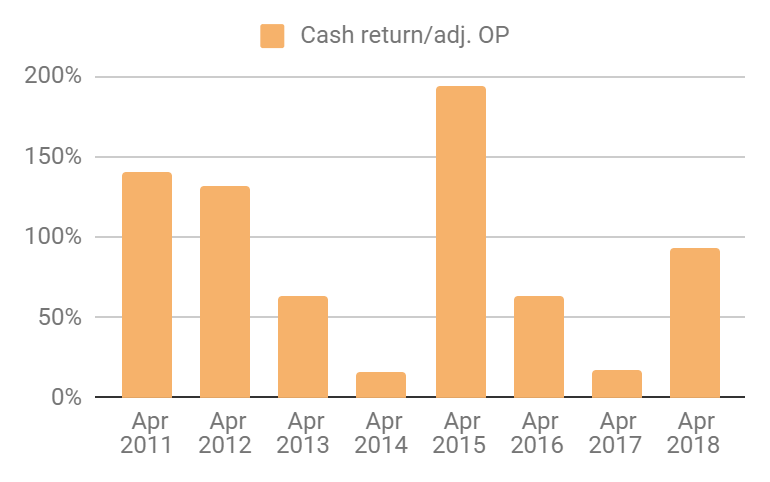

Cash flow after capital expenditure is erratic, the company tends to gobble up cash as it gears up to supply large contracts and then collect cash when it is paid, but it is healthy when averaged over the long term. Cash flow after capital expenditure is about 83% of adjusted operating profit averaged over the last seven years:

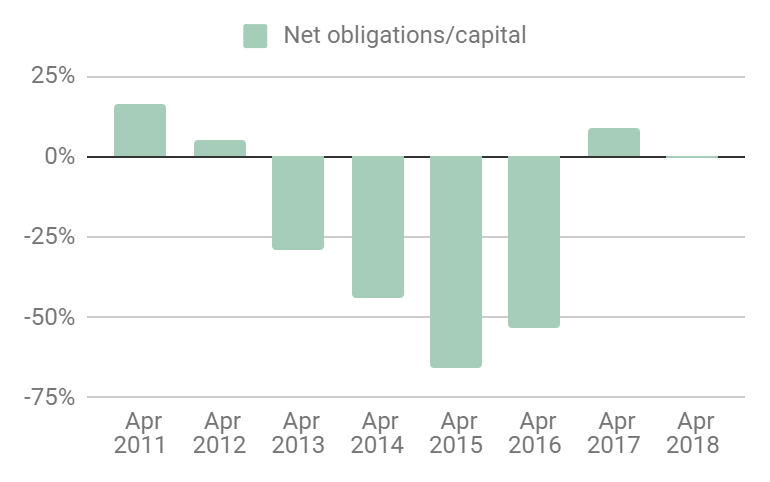

Good cash flow in 2018 enabled Cohort to exit the year in a strong financial position, despite paying out £3.5m to increase its stake in EID and making the final £2.5m payment for an earlier acquisition, MCL. MCL customises and supplies military equipment sourced from third parties.

In April 2018, the company had more cash than debt. Even after roughly calculating the value of lease obligations it was almost entirely self-funded:

There could be trouble in 2019, though. At the year end the Cohort's order book was considerably less full than it was in April 2017, at £103m compared to £137m the previous year, a situation that had improved little by the end of July.

To keep revenue and profit moving in the right direction the company must secure the successful renewal of contracts and new orders in the remainder of the year. It is choosing its words carefully, saying it is a "strong contender" in the competition to secure the follow-on to a £50m operational support contract originally awarded to MASS, Cohort's most profitable business, by the MoD in 2010. It is holding "positive discussions" with overseas customers about potential orders for torpedo launch systems, the Thurbon electronic warfare database system, submarine surveillance systems and vehicle intercoms.

"...A reasonable measure of success in relation to these prospects", Cohort says in its annual report, "is important for our future performance."

While the immediate outlook is far from certain, I believe Cohort’s long-term prosperity is built on somewhat firmer foundations...

Adaptable: How will it make more money?

Score: 1

Cohort is a collection of four businesses, EID, MASS, MCL and SEA, acquired since the company floated in 2006 and augmented by even smaller acquisitions. Although they have distinct capabilities, they also overlap and the group’s core competencies lie in the interrelated fields of secure communications, electronic warfare, and surveillance. It makes and customises hardware, writes software, and provides engineering, project management and administrative personnel, training, and research.

The board believes long established connections with the Ministry of Defence and its suppliers would be hard for rival small independent businesses to establish. It is certainly a close-knit group. The executive chairman Nick Prest and his co-founder Stanley Carter, a non-executive director, worked with chief executive Andrew Thomis to float Cohort in 2006. Prest and Thomis had worked together at defence contractor Alvis before it was taken over by BAe, they have also both worked at the MoD, as has Carter, who previously served in the Royal Artillery. Finance Director Simon Walther is another Alvis alumnus.

By operating each of the businesses with light-touch strategic and financial controls, Cohort believes it offers customers the best of two worlds: direct access to specialists without the long decision chains associated with larger contractors and the confidence building financial strength of the wider group, which means it will probably be around in five years time to service long-term contracts.

It is a profitable strategy, but much of the work is bespoke, and I wonder if it is scalable...

Resilient: What could go wrong?

Score: 1

Long-term shareholders must steel themselves to the episodic nature of some contracts and the current uncertainty about defence spending. Even in areas identified as high priorities by the Government, submarine programmes and operational support to the armed forces, Cohort is experiencing delays.

A major reason for the decline at SEA is the "continued decrease in activity" in the submarine programme. Cohort says work on the Astute class is "elongated", while the commencement of work on the Dreadnought class is slipping "to the right", code, presumably, for delays. SEA supplies the External Communications System for the subs, and the contracts are among Cohort's most lucrative in revenue terms.

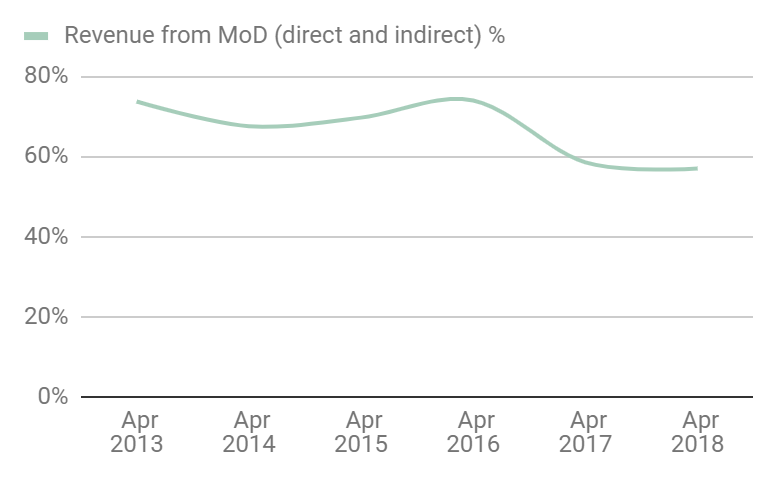

While the acquisition of EID reduced Cohort's dependence on the MoD, it still earns more than half of revenue directly or indirectly from its biggest customer:

That dependence probably explains why Cohort's last two acquisitions are product companies, why its latest one had a foreign home market in Portugal, and why it is seeking to expand exports across the board. While the Ministry of Defence can save pennies on training and research by doing some itself or not doing it at all, it is not a manufacturer so product supply ought to be more consistent. Product focused businesses are easier to scale too, especially abroad.

Sadly, though, export revenue contracted in 2018 after an EID induced surge:

I think a product and export focused strategy addresses the risk of dependence on the MoD, but it is early days and Cohort remains a complex and relatively small business. This, I think, is an advantage and a disadvantage. It would be incredibly hard to replicate Cohort’s blend of capabilities, but the opportunity for mishaps is ever present, particularly in the pricing and management of long contracts by its semi-autonomous subsidiaries.

Equitable: Will we all benefit?

Score: 2

Cohort says employees are key to success. They develop the hardware and software, work with partner firms and provide operational support to the armed forces. Many, it says are current reservists or former soldiers, sailors and airmen. It runs training programmes for future leaders and high potential engineers and MASS has joined the 5% Club, which is not a euphemism but an actual organisation. Its member firms seek to boost the number of students, apprentices and graduates on training schemes to 5% of their total workforce.

Unusually, perhaps, the company's founders sit on the remuneration committee in defiance of the QCA Corporate Governance Code, which requires that only independent non-executives participate. I think this is a good thing. They are very experienced, Stanley Carter a non-executive director owns 22% of the shares, and Nick Prest, executive chairman, owns 5% of the shares. They have kept a lid on remuneration, where it has spiralled out of control at so many "compliant firms". Yet the talent has not walked out of the door as the high pay club might insist. Chief Executive Andrew Thomis and finance director Simon Walther have worked for the company since 2006, the year it floated, which may speak volumes about the culture.

They are paid well, about ten times the national median wage, but not extravagantly by modern standards. Bonuses can add up to 85% of salary, which believe it or not is modest in comparison to other firms, and executives are paid in a mixture of cash, restricted shares, and share options issued at the prevailing market price. Restricted shares cannot be sold without the approval of the chairman of the remuneration committee until the executives quit.

I think the company has the long-term interests of shareholders at heart, and these values are visible in the annual report, which is rich in detail.

Cheap: Is the firm's valuation modest?

Score: 2

Cohort shares trade at about 13 times profit, adjusted for debt and many other things. That makes them something of a bargain to my mind, probably because of the pervading uncertainty.

Only last week though The Times reported that the Government is launching a new £250m "cyber-force" to take the battle to hostile states and terrorists. It remains to be seen whether this is new money, or whether any of it trickles down to Cohort, but long-term I am afraid Cohort is likely to be busy.

A score of 8/10 means I think the firm is a good long term investment.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Richard owns shares in Cohort.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.