AIM shares and the Budget: winners and losers

Rumoured changes to tax relief in this year’s Budget could have been devastating for the AIM market. Award-winning AIM writer Andrew Hore examines what actually happened and why it’s not all bad news for small-cap investors.

8th November 2024 15:01

by Andrew Hore from interactive investor

Last week’s Budget was not as bad for AIM as some people feared, but it has reduced the attractions of the junior market even though they have not been totally removed. The one good thing is that the uncertainty is out of the way.

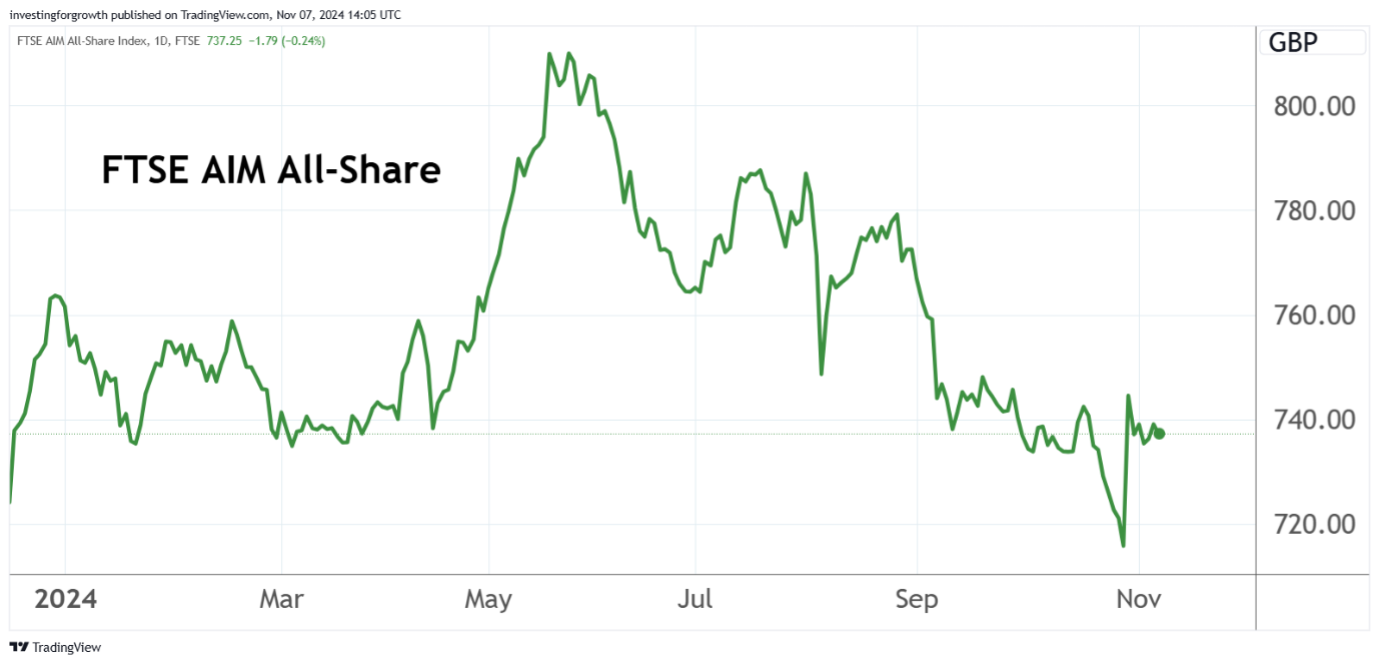

AIM had been held back by Budget fears which had been going on for months. The relief was highlighted by the sharp bounce back in the FTSE AIM All Share index on the afternoon of the Budget.

- Invest with ii: Top UK Shares | What is a Managed ISA? | Open an investment Account

Even so, the index still ended 0.4% down in the month of October. That was still better than the other main measures of the London stock market – the FTSE 100 was 1.5% lower and the FTSE 250 fell 3.2%. However, AIM is underperforming for the year as a whole with a 3.4% decline.

Source: TradingView. Past performance is not a guide to future performance.

Inheritance tax relief

The 50% inheritance tax (IHT) relief on investment in eligible AIM shares appears to be a compromise. Chancellor Rachel Reeves wanted to show that industry professionals had been listened too, while also being seen to raise the potential income from inheritance tax.

The new regime does not start until 6 April 2026. That means that there will not be a dumping of shares, but there could be a steady flow of disposals over the coming months.

Octopus Investments is one of the major providers of AIM IHT portfolios, and it advises that its investors do not need to take any action. It is still early days, and the providers do not appear to have updated their marketing information yet.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Budget 2024: AIM shares no longer IHT exempt, and ISA allowance frozen

Of course, portfolio providers are not going to want the existing investors to claim their money back, but there is no hurry to liquidate holdings before the full benefits of the tax incentive run out.

There is always a danger that there is a steady outflow of money from the portfolios, which means that shares have to be sold in the market. Even with some of the more liquid AIM shares, they can be hit by limited selling.

It is noticeable that some share prices of the solid AIM businesses that tend to form the backbone of portfolios, such as floor-coverings manufacturer James Halstead (LSE:JHD) and soft drinks maker Nichols (LSE:NICL), have risen by more than 10% since the morning of the Budget. AIM is just over 3% higher in the same period.

Best AIM 100 performers

Share price change (%) | ||||||||

Name | Sector | Price | Market cap (m) | 29 Oct to 5 Nov | 1-month | 2024 so far | Forecast yield (%) | Forward PE |

Technology | 690p | £209.4 | 31.4 | 29.0 | -25.8 | 0.3 | 25.6 | |

Technology | 181.5p | £211.6 | 24.3 | 19.4 | 69.6 | 2.7 | 9.3 | |

Technology | 351p | £411.9 | 16.4 | 4.8 | -10.0 | |||

Financial Services | 1980p | £699.8 | 15.9 | 0.0 | 13.1 | 1.4 | 25.1 | |

Healthcare | 440p | £209.8 | 15.1 | 13.4 | -4.4 | 3.4 | 26.6 | |

Energy | 22.175p | £250.6 | 14.2 | 21.8 | -14.7 | |||

Industrial Goods and Services | 750p | £358.9 | 13.9 | 16.3 | 21.0 | 2.2 | 17.6 | |

Healthcare | 3650p | £190.5 | 13.2 | -9.9 | -15.1 | 4.3 | 21.8 | |

Construction and Materials | 200.5p | £867.8 | 12.9 | 9.9 | -1.7 | 4.4 | 19.2 | |

Financial Services | 687.5p | £253.3 | 12.4 | 29.7 | 51.1 | |||

Source: SharePad. Performance is between close of business on 29 October 2024 (day before Budget) and 5 November 2024 (US election). Past performance is not a guide to future performance.

The financial services industry is likely to innovate and offer new products to offset IHT, and this could be a factor in how much money is withdrawn. If investors were taking sensible investment decisions, then there will be arguments for retaining the AIM shares as an investment.

The other side of the coin is that inflows of cash to AIM due to IHT relief will decline. It may still prove to be an attractive incentive for some, but any decline in cash invested in AIM will exacerbate current problems.

Despite the negatives there should still be scope for further recovery for AIM shares because their ratings have generally slumped to low levels. Recent takeover bids show that there is value.

The post-Budget bounceback is clawing back some, but not all the previous losses.

Capital gains tax

The lower rate of capital gains tax (CGT) has been raised from 10% to 18% and the higher rate from 20% to 24% as of the end of October. Many investors and directors were locking in gains ahead of the Budget.

However, Investors’ Relief will rise to 14% in April 2025 and then to 18% in April 2026. This is available to investors that have bought newly issued shares in an unlisted company, such as those on AIM.

The increase in CGT rates could have a negative effect on the market over the coming months if shareholders seek to take gains made before the new rates come into force. If there are directors or other major shareholders who want to place a large number of shares, that could have a short-term hit on the share price – even if it is well managed. That might provide buying opportunities.

Small investors can shelter gains in a stocks and shares ISA, although an ISA to incentivise investment in British companies is no longer planned.

- Stockwatch: a tax warning for UK and US investors

- Is it time to come out of cash? And what to buy now

These tax changes are going to lead to some selling of shares, although the quantum is hard to assess. Some of the CGT planning has already happened. If there is demand for the shares, then the negative effect on share prices could be limited. This will likely depend on the liquidity of individual shares.

Oil and gas

Oil and gas is an important sector for AIM, and many of the companies have exposure to production and developing projects in the UK, where tax changes are a negative. The hope is that these changes will provide some longer-term certainty.

Tax measures for the North Sea oil and gas industry laid out in the Budget were broadly in line with previous indications – there were concerns that there could be additional measures. The Energy Profits Levy (EPL) rate will increase by three percentage points to 38%, so the headline rate of taxation will be 78%. This tax regime lasts until 31 March 2030, or earlier if the oil price falls below a threshold set by the Energy Security Investment Mechanism – currently $74.21/barrel and 54p/therm for gas – for a sustained period.

The 29% investment allowance will be removed, and the rate of decarbonisation investment allowance will be cut from 80% to 66%. Spending prior to 1 November is under the previous regime. Following the change, capital spending gets £84.25 of tax relief for every £100 spent, down from £91.25 for every £100.

There are two consultations that will be carried out that will have a significant effect on long-term investment. There is a consultation that should be finished in early 2025 that will assess what any replacement for the EPL should be when it ends. The idea is that companies can invest knowing what the tax regime will be for another 10 to 20 years.

The other consultation is to consider new environmental guidance for assessing emissions from oil and gas projects. Oil and gas project developers have to consider Scope 3 emissions as part of an Environmental Impact Assessment (EIA). This guidance should be published next spring.

The overall impact is likely to be negative for producers. Serica Energy (LSE:SQZ) is purely focused on the North Sea and its profitability will be held back, but there are tax losses that it can still utilise.

The consultations are going to be important when decisions are made on new projects. Major new developments might not be commercial under the new regime. For example, the Greater Buchan Area, where Jersey Oil and Gas (LSE:JOG) has farmed out part of its stake and still retains 20% and Serica Energy has a 30% stake, could prove to be marginal. The operator Neo Energy Metals (LSE:NEO) has already cut back on activity because of the uncertainty over the tax regime and its own ownership.

Clean energy

There were hydrogen projects confirmed in the Budget, but these were already known ones. Even so, there is a positive outlook for hydrogen-related companies, including Clean Power Hydrogen (LSE:CPH2), ITM Power (LSE:ITM) and AFC Energy (LSE:AFC).

The government announced £3.9 billion of funding for carbon capture, usage and storage. Synergia Energy Ltd (LSE:SYN) raised £632,500 at 0.05p/share after the Budget, and converted money owed to creditors into shares. This provides funding for the Medway Hub Camelot carbon capture and storage joint venture with Harbour Energy. Synergia Energy wants to farm out up to 25% of the project.

Oil and gas companies are being offered relief payments for assets sold for carbon capture and storage, and this cash will not be subject to the EPL. This could benefit AIM companies with projects coming up for decommissioning.

Next year, more than £200 million will be invested in rolling out on-street charging points for electric vehicles. That should be good news for Good Energy Group (LSE:GOOD) associate Zapmap, which collects data on electric vehicle chargers and provides updated information to drivers. Even though the target of 300,000 public charge points by 2030 is not likely to be hit.

Good Energy has launched an off-peak charging rate for electric vehicles that comes bundled with a Zapmap subscription. Zapmap has 916,000 registered users and this will grow with the market. It recently entered a strategic partnership with energy saving company Hive. Its customers will receive charging credit of £20 for Zap-Pay-enabled chargers. The Hive app and Zapmap platform could be brought together. Zapmap also provides data to industry players.

Good Energy, which is the subject of a bid approach, is also likely to benefit from a £3.4 billion commitment over three years to energy efficiency, an area the energy supplier has been growing via acquisition.

- Trump victorious: these UK stocks are also big winners

- Watch our video: why UK small caps will continue to recover

Vertu Motors (LSE:VTU) has been increasing the number of electric vehicles it is selling. The current incentives remain, however from next spring vehicle excise duty will be charged on electric vehicles that were previously exempt. That will offset some of the savings compared with petrol and diesel vehicles, although it should still be £1,350 cheaper initially – depending on the CO2 emissions of the comparable vehicle.

The high price of electric vehicles means that they are subject to an expensive car supplement of vehicle excise duty. The government may raise the price level for zero emission vehicles from £40,000 in the future.

Vertu Motors should be able to continue to outperform in the electric vehicles market, although it is unlikely to gain an extra boost from the latest announcements.

The increase in the Employer’s National Insurance rate and the rise in the national minimum wage will hit AIM companies, particularly those that employ large numbers of people. This includes pub operators, such as Loungers (LSE:LGRS) and technology companies.

Panmure Liberum estimates that the Budget measures and the workers’ rights bill could add 12% to the salary costs of retailers. Higher prices may be difficult to push through so employment levels could be hit.

All these tax changes should be good news for professional services firms, such as Gateley (Holdings) (LSE:GTLY), FRP Advisory Group Ordinary Shares (LSE:FRP), DSW Capital Ordinary Shares (LSE:DSW) and Knights Group Holdings (LSE:KGH), with clients wanting advice on various areas of tax, including how to plan for inheritance tax liabilities.

Andrew Hore is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.