AIM performance since boom year: winners and a lot of losers

It took a pandemic for AIM to achieve its best year in the past decade. Award-winning AIM writer Andrew Hore studies performance since those heady days and explains share price behaviour.

7th February 2025 13:34

by Andrew Hore from interactive investor

The most successful year in the past decade for AIM new admissions in terms of number of companies and money raised was 2021. Yet, it cannot be described as a success when the performance since is assessed. This, and the poor performance of AIM itself, has not encouraged companies to join AIM, while share price declines for those new admissions has been even more stark.

There were 87 new issues in 2021, although that includes 10 reverse takeover (where a private company buys a publicly traded one to get a stock market listing) and redomiciles, plus five moves from the Main Market. That leaves 72 completely new companies coming to AIM during the year. They were taking advantage of what was a booming junior market in 2020.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

All the new issues, including reversals, raised £1.85 billion, compared with £776 million in total in the following three years. The 2021 figure includes £350 million raised by pharma offices and laboratories investor Life Science REIT Ord (LSE:LABS), which subsequently switched to the Main Market on 1 December 2022.

Background

To put everything into perspective, 2020 had been a good year for AIM. After a slump in share prices up to the middle of March due to the start of Covid lockdowns, AIM bounced back.

AIM ended 2020 with its highest-ever market capitalisation at £131.1 billion, which is almost double the current level of around £69 billion. At the end of 2021, there were 24 AIM companies worth more than £1 billion and their total valuation was around £50 billion.

There was £5.27 billion raised by existing AIM companies to shore up their balance sheets due to the uncertainty during 2020, which was the most since 2010.

The FTSE AIM All Share was 20.7% higher and the FTSE AIM 100 rose 19.6% in 2020. That compared with a fall of 14.3% for the FTSE 100.

Source: TradingView. Past performance is not a guide to future performance.

AIM rose a further 5% in 2021, compared with a 14.3% increase for the FTSE 100 index, which was catching up. Continuing underperformance by online retailers ASOS (LSE:ASC) and Boohoo Group (LSE:BOO), the two largest companies at the end of 2020, meant that the AIM 100 underperformed the wider AIM market.

In the next three years, AIM had a negative total return of 37.7%, while the AIM 100 total return was down 39%. That takes into account dividends paid, so the index decline was higher.

New admission performance

By the end of 2024, 13 out of the 72 new companies were trading at or above their flotation price or, in the case of Spectral MD, the gain is on the estimated value of its reversal into Nasdaq-listed cash shell Rosecliff Acquisition Corp 1 to form Spectral AI Inc Ordinary Shares - Class A (NASDAQ:MDAI) – although that share price has fallen since the deal went through.

Two of these companies were introductions and the starting prices are estimates that can prove way off the price at the end of the first day. That includes 4basebio Ordinary Shares (LSE:4BB), the best performer with an 813% rise. The synthetic DNA producer was demerged from another company and liquidity is limited. The share price touched £18.20 last summer and £40 million was raised at £15/share late in 2024.

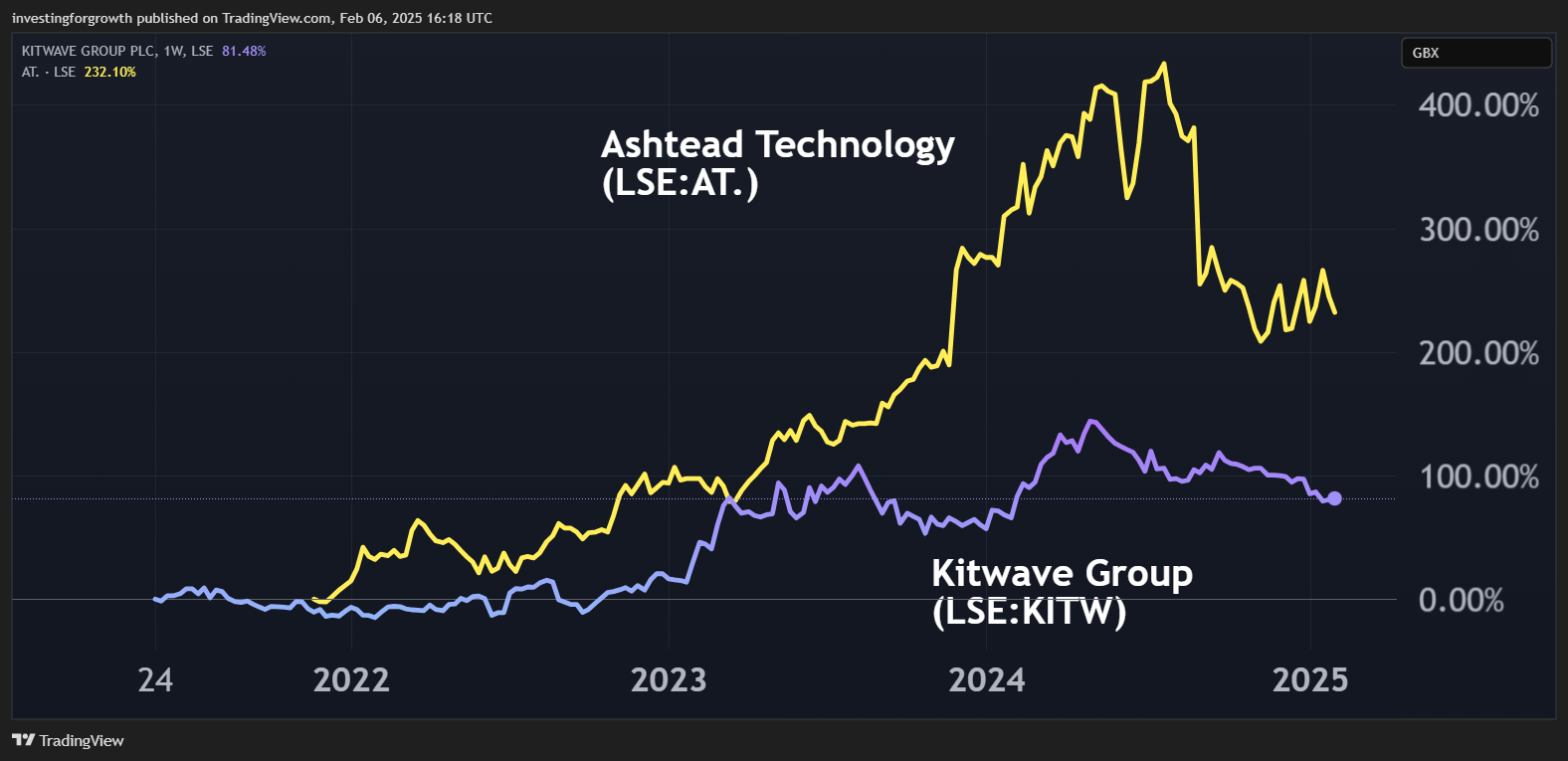

The other risers are a mixture of resource businesses and profitable companies. Food distributor Kitwave Group (LSE:KITW) and undersea services provider Ashtead Technology Holdings Ordinary Shares (LSE:AT.) have both made acquisitions since joining AIM, which has helped them enhance earnings.

Source: TradingView. Past performance is not a guide to future performance.

Of the 59 fallers, it is notable that the lowest decline among them is 25%. There are 48 that have at least halved with four that have gone bust, including coal miner Bens Creek, where the share was 850% higher at one stage in 2022.

There are a further 13 companies where the share price has slumped by at least 90%. That includes two companies that chose to leave AIM, plus musicMagpie was taken over and the share price is based on the bid price by AO World.

There are a total of five companies that chose to leave AIM, and the share price always falls following that type of announcement, so the declines are exacerbated.

As well as musicMagpie, accounting software provider Glantus, venture capital investor Forward Partners and marine tracking technology Windward have been or are in the process of being taken over. Windward is the only one being bought at a premium to the issue price.

Reasons

The alternative energy subsector is part of the energy sector that also includes oil and gas. The sharp outperformance of the FTSE AIM energy sector in an already booming junior market in 2020 was nothing to do with oil and gas, because the oil price declined.

Fuel cell and electrolyser technology developer ITM Power (LSE:ITM) and Ceres Power Holdings (LSE:CWR), which has moved to the Main Market, were both in the top 10 AIM companies by valuation. Their share prices peaked in early 2021 and they have been on a consistent downward trend since then. For example, ITM Power has fallen by more than 90% over the past four years.

Both these companies have been quoted for more than two decades, and significant cash outflows are continuing. Other cleantech companies were also in demand and did well.

This sparked the flotations of alternative energy and cleantech companies. The alternative energy sector was already starting to decline when most of these flotations were completed.

Three companies that have gone bust were all involved in electric vehicles and batteries. The outperformance of alternative energy companies in 2020 made these companies attractive to investors. They were able to raise money for their immediate needs but were always going to have to come back to the market on a regular basis.

The major change has been that investors were willing to buy shares in companies that were a long way from generating significant revenues, let alone cash. That had changed completely by 2022. Investors in these types of companies became scarce and share price discounts for fundraisings had to be high. There is little sign of this changing yet.

The alternative energy businesses are a good example of how companies are keen to float because of the high valuations, but there is not enough consideration concerning whether they can be sustained. Brokers spot a chance to generate fees.

It is a similar story for the unprofitable pharma and diagnostic companies that joined AIM. Healthcare was a hot sector in 2020 and 2021 and there was a rush of companies taking advantage of the cash on offer. 4basebio and Spectral MD did well, but some of the worst performers are healthcare related.

Aptamer Group Ordinary Shares (LSE:APTA), which develops Optimer binders for diagnostics, is the worst performer still on AIM, but the business has restructured and is winning new contracts. The share price is recovering and there should be more to come. Genetic health risk tests developer GENinCode (LSE:GENI) is also showing signs that there is potential to accelerate the growth of its revenues.

Another group of companies that have performed poorly are ones that got an additional boost from lockdowns, and where floating in 2021 meant that that they could get high valuations for trading that was not likely to be sustained.

Virgin Wines UK (LSE:VINO) is an example of a business boosted by online sales of wine when people could not go out. Trading dropped off when it was permitted to go out and socialise or go shopping.

Victorian Plumbing Group (LSE:VIC), CMO Group (LSE:CMO) and Lords Group Trading (LSE:LORD) all profited from increased levels of DIY in lockdowns, and they have subsequently been hit by the weak economy. Any improvement in the UK economy would spark a recovery for these companies.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- 16 UK stocks least likely to be impacted by Trump tariffs

Video games distributors were another subsector that benefited from lockdowns. Devolver Digital Inc (LSE:DEVO) and TinyBuild Inc (LSE:TBLD) joined AIM before business started to decline. The video games business is still weak.

One company that has shown it knows when to float and sell out to a bidder is broker Peel Hunt Ltd (LSE:PEEL). Existing shareholders were major sellers when Peel Hunt returned to AIM, having been acquired two decades earlier when the market was relatively strong. Those share sales raised £72 million, which is around two-thirds of the current Peel Hunt market capitalisation.

Cosmetics supplier Revolution Beauty Group (LSE:REVB) is an example of a company where the share price decline is all down to the stewardship of the previous management and cannot be blamed on the market.

Even so, most of the underperformance of these companies is down to the excessive valuations at the time of flotation and the discounts required for further fundraisings. In tougher markets, it tends to be the better-quality companies that float and they have more realistic valuations. That is not to say that investors still need to be choosy, though.

Andrew Hore is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.