The aggressive and conservative ETFs to use for value investing

Dimitar Boyadzhiev looks at the performance of value stocks and explains the ETFs that provide exposure.

12th February 2021 09:07

by Dimitar Boyadzhiev from ii contributor

Dimitar Boyadzhiev looks at the performance of value stocks and explains the ETFs that provide exposure.

Value investing focuses on stocks underappreciated by the market; stocks thought to trade below their fair price and which could thus offer high returns when the market eventually pushes prices up. This concept dates back the 1920s and has been supported by numerous empirical studies. From 1975 to date the MSCI World Value index has posted returns similar to those of the MSCI World Growth index and the broad market itself, as represented by the MSCI World index.

However, value has lagged for nearly two decades as investors favoured growth stocks. That is, stocks from companies with solid growth potential.

This can be seen in the performance of value and growth indices using 10-year rolling periods starting from December 2002. This approach resembles the experience of a long-term investor who drip-feeds small amounts of money into their portfolio each month.

- What is behind the supposed death of value investing?

- The ETFs Show: the new trends and innovations

- Consumer spending set to boom – but don’t play it with these ETFs

Value underperformed growth in almost 92% of the periods and, as of the last 10-year period in December 2020, growth had outpaced value by an annualised 6.3%.

A $10,000 lump sum invested in value in December 2002 would have underperformed growth by 3.2% per year and would now be worth $35,500 compared to $60,800 in growth stocks.

However, with global developed stocks delivering strong returns amid the pandemic, investors are beginning to wonder whether growth stocks have become too expensive and value may be in for a comeback.

Banks, Big Oil, nuclear energy and Silicon Valley: the perfect storm

Value investing depends on buying companies that appear cheaper than the market. The typical value ETF favours sectors such as financials, utilities and energy at the expense of technology. The MSCI World Value index underweights technology by 25% and overweights financials by nearly 20%.

Over the past five years, this investment bet has not delivered good results. Financial institutions have had to cope with increased regulatory scrutiny and ultra-low interest rates, while technology companies, such as the FAANGs (Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX), Alphabet (NASDAQ:GOOGL)) have enjoyed a meteoric rise, outperforming nearly five-fold.

This huge gap in performance raises the question of how well a typical value ETF can perform if investors begin to move out from growth.

Choose an ETF that matches your level of conviction

Still, if you want to bet on the resurgence of value there are several ETFs to choose from. Selecting the right one, however, can be cumbersome as index approaches to value are often complicated to evaluate. Some metrics used to identify value stocks, such as price-to-book and price-to-earnings ratios, are simple to understand, but they are often blended with many others.

- Emerging market funds are back in form

- Tom Bailey Column: Help! I believe in passive but buy active funds

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

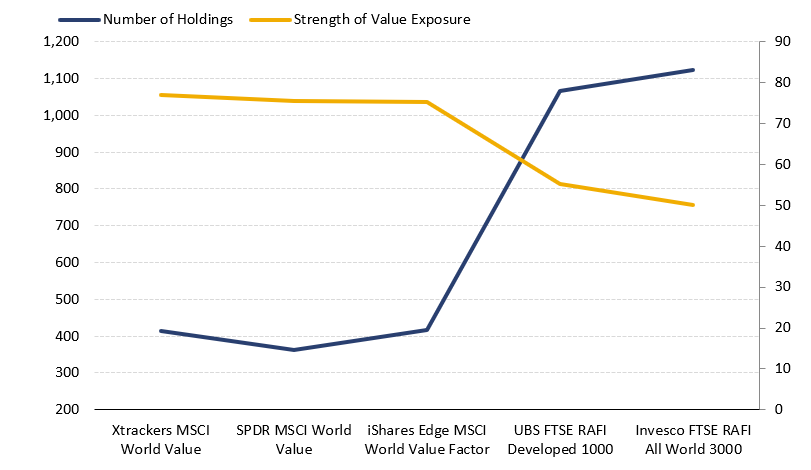

Instead, investors can get a fair indication of how strong the value factor exposure is by simply comparing the number of stocks held by different ETFs. Diversification always comes at the cost of exposure and value investing is no exception. The stronger exposure to the value factor, the higher the returns if it outperforms. The more aggressive strategies will focus on a small portion of the investment universe.

The aggressive and conservative options

The iShares Edge MSCI World Value Factor ETF (LSE:IWVL) and the Xtrackers MSCI World Value ETF (LSE:XDEV) both track the MSCI World Enhanced Value Index. This index focuses on around one-quarter of the global developed large and mid-cap universe and selects the cheapest stocks from each sector. This level of concentration makes these two ETFs options for investors with a high conviction in value.

The Invesco FTSE RAFI All World 3000 ETFs (LSE:PSRW)offers more moderate exposure to value by favouring diversification. FTSE RAFI indices achieve exposure to value by weighting constituents according to their dividend yield, free cash flow, total sales and book equity value. This ETF would be an options for investors with a more conservative risk profile.

Dimitar Boyadzhiev is senior analyst for manager research and passive strategies at Morningstar.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.