44% of ii SIPP holders in drawdown took full 25% tax-free lump sum

interactive investor reveals how its SIPP customers make use of the 25% tax-free pension lump sum.

7th August 2024 10:43

by Myron Jobson from interactive investor

- Since 6 April 2023 to 2 August 2024, of the ii customers who were age 55 and chose to move all or part of their SIPP into drawdown, 53% withdrew the full 25% tax-free lump sum

- The percentage is 44% for the broader cohort who entered drawdown

- Four in 10 (39%) put some or all the money in their bank and savings account, according to ii’s Great British Retirement Survey 2023

- 25% used some or all the money to repay their debts and/or mortgage

- 12% said the cash helped fund day-to-day living, and to offer financial assistance to their child/children, respectively.

With a comprehensive review of the pension landscape under way by the new government, coming months after the 10-year anniversary of the pension freedoms announcement, interactive investor, the UK’s second-largest investment platform, explores how its SIPP customers make use of the 25% tax-free pension lump sum.

- Invest with ii: Open a SIPP | Best SIPP Investments | SIPP Withdrawal Rules

The ability to take up to 25% of your pension tax-free (subject to a maximum of £268,275), once you reach 55 (57 from 2028), is one of multiple attractive tax perks of paying money into pension. For many retirees, their pension pot needs to last the rest of their life, and perhaps a loved one’s too, so paying as little tax as possible is vital.

Since 6 April 2023 to 2 August 2024, of the ii customers who chose to move all or part of their SIPP into drawdown, 44% decided to take the maximum tax-free lump sum of 25% of their whole SIPP.

Meanwhile, over a third (34%) of the cohort withdrew less than 10% of their pension pot tax-free, while 22% took out a sum amounting to between 10% and 24%.

These figures are slightly higher for customers who were age 55, which represents 10% of the broader cohort: 53% withdrew the full 25%, 25% took between 10% and 24%, while 22% took less than 10%.

| Cohort | Full 25% | 10-24% | Less than 10% |

| All SIPP customers in drawdown | 44% | 22% | 34% |

| SIPP customers in drawdown who were age 55 | 53% | 25% | 22% |

Percentage of ii customers who move all or part of their SIPP into drawdown taking up to 25% of their SIPP tax free. Source: interactive investor

How is the money being used?

Findings from interactive investor’s Great British Retirement Survey 2023, involving a sample of 9,000 pension savers, offers some clues on how the money is being used.

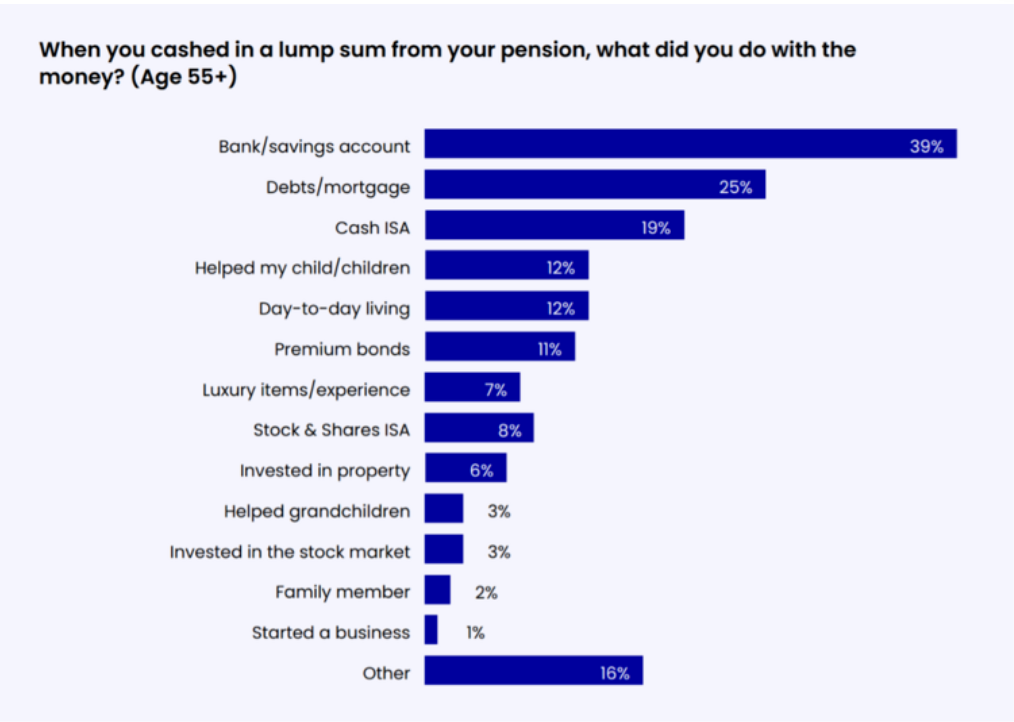

Responding to a multiple-choice question on how they’ve used the money withdrawn from their pension, the highest percentage of respondents (39%) said they put it in a bank or savings account, while 19% and 11% put it in a cash ISA and Premium Bonds, respectively.

One in four (25%) said they used some or all the money to repay their debts and/or mortgage, and 12% said the cash helped fund day-to-day living. The same percentage (12%) of the sample said they used the money to offer financial assistance to their child/children.

Source: interactive investor Great British Retirement Survey 2023.

Myron Jobson, Senior Personal Finance Analyst, interactive investor, says: “The 25% tax-free pension lump sum rule is popular among our customer base, particularly among those who reach retirement age – most of whom took the full amount in one fell swoop once they reached retirement age of 55 since the start of the 2023-24 tax year.

“It is worth bearing in mind that this cohort of retirees is likely to have defined benefit schemes that offer a guaranteed income for life, an arrangement that has largely gone the way of the dodo because they have become too expensive for employers to run. The ability to withdraw a quarter of a pension pot tax-free is hugely beneficial to savers immediate financial obligations, such as paying off a mortgage, clearing debts, or to help their children on to the property ladder.

“If you are going to take a tax-free lump sum from your pension, make sure you have plans for your money - withdrawing cash you don’t need can come with several potential pitfalls. These include paying more income tax and capital gains tax than necessary, increasing your inheritance tax bill, and harming how quickly your money grows in the future.

“It is interesting that a large percentage of those surveyed who have accessed their pension pot said they have redirected the funds into some type of savings account. Having a large sum of money readily available can provide a sense of security and reduce financial anxiety in retirement. However, it is important to bear in mind that interest earned on savings above the annual tax-free savings allowance (£1,000, £500 and £0 for basic, higher-rate and additional-rate taxpayers, respectively) and outside an ISA and SIPP is taxable.

“Those with an ample rainy-day fund, who can afford to put money away for at least five years, should consider leaving their money invested for the potential of long-term inflation-beating returns that can far outstrip savings rates.

“It is also important to remember that where inheritance tax is concerned, money is best left in your pension. If you want to pass on anything to your beneficiaries, anything in your pension is typically protected from inheritance tax.

“In addition, if you delay taking some or all of your 25% tax-free cash, you could enjoy a larger amount in the future, although this is dependent on your pension pot ticking up in the value.”

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.