3 great European shares for your ISA in 2023

15th March 2023 09:15

by Rodney Hobson from interactive investor

The recent run on bank shares has created buying opportunities in the finance sector, and overseas investing expert Rodney Hobson has put three on his buy list.

Finding solid European companies paying attractive dividends to tuck into your ISA is surprisingly much harder than for US companies. The finance sector may offer the best opportunities as the financial year approaches its end.

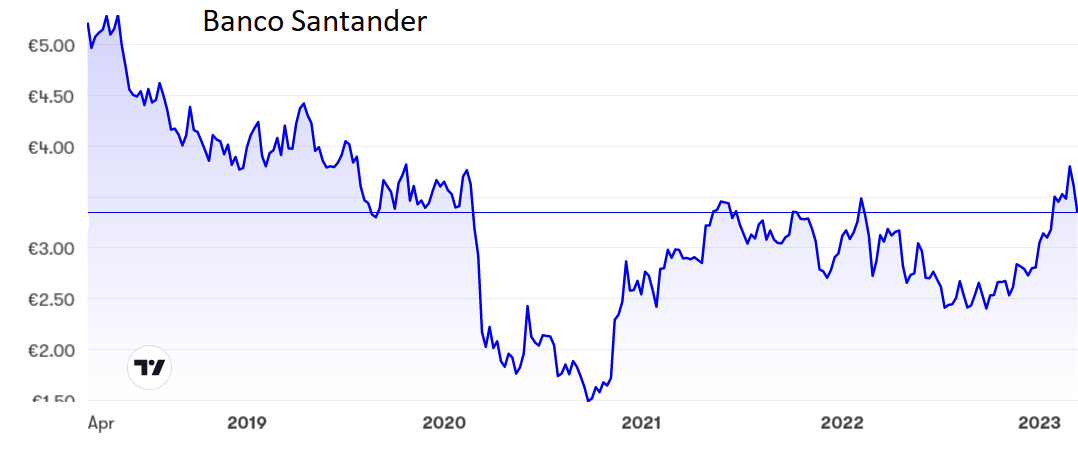

This week’s run on bank shares has created buying opportunities in the sector and one possibility is Spanish outfit Banco Santander SA (XMAD:SAN), which also has a strong presence in the UK. This is a truly international bank with outlets elsewhere in Europe plus North and South America.

- Learn with ii: Stocks & Shares ISA Explained | ISA Investment Ideas | Transfer an ISA to ii

Most of its revenue comes from retail banking but it also has divisions covering corporate and investment banking, wealth management and insurance. It also has ambitious plans, such as adding another 40 million customers over the next 2-3 years after attracting a similar number since 2014.

If this works, it will enable Santander to increase revenues by 7-8% a year while improving the bank’s efficiency and return on capital.

Investors will benefit from a plan to return 50% of profits to shareholders, including a €921 million share buyback programme that has just been approved.

Figures for 2022 suggest Santander is well on track to deliver its promises. Total revenue rose 12% to €2.15 billion thanks to a 16% surge in net interest income, while pre-tax profits edged up 4.8% to €15.25 billion, with a positive performance across all regions apart from one or two question marks over the UK. The dividend total was raised 18% to 11.78 cents.

The shares have recovered impressively since slumping well below €2, but a recent rally has run out of steam at around €3.80, which could prove to be a ceiling in the short term. This week’s run on banks took the shares down to €3.33, which looked to be a drop too far and they are already picking up again so the chance to buy may be short-lived.

The price/earnings (PE) ratio now allows for a lot of bad news at 6.7, while the yield, although not overwhelming, is a respectable 3.2%.

Source: interactive investor. Past performance is not a guide to future performance.

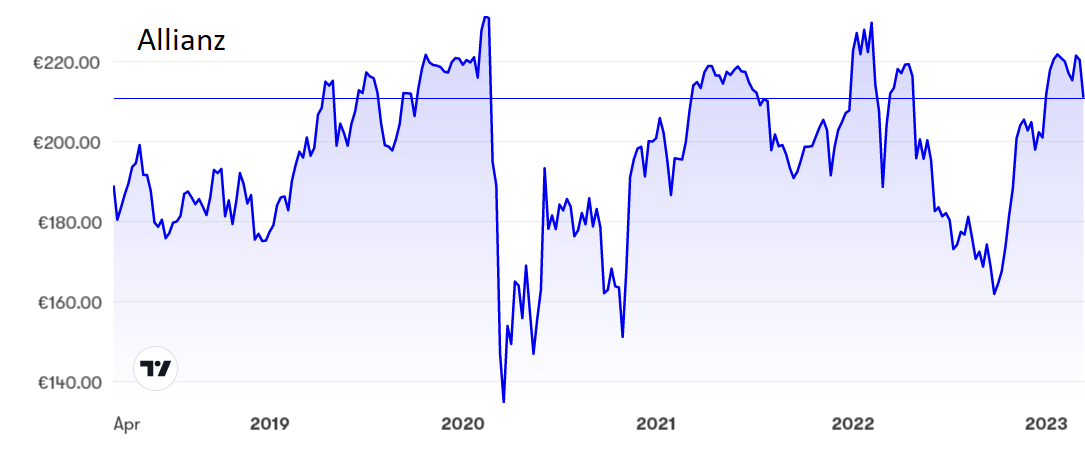

Insurance is inevitably a somewhat risky business as you never know what disaster is round the next corner, but Allianz SE (XETRA:ALV) has a wide spread of products that offers considerable stability, mainly life, motor, home, travel and personal liability. This type of insurance also means that individual claims are likely to be comparatively small, so there will not be one big hit that blows Allianz off course.

Although operations are mainly in Europe, there is also some exposure to the United States and Australia, all reasonably reliable markets.

- ii view: how Volkswagen will spend €180bn in next five years

- ‘High risk? I don’t see it that way’: the investment secrets of an ISA millionaire

- ISA ideas: alternatives to the most-popular funds and trusts

- ISA tips: around the world in eight funds and trusts

Revenue and profits can vary from quarter to quarter, but Allianz managed to increase revenue in the fourth quarter of 2022 compared with a year earlier and swung into a net profit if €2.11 billion after losing €165 million in the previous final quarter.

Over the past four years there seems to have been a solid ceiling at €220-230 and the shares are not much below that level at the moment, so the upside may be limited. On the other hand, a yield of 5.1% looks very attractive in such a solid company.

Source: interactive investor. Past performance is not a guide to future performance.

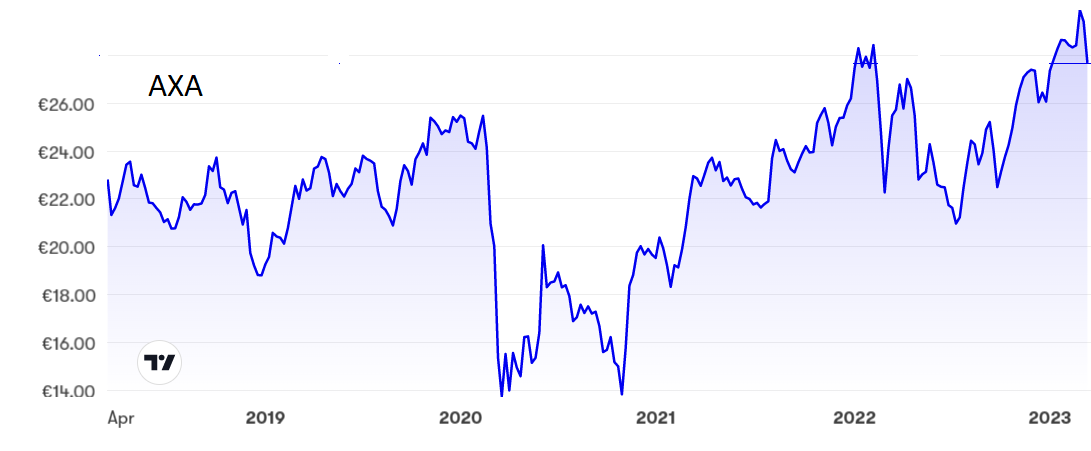

An alternative composite insurance company is AXA SA (EURONEXT:CS) (EURONEXT:CS), originally a life insurance and savings group with operations almost exclusively in France but now covering all aspects of insurance Europe-wide and with interests in the US.

- Eight easy ways to boost your ISA returns

- Use this neat ISA trick to avoid a big tax bill in 2023

- Stockwatch: five guiding principles for stock selection in an ISA

Although net income fell 11% in 2023, this was because of a revaluing of assets. A truer picture was the 7% increase in underlying earnings on revenue 2% higher. The total dividend rose 10% to €1.70 and a €1.1 billion share buyback programme has just been launched.

AXA shares have peaked at just under €30, a level that should be topped soon given the unchallenging PE ratio of 9.1 and the attractive yield at 5.6%.

Source: interactive investor. Past performance is not a guide to future performance.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.