25 years of Aim: how the junior market has become less risky

Its biggest companies today include Fevertree, Asos, and Boohoo, while this year’s winners may be fi…

4th June 2020 14:41

by David Prosser from interactive investor

Its biggest companies today include Fevertree, Asos, and Boohoo, while this year’s winners may be firms able to help the world confront Covid-19, such as Novacyt. What’s next for Aim?

It was the month in which John Major resigned as Conservative Party leader to face down the eurosceptic “bastards” destabilising his government. In the City of London, meanwhile, the London Stock Exchange (LSE) was preparing to launch what it now describes as “the most successful growth market in the world”. The Alternative Investment Market (Aim) opened its doors on 19 June 1995.

Some 25 years later, the LSE is proud of what Aim has achieved. Launched with stripped-down regulatory and governance requirements, its junior exchange was intended to help smaller, less developed businesses raise equity finance from both institutional and private investors. “Powering the companies of tomorrow, Aim continues to help smaller and growing companies raise the capital they need for expansion,” the LSE now boasts.

From £82 million to £104 billion

On the face of it, the positive spin is justified. A market that initially listed just 10 companies with a combined market capitalisation of £82 million had expanded to more than 860 companies collectively worth £104 billion by the end of 2019. More than 3,600 businesses have raised money on Aim, including hundreds of international companies as well as domestic enterprises, with a liquid secondary market in their shares.

“Aim has been incredibly successful at providing a platform for small companies to gain access to capital and long-term shareholders,” says Richard Power, head of quoted smaller companies at Octopus Investments, one specialist in Aim investment.

- Where is the vibrancy in the economy? Small firms

- Why small is beautiful for investors

Along the way, many investors have reaped rewarding returns – not least thanks to the generous tax treatment afforded to Aim shares by the UK government (see box below). The Aim All- Share index was up 28% over five years to end February, before the Covid-19 pandemic sent financial markets into a spin.

The Aim 100 index of the market’s largest companies delivered 45% over that period. By contrast, the FTSE All-Share Index returned just 9%. “Aim has changed almost beyond recognition,” says Paul Jourdan, a fund manager at Amati Global Investors who has been investing on the market for more than two decades. “In its early days, there were extraordinarily few outstanding high-quality businesses; there is now a significant number.”

- How to use Aim shares to guard against inheritance tax risk

Indeed, Aim’s leading businesses will be familiar. Its biggest companies today include the drinks company Fevertree, online retailers Asos and Boohoo, Abcam and Hutchison China Medtech in the pharma sector, and the likes of construction group Breedon and the media business RWS.

It’s not just the household names that give credence to Aim’s claims to be providing the foundations for immature companies to grow. A key part of the attraction for many Aim investors is the opportunity to identify stocks that will deliver stellar returns over shorter periods, often in sectors such as oil and gas or phamaceuticals. Last year’s top-performing Aim share, for example, was the Irish exploration and production company Petrel Resources, which rose more than 1,700%. In the pharma sector, Silence Therapeutics returned almost 700%.

Novacyt shines bright

This year’s winners may well turn out to be businesses able to help the world confront the Covid-19 pandemic. Shares in Aim-listed Novacyt, for example, increased almost 30-fold over the three months to mid-April; the Southampton-based company received orders from 80 countries for its coronavirus test.

- How healthcare and biotech trusts can revive portfolios

For all the success stories, however, Aim has plenty of critics. They point out that the market has been shrinking for almost 15 years. Aim achieved its high-water mark in 2007, with some 1,694 companies listed on the market, including almost 750 that had made their debut over the previous 12 months. But by March 2020, Aim numbered just 843 companies, with the total having fallen in each of the past six years.

New issues have failed to keep pace with the numbers leaving Aim, whether for positive reasons such as a graduation to the London Stock Exchange’s main market or a takeover, or because they’ve failed. Just 23 companies joined Aim last year and 2020’s figure looks set to be even smaller.

One problem is a widely held perception that the lower regulatory demands made of Aim-listed businesses have attracted unscrupulous operators. Various new standards introduced following scandals on Aim, including the £375 million Langbar International fraud in 2005, do not seem to have prevented further setbacks.

Last year alone saw cases ranging from accounting irregularities at Patisserie Valerie and Goals Soccer Centres to a row over governance at the professional services company Burford.

The collapse in new issues also reflects the increased diversity of the funding environment for growing companies in the UK. Where businesses seeking equity finance would once have had no option but to look to public stock markets, venture capital and private equity capital is now more widely available.

“Good-quality companies can find ample funding, so they are opting to stay private for longer,” argues Alex Davies, the founder of investment platform Wealth Club. “Innovation in the funding of businesses and a booming UK start-up ecosystem has become a key competitor to Aim.”

Less attractive?

And if the best up-and-coming companies are avoiding Aim, the market may now be a less attractive hunting ground for investors. Certainly, demand for Aim shares has waxed and waned. Trading turnover was down almost 14% in 2019 compared to the previous year.

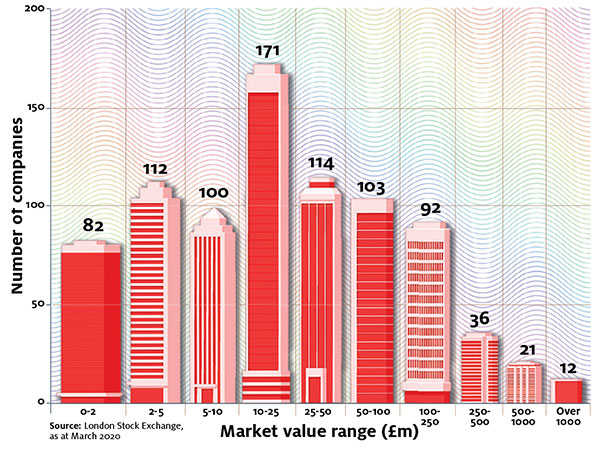

Many investors have had their fingers burned. The headline returns posted by Aim’s indices are less meaningful, given the huge diversity of the businesses listed on the exchange. While there were a dozen Aim-listed companies worth more than £1 billion in March, more than half the market’s constituents were capitalised at less than £25 million, including 194 worth less than £5 million. Inevitably, performance is patchy.

Some 47 Aim-listed companies more than doubled in value last year, but 124 lost more than half their value.

Still, this is the nature of investment in small businesses. And the LSE rejects suggestions of fundamental problem with standards on Aim, or that high-profile failures undermine the case for a junior market designed for immature companies.

“We believe that for many people, accessing Aim via a professional fund manager is better than attempting to pick stocks directly,” insists Davies.

Bear in mind, however, that inheritance tax exemption, one important attraction of Aim shares for many investors, is only available on direct holdings – not on Aim shares held via collective funds. Still, specialist advisers do offer managed portfolio services to help investors secure this benefit.

“For most investors, a fund investing in Aim shares is the most sensible route,” agrees Ben Yearsley, a director of Shore Financial Planning. “It provides diversity and professional management in a more lightly regulated market with typically younger companies.” As a starting point, Yearsley picks out Aim specialists such as Paul Mumford’s Cavendish Aim fund, as well as smaller companies vehicles with significant Aim holdings, including Amati UK Smaller Companies and Montanaro UK Smaller Companies investment trust.

Another option is a venture capital trust (VCT) specialising in Aim securities, with managers including Amati, Hargreave Hale, Octopus and Unicorn active in this area. VCTs offer a range of generous tax breaks, though only investors in new shares – typically issued during the final few months of the tax year – qualify in full.

Spread of Aim companies by size

Tax breaks for Aim investors

Aim-listed shares offer a range of attractive tax reliefs, designed to encourage investors to back what are potentially more risky companies. It never makes sense to invest just to secure a tax break, but these reliefs can help mitigate losses and enhance returns.

Inheritance tax – most Aim stocks qualify for business property relief; once held for two years or more, they fall out of your estate for inheritance tax purposes and can therefore be passed on to heirs tax-free.

Individual savings accounts – Aim shares are eligible for inclusion in your £20,000 annual Isa allowance, making it possible to shelter returns from income and capital gains tax.

VCTs and EIS – many Aim-listed businesses are eligible holdings for venture capital trusts and the enterprise investment scheme, which offer incentives including 30% upfront income tax relief.

Stamp duty – there is no stamp duty to pay on purchases of Aim-listed shares.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.