2021 outlook: Covid vaccine sparks hope for UK stocks…

…but China predicted to perform best, according to our customer poll.

14th December 2020 12:22

by Myron Jobson from interactive investor

…but China predicted to perform best, according to our customer poll.

The start of the mass rollout of the Covid-19 vaccine has stoked a bullish outlook for domestic stocks in the next year – but sentiment has significantly waned from 2020 predictions, a new interactive investor poll finds.

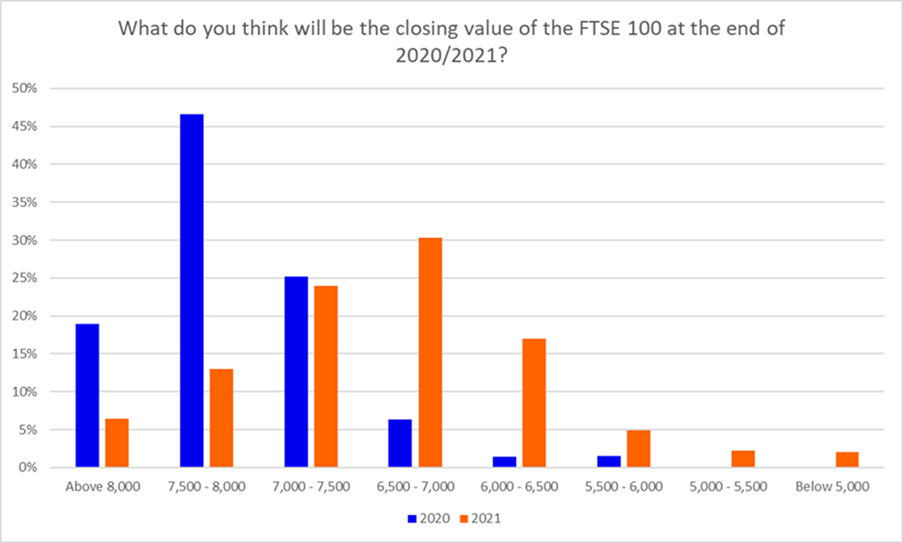

A snap poll of 1,503 interactive investor website visitors, between 10 and 11 December 2020, found that the highest percentage of respondents (30%) think the FTSE 100 will close at between 6,500 and 7,000 points at the end of 2021.

Just under a quarter (24%) believe the UK’s blue-chip index will end next year at 7,000-7,500, 13% say 7,500-8,000, while 6% think it will exceed its highest value and break 8,000.

Others are less optimistic. Some 26% of the sample estimate below 6,500 – of which only 2% predict a dip in the index to below 5,000.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

This contrasts to last year’s instalment of the survey, which took the views of 787 website visitors, when 19% thought the FTSE 100 would surpass 8,000 points at the end of 2020, while the majority, 47%, guessed that the index will end the year around its record value at 7,500 - 8,000. Only 3% predicted a dip in the index to 6,500 or below.

Lee Wild, Head of Equity Strategy, interactive investor, says: “The world was a very different place a year ago. Few of us had heard of coronavirus. Now we’re all experts. And that’s reflected in expectations investors have for 2021. Christmas 2019 was a time of optimism, with a UK General Election result bringing clarity over Brexit, and seemingly paving the way for a flood of money into UK assets.

“Well, here we are 12 months later with the clock ticking down to midnight, and we’re still waiting for a Brexit trade deal. This and the pandemic have clearly tempered enthusiasm for UK stocks compared with last year, but whatever happens between now and 31 December, there will be a final resolution to Brexit. That is certain. A series of Covid vaccine programmes should also begin the global economy’s return to normality.

“Throw a new US president into the mix, one which will have to spend heavily on domestic stimulus programmes, and you can see why almost three-quarters of respondents to our poll believe the FTSE 100 index will be higher in 12 months’ time than it is now.”

China most favoured region for 2021

The plight of the ongoing coronavirus crisis on the Western world is likely to explain why the highest percentage of respondents (41%) believe China, which appears to have fared better at controlling the virus and reducing its economic impact, will be the best performing region.

This sentiment is also reflected in interactive investor’s most bought funds and investment trusts lists, with Chinese strategies rising up the ranks over the past couple of months.

Despite the continued uncertainty over the Brexit trade deal, the UK emerged as the second most favoured region (21%), ahead of the US (16%), Japan (10%), Europe (5%) and India (4%), with investors potentially seeing the UK as a recovery play.

Asked what they would do if they had a £50,000 lump sum to invest now, 35% of respondents said they would put most in shares and keep some cash back, while almost a fifth (19%) would split the money equally in stocks and cash.

Lee Wild says: “America was the place to be invested during 2020, the forced shift to working from home during lockdowns accelerating demand for technology and the companies making it happen. But the jury is out on whether this can continue in 2021. Business is good, but the pace of growth will eventually level off, then decline.

“With that in mind and given the clarity that a Brexit deal might bring (with the emphasis on ‘might’), plus an improving Covid situation, it is understandable why UK stocks may represent good value next year. We have already seen the early stages of a switch to so-called value stocks. But it is China that is next year’s hot destination for investors.

“Over 40% of ii customers polled think China will do best in 2021. That may have something to do with the way in which it coped with the pandemic, emerging from the crisis far sooner than other nations. The growth potential there remains significant, too, and investors who know the value of diversification have been pouring money into Chinese stocks since the March crash.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.