18 new investment trusts reviewed

11th January 2019 16:21

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

After a flood of new investment trust launches in 2018, we review their investment theses and performance so far...

Class of 2018...

William Sobczak, analyst at Kepler Trust Intelligence

Last year set new records for the investment trust sector, with launches from Baillie Gifford, Fundsmith and Mobius Capital Partners amongst others adding to assets which reached a record of £189bn by the autumn. We look at the new funds which came to market and examine the progress of the most interesting so far…

2018 was a notable year for investment companies. Over the year, we saw 18 new investment companies launch, raising close to £3bn. This was the third-highest amount raised since AIC records began and represents an increase of around £500m from 2017. By September, organic growth, as well as primary and secondary issuance meant that investment trust assets reached an all-time high of £189bn (double 2013 levels), showing a rate of growth considerably greater than that of the open-ended industry. This increase has been assisted by multiple large IPOs, including the largest UK investment company launch ever, Smithson Investment Trust, which raised £823 million.

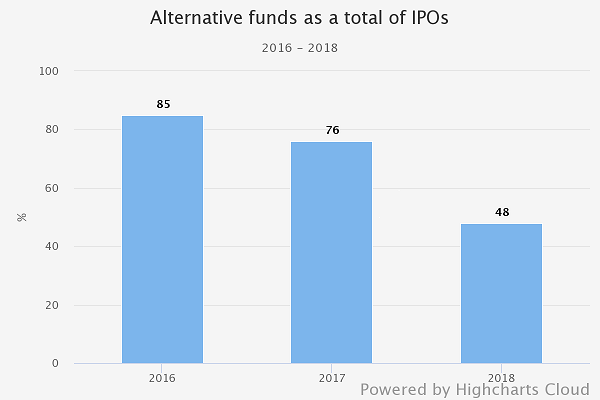

As we mentioned in our previous article, the majority of fundraising activity historically has been in alternative asset classes, but 2018 saw a shift towards a real mix in the type of alternative being launched. For example, we have seen launches in renewable energy (Gore Street Energy Storage Fund (LSE:GSF)), song royalties (Hipgnosis Songs (LSE:SONG)) and big box logistics (Tritax EuroBox (LSE:BOXE)). However, the trend of seeing more alternatives than equities seems to have reversed, and as can be seen below alternatives represented a considerably reduced 48% of IPOS (according to our assessment, and excluding Trian Investors 1 (LSE:TI1)).

Alternative Funds Raised as a Total of IPO Assets Raised

Source: AIC and Numis

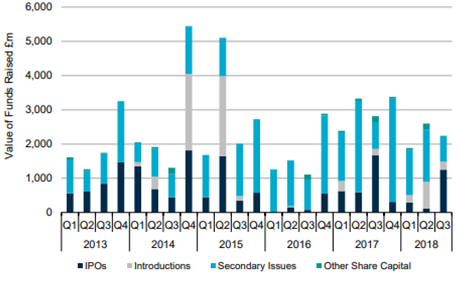

Alongside £882m Smithson (LSE:SSON), which clearly dominates new issuance statistics this year, there have been other decent-sized launches in the equity sphere, including Baillie Gifford US Growth (LSE:USA)(£173m), Mobius Investment Trust (LSE:MMIT) (£100m) and AVI Japan Opportunity (LSE:AJOT) (£80m). In particular, Q3 stood out with six IPOs raising close to £1,020m. As shown below, this sits firmly in the top five quarters for fundraising in the last six years.

Issuance by Quarter

Source: Numis

In the chart below, one can see the 18 new investment companies that launched over the year, their AIC sector, and also their assets (£m). We have summarised all of the equity or growth mandated launches, reviewing their investment theses and performance since launch.

| Month Launched | Company Name | AIC Sector |

|---|---|---|

| Feb | Marble Point Loan Financing | Sector Specialist: Debt |

| Mar | Augmentum Fintech | Sector Specialist: Tech, Media & Telecomm |

| Mar | Baillie Gifford US Growth | North America |

| Mar | JPMorgan Multi-Asset | Flexible Investment |

| Mar | Life Settlement Assets | Sector Specialist: Insurance & Reinsurance Strategies |

| May | Gore Street Energy Storage | Sector Specialist: Infrastructure - Renewable Energy |

| May | Odyssean | UK Smaller Companies |

| Jul | Ashoka India Equity | Country Specialists: Asia Pacific |

| Jul | Hipgnosis Songs | Sector Specialist: Tech Media & Telecoms |

| Jul | Tritax Eurobox | Property Direct - Europe |

| Oct | AVI Japan Opportunity | Japanese Smaller Companies |

| Oct | Ceiba Investments | Property Specialist |

| Oct | Mobius | Global Emerging Markets |

| Oct | Smithson | Global Smaller Companies |

| Nov | Gresham House Energy Storage | Sector Specialist: Infrastructure - Renewable Energy |

| Nov | M&G Credit Income | Sector Specialist: Debt |

| Nov | Merian Chrysalis | Private Equity |

| Dec | SDCL Energy Efficiency Income | Sector Specialist: Infrastructure - Renewable Energy |

Source: AIC

Odyssean Investment Trust

Odyssean Investment Trust (LSE:OIT) seeks to deliver attractive returns through investing in high quality businesses and supporting their growth over time. Odyssean is the new vehicle for Stuart Widdowson, who previously managed Strategic Equity Capital. Constructive corporate engagement with the underlying companies is a unique selling point of the trust, and the team is keen to draw on its long track record and experience in public and private equity. The fundamental and research-driven approach is built upon three pillars; value, quality and engagement, which they believe will help to deliver long-term outperformance.

The portfolio is comprised of UK smaller companies, typically those that are too small to be included in the FTSE 250. The managers utilise an extremely concentrated approach and within the mandate a maximum of only 25 constituents is permitted. Up until the end of Q3, nine investments had been made, largely within the TMT (13.5%), industrials (12.5%) and business services (9.4%) sectors. Currently, 54.5% of the cash is still waiting to be deployed.

Since launch, the trust has failed to deliver positive NAV returns (-3.7%); however, considering the performance of smaller companies in the UK, the trust has performed admirably. As an example, the FTSE Small Cap has lost c.-12% over the same period. With this in mind, there is little surprise the trust has consistently traded at a premium since launch, and is currently trading at 4.5%, relative to its seven-month average of 5.4%.

Ashoka India Equity

Ashoka India Equity Investment (LSE:AIE) aims to achieve long-term capital appreciation, mainly through investing in listed and unlisted securities with a significant presence in India. The manager believes that many of these companies are under-researched and as such allows the team to utilise their expertise and generate alpha. Currently, the team believes that India offers a ‘multi-generational opportunity’ because of the strong growth potential and attractive demographics that the country offers. Additionally, the country continues to show rising domestic consumption.

Interestingly, the trust has chosen to follow Woodford Patient Capital Trust (LSE:WPCT) and Auora in not levying an annual management fee.

Instead, Ashoka will charge a performance fee paid in shares if it successfully grows its net asset value (NAV) faster than the MSCI India IMI index.

Since launching last July, the trust has failed to generate positive returns (-2%) and trailed the MSCI India IMI by 4.7%. Much of the underperformance relative to the benchmark (since the IPO) is due to cash being invested in the weeks following the IPO during which time the benchmark moved significantly. As with many new launches, the trust launched on a premium, which in September reached highs of c.10%. Since then, the trust has slipped to a discount, and is currently trading at -5.5%.

AVI Japan Opportunity

AVI Japan Opportunity (LSE:AJOT) aims to deliver capital growth through investing in a focused portfolio of over-capitalised small-cap Japanese equities. The trust is run by Asset Value Investors (AVI) and managed by Joe Bauernfreund, who also manages sister trust British Empire. The team is hoping to utilise decades of experience to engage with company management and help to unlock value in this under-researched area of the market. The portfolio will typically be comprised of 20-30 smaller and medium-sized companies that the manager deems to be undervalued and are cash-rich. Currently the trust has 29 holdings, and still holds 28.6% of NAV in cash.

To identify opportunities, AVI looks at the liquidity and net financial value of companies (as a percentage of market cap) to narrow down the broad universe of 3,475 non-financial Japanese companies. From there, AVI conducts detailed in-house research on each companies' business and earnings power, as well as the potential for changes to corporate governance.

Since launching at the end of October, the trust has outperformed the MSCI Japan Small Cap (-6.1%) but failed to produce positive returns (-3%). The trust has continued to trade at a premium, and is currently trading at 5% to NAV. The trust also has a four-year liquidity option, which gives an 'out' for investors if the strategy works either too well or too poorly, and should control the discount/premium in the meantime.

Mobius Investment Trust

Mobius Investment Trust (LSE:MMIT) is managed by Mobius Capital Partners, an investment manager launched in May 2018 by Mark Mobius, Carlos Hardenberg and Greg Konieczny. They launched the trust with the aim of changing the way investing in emerging and frontier markets is approached. They believe that through actively partnering with portfolio companies they are able to unlock significant value, in particular when investing in small- to medium-sized companies. They see the closed-ended structure as the perfect vehicle for this type of strategy, as it allows access to less liquid stocks and markets with greater inherent inefficiencies and therefore greater potential upside.

MMIT will typically hold between 20 and 30 companies, but is currently still in the process of deploying its IPO proceeds and is actively engaging with both portfolio and target companies. As of 7 December 2018, 40.1% of the trust's capital had been invested across 10 companies, and the largest exposures were to Poland (7.5%), China (6.9%), Brazil (4.7%), South Korea (4.6%), and Turkey (4.3%).

In terms of performance, the trust has fared well in a particularly tough environment for emerging markets. Since the launch in October 2018, the trust has returned -0.3%, almost 3% greater than the MSCI Emerging Markets. The pessimism towards the outlook for emerging markets has been reflected in the discount, and after launching at a 3% premium, the trust is now trading on a discount of close to -5%.

Smithson Investment Trust

Smithson Investment Trust made waves in 2018 with a record breaking launch in October, raising £822m. Clearly, the pull of the Fundsmith name is very strong and this goes to show the impact a 'star fund manager' can have on attracting investors.

The trust is managed by Simon Barnard, with assistance also from Will Morgan, both of whom joined the company from Goldman Sachs in 2017. However, Smith is expected to "offer support and advice" to the manager, and the trust will follow his strategy of buying good companies, not paying over the odds, and holding for long periods. We anticipate a low stock turnover.

The company's investment policy is to invest in shares issued by small and mid-sized companies, with a market capitalisation of between £500m and £15bn (although the company expects that the average will be approximately £7bn) on a long-term, global basis. They see this type of company as a good source of long-term growth for investors who are willing to ride out the volatility of the asset class. The global scope of the fund gives the fund managers a wide universe of stocks to choose from, which is whittled down through screening and fundamental analysis to deliver a concentrated portfolio of high conviction investments. It is widely expected that the trust will perform similarly to its bigger open-ended relative, although this will come with greater risk and volatility due to the investment style.

From launch to the end of November, the trust had initiated positions in 29 companies and invested 97.4% of the net proceeds of the fund raising. The largest geographical allocations are to the USA (52.5%), UK (18.2%) and Denmark (6.8%).

The trustlaunched during an extremely tricky period, and as such was -5.8% down over the two-month period. In comparison, the MSCI World Small Cap has returned -7.5%. Despite this volatility, the trust has been trading at a premium throughout its lifespan, and after reaching a high of c.10.5%, has settled down to a premium of 3.8% at the time of writing.

Merian Chrysalis

Merian Chrysalis (LSE:MERI) aims to generate long-term capital growth through investing in a portfolio of unquoted companies. The managers look to identify unlisted companies in the UK which are trading at attractive valuations, in particular when compared to similar listed firms. Often these companies are fast-growing and technology enabled businesses that are difficult for the everyday investor to access. These companies will be at the later stage of private ownership and beginning to think about stock market flotation. As we have discussed previously, businesses are staying private for longer, and the team believes that private markets offer attractive opportunities, not least because there is typically higher growth before a company lists on the stockmarket.

The managers are strict on only investing in business that already have an established and proven business model, and the managers are not looking to invest in speculative 'concept' businesses, nor any resources or biotech firms. Overall, the trust is expected to hold between seven and 15 securities, though it is expected to be six to nine months before this happens. The company has deployed almost 60% of the net proceeds of the issue after announcing to invest $25 million in Graphcore Limited earlier in December.

Since launching, the trust has consistently traded around a 5% premium.

Bright young things (redux)...

We examined a number of new launches in May last year in our article "Bright Young Things" published in May 2018. Overall, the majority of those launched in the first half of the year have performed well, however all but one are now trading on discounts.

Since launching at the end of March, Bailie Gifford US Growth has been the standout performer. Delivering an exceptional cumulative return of 16.12% (since inception), the trust has benefited from its unashamed growth mandate and the extensive bull run we have seen in the US, in particular in the tech sector. As one might expect, this has not come without its ups and downs, and over its lifetime the trust has had an NAV standard deviation of c.30%. Accompanying this we have seen volatility in the premium of the trust and over the past nine months USA has traded between -1.5% and +8.9%. Currently the trust is trading at a +3.6%.

Gabelli Merger Plus (LSE:GMP), the only 'alternative' fund in our shortlist, has delivered the second greatest returns since launch. Although over 18 months (the trust launched in July 2017) a cumulative return of 10.05% doesn’t sound particularly notable, it is exceptionally impressive relative to the Morningstar IT Hedge fund peer group which has only returned 0.5%. The first half of 2018 was particularly striking in assisting this, as we saw a record setting six months for global merger activity. With this said, similar to Baillie Gifford US Growth, the trust has not been able to deliver these returns without relatively high levels of standard deviation (11.11%). After spending most of its first year on a premium, even reaching highs close to 10%, the trust has since slipped to a significant discount. June to August was a particularly torrid time, and we saw the trust slip from a premium of 3% to a discount of over 18%. In December, the trust was trading at a discount of -12.3%.

Augmentum Fintech (LSE:AUGM) was launched in mid-March and has so far delivered annualised returns of around 5%. Given the recent fall off in sentiment towards technology companies, it remains to be seen whether continue delivering returns on this level; which put it among the top ten new launches over two years. Over 2018, the team have been deploying capital, and have invested in five more businesses (taking the tally to 11) and representing just over 50% of the launch NAV. An interesting point for the trust is their positivity with Brexit around the corner; they believe that the young and dynamic fintech businesses they invest in are often better placed to respond to these new challenges than the incumbents that they are looking to disrupt. Like Gabelli Merger Plus, Augmentum has spent the majority of its life on a premium before falling to a discount in recent times. Over the year the trust has ranged between c.6% and c.-10% and at the time of writing was trading on a discount of -6%.

JPMorgan Multi-Asset (LSE:MATE) and ScotGems (LSE:SGEM) are the final trusts in our roundup. They have delivered 1.85% and -4.36% respectively. For MATE, 2018 has been a tough environment and the uncertainty surrounding the global markets due to politics have negatively impacted investor sentiment towards the trust. More recently, the main detractors to performance have been their developed market equity allocations and fixed income allocations, as they have witnesses a decline in government bonds and market debt.

MATE has spent the majority of its life trading on a discount of c.-3% and -c.8% and is currently trading at a discount of -4.7%. Similarly, the managers at SGEM look to the political and economic uncertainty for the poor performance and stock market turbulence. However, they recognise these conditions can benefit their opportunistic approach, and hope that the current turbulence will throw up opportunities to invest in high quality companies at more reasonable valuations. Indeed, the market turbulence may be playing into their hands given that, as at the end of September, they remained around only c.60% invested. After trading at a premium of around 2%, the trust has slipped to a discount. In November the trust reached lows of -12%, but recovered to close to -1% in December.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons.

The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.