15% of investors will trade less if trading hours are cut

With the LSE’s consultation on trading hours about to close, we polled customers to gauge their views.

29th January 2020 10:50

by Myron Jobson from interactive investor

With the LSE’s consultation on trading hours about to close, we polled customers to gauge their views.

With the closing date for the London Stock Exchange's consultation on market structure and trading hours approaching this Friday 31 January, interactive investor has polled customers to gauge their views.

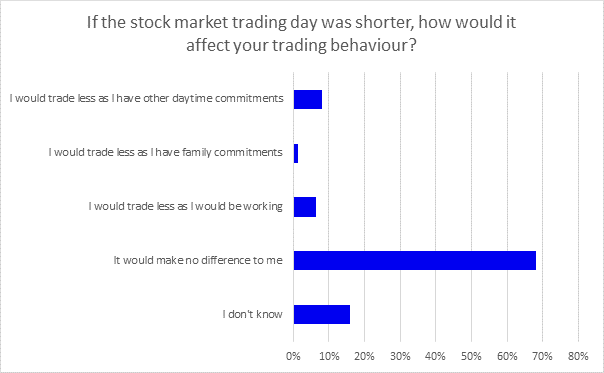

There is a clear consensus from respondents that changes to market opening hours are unlikely to materially impact their trading behaviour. Some 76% say changes to market hours would not make a difference to their trading behaviour, but some 15% of investors would make fewer trades if the day was shorter.

The survey, which took the views of 1,871 investors between 7 and 8 January 2020, found that work (6%), family and other daytime commitments (9%) would cause investors to trade less if the LSE trading day was shorter.

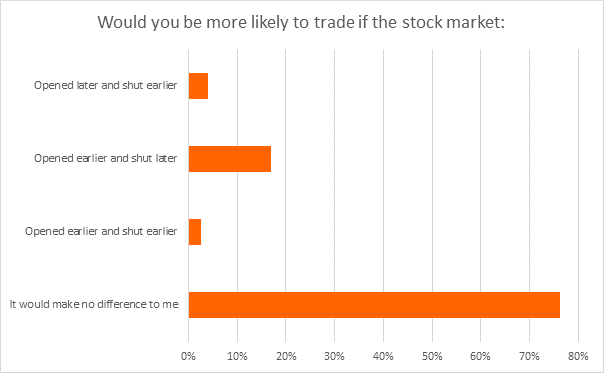

Where a preference was expressed, it was for earlier opening and later closing, which was not one of the options outlined by the LSE.

Richard Hunter, Head of Markets, interactive investor, says: “We very much welcome improvements to the investment landscape which may benefit investors, but we are equally wary of change for change’s sake.

“All things being equal, a shortened trading session would improve liquidity as it would compress an equal number of trades into a shorter timeframe. It could, however, also come with increased volatility, as regularly evidenced on “triple”, or even “quadruple witching” days, where index options are unwound on a quarterly basis in a very short period of time. This added volatility can decrease price stability and could, in theory, become a feature of a shortened trading day.

“From a broader perspective, and especially in the current environment, any measure which is perceived to lessen London’s pre-eminence as the European trading venue of choice is unwelcome. Specifically, the overlap which London enjoys with both Asian and American markets is one which is a particular attraction to global investors, and if timing changes were made they would need to be synchronised with European bourses in order that London should not suffer competitive loss as a result. In addition, comparisons with the hours worked with other major global hubs in different continents are not totally relevant given London’s unique position in its particular time zone.

“Of ultimate importance to us is the underlying investor. We polled a number of our customers for their opinion on reduced hours. Although the majority advised that it was unlikely that their trading behaviour would change, a significant number (around 15%) also made the point that they would trade less given other daily commitments, such as work or family considerations. Access to the market on the current basis is therefore of importance.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.