The 12 most-consistent funds over the past three years

14th February 2022 14:23

by Douglas Chadwick from ii contributor

However, half the funds have produced a negative return over the past six months due to being negatively impacted by the market rotation.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

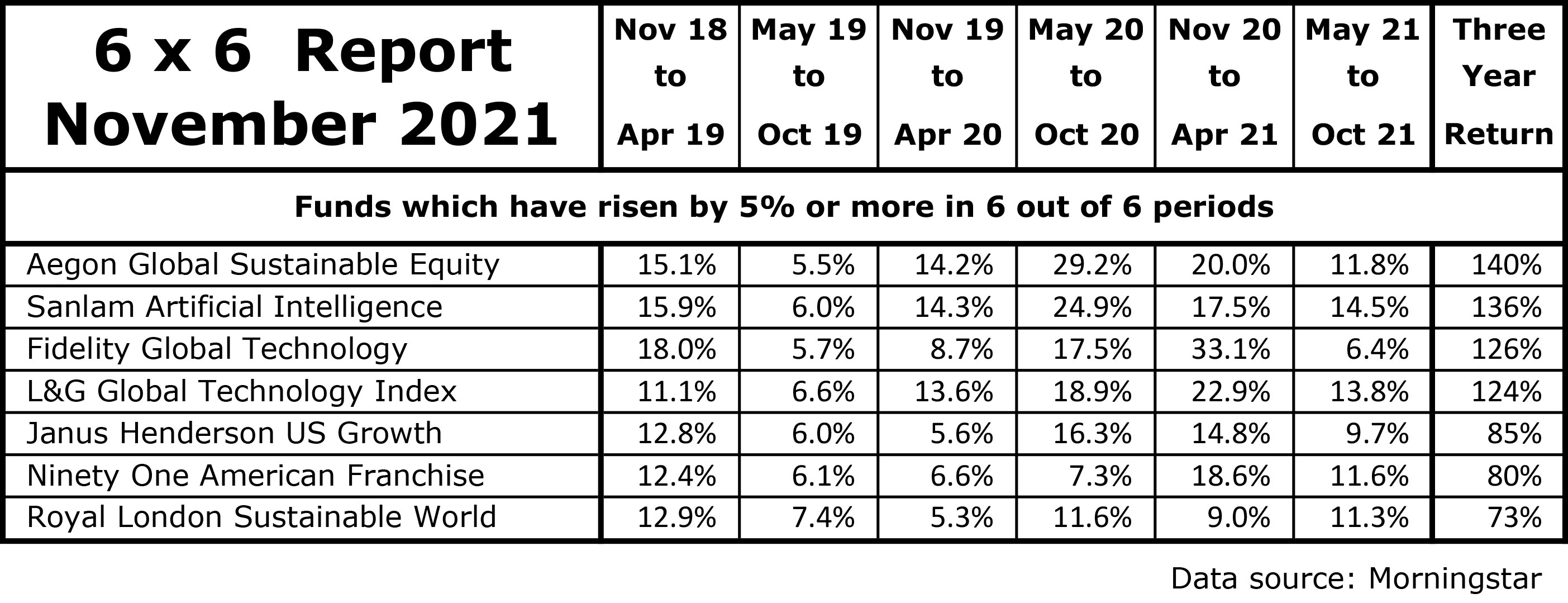

Every three months, we trawl through our fund data looking for funds that have consistently achieved gains of 5% or more in six consecutive six-month periods. The results are published in our ‘6 x 6 Report’. When we crunched the numbers at the beginning of November, there were seven funds that had scored the elusive six out of six.

Two of the funds were from the Technology & Technology Innovations sector, and the rest were also in sectors that allowed them to invest in the large US tech stocks that have done so well over the last couple of years.

Past performance is not a guide to future performance

At the beginning of this month, we ran the numbers again and this time we could not find any funds that had achieved the target return in each of the six-month periods. However, there were 12 funds that had managed to do it five out of six times.

- How Saltydog invests: a guide to its momentum approach

- Baillie Gifford retains crown as active investors’ favourite fund firm

- UK funds are making a comeback, but remain unloved by investors

6x6 Report February 2022

| Feb 19 | Aug 19 | Feb 20 | Aug 20 | Feb 21 | Aug 21 | Three-year return | |

| to | to | to | to | to | to | ||

| July 19 | Jan 20 | July 20 | Jan 21 | July 21 | Jan 22 | ||

| Funds that have risen by 5% or more in 5 out of 6 periods | |||||||

| L&G Global Technology Index | 27.9% | 9.4% | 15.6% | 18.4% | 15.3% | 3.2% | 128% |

| Fidelity Global Technology | 21.9% | 7.0% | 14.8% | 23.8% | 12.8% | 2.5% | 114% |

| Sanlam Artificial Intelligence | 28.2% | 6.3% | 21.9% | 20.9% | 6.4% | -5.0% | 103% |

| Baillie Gifford Positive Change | 16.2% | 11.3% | 39.0% | 32.9% | 6.7% | -20.4% | 103% |

| GAM Star Disruptive Growth | 21.8% | 5.7% | 15.1% | 35.4% | 5.5% | -4.7% | 102% |

| Janus Henderson Global Tech | 27.4% | 6.1% | 11.7% | 19.0% | 10.3% | -4.2% | 90% |

| New Capital US Growth | 11.0% | 9.3% | 15.0% | 17.1% | 17.9% | -3.2% | 87% |

| abrdn Global Innovation Equity | 27.5% | 8.5% | 14.1% | 24.3% | 9.1% | -20.1% | 71% |

| Allianz UK Equity Income | 7.8% | 11.3% | -24.7% | 22.2% | 15.7% | 11.3% | 42% |

| Artemis SmartGARP UK Eq | 5.4% | 7.3% | -22.5% | 21.3% | 23.2% | 8.2% | 42% |

| Slater Income | 6.2% | 8.7% | -26.5% | 19.5% | 16.9% | 7.0% | 27% |

| Fidelity MoneyBuilder Dividend | 6.6% | 5.5% | -15.6% | 5.1% | 11.2% | 8.4% | 20% |

Data source: Morningstar. Past performance is not a guide to future performance.

At the top of the table are two funds from the Technology & Technology Innovations sector, L&G Global Technology Index and Fidelity Global Technology. Up until recently, we were holding the L&G Global Technology Index fund in one of our demonstration portfolios, but we sold it last month. Although it is still showing a gain over the last six months, it has not gone up by 5% or more, and over the last three months it has gone down.

The eight funds at the top of the table all follow a similar pattern. They went up by 5% or more in each of the first five of the six-month periods, from the beginning of February 2019 to the end of July 2021, but they have been unable to sustain that over the last six months. Some have made significant losses between the beginning of August 2021 and the end of last month. Two funds, Baillie Gifford Positive Change and Abrdn Global Innovation Equity, have fallen by more than 20%. As the table above shows, half the funds have produced a negative return over the past six months having been negatively impacted by the market rotation.

- Nick Train: The Richard Hunter Interview Podcast

- Watch our share, fund and trust tips, plus outlook videos for 2022

- Friends & Family: ii customers can give up to five people a free subscription to ii, for just £5 a month extra. Learn more

The four funds at the bottom of the table invest in UK shares, and have achieved the 5% target in the last six months. Their nemesis was the Covid-19 crash in the first quarter of 2020. Three funds are from the UK Equity Income sector. They are Allianz UK Equity Income, Slater Income and Fidelity MoneyBuilder Dividend. Funds from this sector have also been showing up in our regular weekly analysis.

In our two demonstration portfolios, we have sold all the funds that we were holding at the end of last year and are sitting on a large amount of cash. Not a bad place to be when you look at the overall performance of funds over the last month.

We have invested in a few new funds this year, three of which are from the UK Equity Income sector. They are JOHCM UK Equity Income, Schroder Income and Vanguard FTSE UK Equity Income Index. When I checked this morning, they were all showing gains since we went into them a few weeks ago.

Our best-performing fund this year has been TB Guinness Global Energy. We bought it on 20 January 2022, and it is already up 4.4%. Energy prices have risen significantly over the last six months and if a war breaks out between Russia and Ukraine, then I would expect them to go up further.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.