10 top investment trusts for your retirement portfolio

13th November 2018 09:14

by Jennifer Hill from interactive investor

These outperforming trusts could see an investor through both the accumulation and the decumulation phases of their retirement planning, writes Jennifer Hill.

Investing during the dotcom crash? Drawing an income during the financial crisis? These were pretty hair-raising times for investors, but those who invested regularly in investment trusts in the decade leading up to the financial crisis, then withdrew the natural income in the 10 years since then have virtually quadrupled their money.

They have turned a total investment of £100,000, saved diligently into a range of 10 investment trusts at a rate of £1,000 per trust per year, into almost £390,000, including an income stream of almost £80,000.

These compelling statistics, compiled by the Association of Investment Companies (AIC) for Trust, form a crucial part of this feature, which shows that the same investment trusts can serve investors well in both the investment and the drawdown stages of their retirement planning.

"Pensions freedoms have blown away the line in the sand between the accumulation and decumulation phases of pension planning," says Haig Bathgate, head of portfolio management at Seven Investment Management.

"With two-thirds of us now apparently opting for drawdown, investments need to work harder and for longer. Those out-and-out growth funds can be held for considerably longer than they used to and lower-risk options can stay in the bottom drawer for longer too."

Past performance is not a guide to future performance

Double win

Funds that combine growth with a decent level of income offer a double win for investors in both accumulation (the saving stage) and decumulation (drawing an income).

Ben Yearsley, a director of Shore Financial Planning, a Plymouth-based adviser, says: "In the accumulation period you roll the income up and in the decumulation period you take it. While there used to be a huge emphasis on de-risking investments leading up and into retirement, investors can now glide smoothly from building retirement wealth to drawing on it with little or no changes to their portfolio, provided they choose their investments wisely."

One of the biggest mistakes investors make, he says, is underestimating the level of risk they need to take to keep their pot growing sufficiently to keep pace with inflation and fund what is likely to be a lengthy retirement.

"Quite simply, they don't take enough risk on the way up and are too soon to de-risk on the way down," he says. "While you probably shouldn't be in a frontier market fund in drawdown, you should predominantly be in equities with an emphasis on investing for growth in capital as well as decent – and ideally rising – dividends.

"Even if the yield as a percentage stays constant, if the capital doubles over 10 years then your income doubles too – that's the real attraction in continuing to grow your asset base after retirement."

Unique features

Investment trusts have unique features that make them particularly well suited to investors saving for retirement and then drawing an income from the same investments.

Gearing – borrowing money to make additional investments – is arguably the biggest benefit of the closed-ended investment trust structure for those in the accumulation phase.

Although gearing can make investment trusts more volatile in the short term, the ability to deploy gearing is a competitive advantage that has enabled them to generally beat the returns from open-ended funds over the long term.

The permanent capital structure is another big benefit for those saving for retirement, because it affords managers the freedom to focus on growth rather than managing inflows and outflows.

For income-seekers investment trusts have another significant advantage: they are able to retain up to 15% of their income each year to keep paying and growing their dividends even in volatile markets.

This allows managers to commit to a progressive dividend policy and some trusts have notched up 50 or more consecutive years of dividend growth.

The ability to generate a rising level of income is clearly desirable for investors in drawdown; they are able to take the natural yield without inflation eroding their spending power. It also helps to supercharge investments in the accumulation phase.

"Compounding - the so called eighth wonder of the world - works best if you reinvest your dividends, rather than drawing them - so avoid the temptation to do this too soon," says Bathgate.

Power of 10

To demonstrate the power of investment trusts in both the saving and drawdown phases of retirement planning, we looked at how an investor might have fared over the past 20 years – 10 spent accumulating assets and another decade spent taking the income from them.

This period takes in some pretty nasty falls in the market. The first 10-year period, from 1998 to 2008, encompasses the 2000- 2003 bear market that was sparked with the bursting of the dotcom bubble. The second 10-year period, from 2008 to 2018, includes the financial crisis.

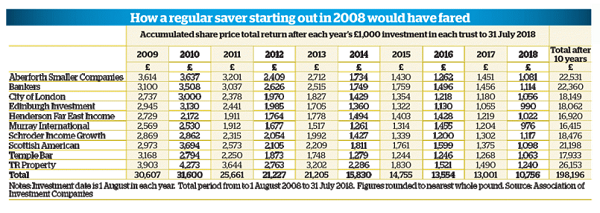

We selected 10 trusts from a variety of sectors with a starting yield of 3% or more on 1 August 2008 – the point at which our hypothetical investor retires. Among them are four UK equity income trusts, two global equity income trusts and one Asia Pacific income trust, as well as a dividend-paying UK smaller companies trust, global growth trust and property trust. All 10 trusts also had to have decent yields in the accumulation phase from 1 August 1998.

In the 10 years from 1998, £1,000 is allocated to each on an annual basis with the dividend income being reinvested. At the end of that period, a total investment of £100,000 has grown to £160,098.

This capital is left invested, but in the subsequent 10 years the natural income from each trust is withdrawn. Over the decade, the investor receives £78,806 in income and still has a capital sum of £310,152, nearly double the amount invested 10 years earlier.

"Trying to time the market is a fool's errand, and what these figures brilliantly illustrate is that the best course of action is to maintain your investment discipline and stick to your strategy, no matter how painful it might feel at times," says Yearsley.

Below, we take a closer look at our 10 examples of trusts that could see an investor through both the accumulation and the decumulation phases of their retirement planning.

Note: The capital values quoted in the profiles account for income reinvested during the accumulation stage and then with income stripped out in the decumulation phase.

Please click here to enlarge tables.

Past performance is not a guide to future performance

Aberforth Smaller Companies (ASL)

Aberforth Smaller Companies has turned a £10,000 investment into £42,298 while generating an income of £6,773. Its current dividend yield of 2.3% is supported by three years of dividend cover.

Bathgate at 7IM has held the trust in client portfolios for the past 20 years. It is by far the largest UK smaller companies investment trust, but trades on one of the widest discounts at more than 10%.

"It's difficult to find investment trusts on double-digit discounts 10 years into a bull market, and income investors have the added benefit here of getting more shares working for them to produce capital and income," says Bathgate.

The six investment managers focus on a 'value' style of investment, which has meant the fund hasn't been exposed to some of the high-profile growth stocks that have driven performance in recent years. This has dented its track record over the medium term, but James Carthew, research director at investment trust research company QuotedData, rates it a 'good option' if UK interest rates rise and investors' focus switches from growth to value.

Bankers (BNKR)

Bankers investment trust has produced capital of £33,283 and income of £5,252 from an initial investment of £10,000.

It sits in the global sector and aims to produce capital growth in excess of the FTSE World index, as well as annual dividend growth that is greater than inflation. Having grown its dividend for 51 successive years, it is among the top four trusts on the AIC's list of 'dividend heroes' and has been a Money Observer Rated Fund since 2013.

It yields less than the average global equity income trust of 3.5%, but more than the 1.9% average in its own sector. Over the past decade, the shares have yielded a very respectable range of 2.1% today to 3.1% in 2009.

The trust's manager Alex Crooke, who is also co-head of equities for EMEA and Asia Pacific at Janus Henderson Investors, believes that focusing on real income growth is "vital to weathering different market conditions".

"In the accumulation stage of savings, the dividends can be reinvested and in drawdown an attractive income can be harvested to supplement living costs," he says.

City of London (CTY)

City of London, a Money Observer Rated Fund since 2015, has turned £10,000 into £21,497 over 20 years, while producing an income of £7,317 over the past decade. The trust yields 4.1% at present and pays a quarterly dividend.

Topping the dividend heroes list with 52 consecutive years' dividend growth, the trust has dipped into its revenue reserves to increase its dividend in seven out of the 27 years since Job Curtis became its manager in 1991.

Shareholders received a dividend of 17.7p per share for the year to 30 June 2018, up from 16.7p the previous year. That left 5.3% of earnings retained in the trust's revenue reserve, which amounts to 85% of the cost of the annual dividend.

Curtis, who is head of value and income at Janus Henderson Investors, manages the trust conservatively, focusing on high-yielding, cash-generative businesses that can consistently grow their profits and dividends.

It is one of the largest UK equity income trusts with one of the lowest ongoing charge ratios of 0.42%.

Edinburgh Investment (EDIN)

Another UK equity income trust, Edinburgh Investment has produced an income of £5,359 over the past 10 years and a capital sum of £21,166 out of an initial £10,000 invested between 1998 and 2018. It yields 3.5% at present.

One of a number of UK equity trusts managed by Mark Barnett at Invesco Perpetual, it is notable for having significant exposure to tobacco companies, which have acted as a drag on performance in recent years as increasing regulation (including on e-cigarettes) bites.

Edinburgh was also hit last year by its holdings in Provident Financial and Capita, both of which succumbed to profit warnings. The trust’s long-term performance still looks good, however.

Barnett's investment process centres on the tenet that dividends prove the differentiator to long-term outperformance. He aims to generate capital growth that is greater than the growth in the FTSE All-Share index by investing in undervalued companies across the size spectrum, and to produce dividend growth that is higher than inflation by investing in companies that have sustainable dividends that he believes can be grown over time.

Henderson Far East Income (HFEL)

In capital terms, Henderson Far East Income has produced middle-of-the-road performance during our period of analysis. It has the fifth highest return out of the ten trusts in question, with a sum of £32,594 in August 2018 from an initial £10,000.

However, in income terms, it is the top performer, having thrown off dividends worth a staggering £15,326 since 2008. In monetary terms it has increased its dividend every year over the past 10 years, while the yield has consistently been more than 4% – as low as 4.4% and as high as 6.3%.

Another in the Janus Henderson stable, this trust currently offers by far the highest yield in the Asia Pacific income sector at 5.9%. This is one reason for it trading close to the value of its underlying assets (whereas certain rivals can be bought at high single-digit or low double-digit discounts).

The trust's focus on income does, however, mean that manager Mike Kerley has missed out on some of the best growth prospects in the region, such as Chinese technology stocks.

Schroder Income Growth (SCF)

Schroder Income Growth has yielded between 2.8% and 4.5% over the past decade (3.1% at present), generating an income in our analysis of £6,015 and a capital sum of £22,761.

The trust has an unbroken 22-year record of increasing its annual distributions to shareholders thanks to its revenue reserves, which it used in four of those years including the years following the financial crisis (2009, 2010 and 2011), when many companies cut their dividends.

"As the market has recovered from the nadir of the global financial crisis both in capital and dividend income terms, the trust has sought to smooth dividend increases to shareholders, balancing continued increased dividends to investors with rebuilding dividend cover and replenishing revenue reserves," says its manager Sue Noffke. Its reserves are sufficient to pay 88% of the cost of its last annual dividend.

Noffke has a flexible investment style, incorporating both growth and value stocks. She holds higher-yielding companies where research gives her confidence in the sustainability of the income payouts and future growth potential.

Murray International (MYI)

Murray International was the star fund in the global equity income sector for many years, but lost its shine more recently because the portfolio is positioned defensively in a world that has borne witness to the longest equity bull run in history.

Nevertheless, the trust sports the highest yield in the sector at 4.3% and has produced an income of £11,405 over the past 10 years from £10,000 being drip fed into it over the preceding decade – the second highest level of income among our selection of 10. In capital terms, the investment is worth £33,388 too.

It is this strong long-term performance record that has seen us award this trust, by far the largest in the sector with £1.7 billion of assets, Rated Fund status for five years running.

Bruce Stout, its manager since 2004, has strong conviction in his ideas and Carthew believes the trust may return to form if markets turn.

Scottish American (SCAM)

Our hypothetical retiree has amassed a capital sum of £20,454 and received income of £5,518 from Scottish American (known as Saints). Patrick Thomas, an investment manager at Canaccord Genuity Wealth Management, likes this global equity income trust for its "very strong process and team" and credentials as a "good global diversifier".

Toby Ross, co-manager of Saints, part of the Baillie Gifford stable, says: "Many people are finding that they still need to be in accumulation mode, even when they’re taking a retirement income from their investments. This is where a trust like Saints comes into its own, because our stock-picking focus is entirely on finding businesses which can deliver a dependable dividend stream, whilst also delivering inflation-beating growth in profits over long periods."

The trust has consistently grown its dividend in monetary terms over the past decade. It has yielded between 3% (today) and 5.2% (in 2009), with strong capital growth pushing the yield lower in percentage terms.

Temple Bar (TMPL)

Temple Bar contrarian, value style has been well and truly out of favour in recent years, but manager Alastair Mundy of Investec Asset Management has nonetheless done well over the longer term, producing a capital sum of £26,700 and income of £7,413 from the £10,000 in our example.

The trust was a Rated Fund from 2013 to 2015 and returned to our recommended list this year thanks to signs of a renaissance.

Mundy says he favours "cheap, unloved companies that the market has lost hope in", which meant he "avoided participating in the most bubbly parts of two equity bull markets" during our accumulation phase – the tech boom in the late 90's and financials prior to the financial crisis.

The dividend has been raised for 35 consecutive years. With reserves that equate to 75% of the cost of the annual dividend, David Liddell, a director of IpsoFacto Investor, believes the trust suits an income investor who doesn't mind starting with a below-average yield (3.1% versus 4% average for the UK equity income sector), but would like to see good increases.

TR Property (TRY)

TR Property has delivered the best capital returns out of our selection of ten, turning £10,000 into £56,010 while throwing off the third highest level of income at £8,428.

A Money Observer Rated Fund since 2014, it is highly liquid with assets of £1.5 billion. It invests mainly in the shares of property companies rather than physical property (which generally accounts for no more than 20% of the portfolio). It can invest internationally, but the majority of its holdings are in Europe including the UK.

Lead manager Marcus Phayre-Mudge is an experienced stockpicker. His ideal company is well run with a good balance sheet. He uses gearing proactively to his advantage.

Peter Hewitt, manager of F&C Managed Portfolio Trust, has held TR Property since the inception of his fund of investment trusts in April 2008. "It's been an outstanding investment," he says.

Please click here to enlarge table of How a regular saver starting out in 2008 would have fared.

Source: interactive investor Past performance is not a guide to future performance

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.