10 things to know about money market funds versus cash savings

17th June 2022 14:20

by Alice Guy from interactive investor

We examine money market funds and savings accounts and explain the difference, how money market funds work, how much interest you might get and whether they are a safe option.

With interest rates finally on the rise, many investors are looking for a way to improve returns on their cash savings. We take a look at money market funds, explain how they work and if they might be a good option for some investors.

- Read more about: Money Markets | Bond Yields | Investing in Bonds

1. What are money market funds?

Money market funds are designed to be a low-risk option for investors.

They are run by fund managers who invest in a range of cash-based financial products including fixed deposits and short-dated government bonds. Fund managers can access a range of financial instruments that aren’t available to retail investors, so may be able to get better rates than an individual saver.

They invest in liquid assets, which means they are very easy to buy and sell.

Money market funds are also sometimes called money market mutual funds.

2. What is a high street bank account or savings account?

Savers can set up a bank account or savings account directly with their bank or building society. Interest is set out in the terms and conditions when you open your account and it’s guaranteed by the provider.

Interest rates on standard current accounts or savings accounts are currently extremely low. But you may get access to higher interest rates if you can afford to lock cash away for one or more years.

Your bank will usually contact you when the interest rate changes, and your rates may go up or down when the Bank of England announces it has changed the base rate. The base rate, set by the Bank of England, influences the rates that other banks charge people to borrow money or pay on their savings and mortgages.

3. Are bank savings protected?

Your cash balance is protected and, if you hold money with a UK-authorised bank or building society, you’ll receive up to £85,000 per person if that provider fails.

4. Why would you own money market funds?

Money market funds can be owned inside a pension scheme, stocks and shares ISA or general investment account. They can be a good option if you want to hold some cash within your investment portfolio.

Money market funds aim to give a higher return than a cash savings account, while still providing a low-risk option for investors.

Investors might decide to hold cash in their portfolio for a variety of reasons. Sometimes they might not be sure where to invest yet, or need to access their savings soon. Or investors may hold cash as part of their investment strategy, to help cushion the effect of stock market volatility and reduce the overall risk of their portfolio.

Some wealthy investors also hold some cash in their portfolio to enable them to take advantage of dips in the stock market and buy when prices are cheap.

4. Are money market funds safe?

A money market fund is still an investment, even though it is low risk, and could go down in value. Bond prices can fluctuate over time, and it is possible that a company may not be able to pay back its debt.

However, money market funds are diversified across many financial instruments and providers and so the risk of losing money is low.

Fund values usually remain stable, with very little fluctuation over time. For example, GBP Money Market - Short Term funds enjoyed an average of between 0.00% and 0.17% growth every year between 2016 and 2021.

Most money market funds are set up as separate Open-Ended Investment Companies or Unit Trusts. This means if your investment platform goes bust then you will be protected for up to £85,000 for each separate fund.

5. Why are cash returns so low?

Cash returns in bank and savings account have been disappointingly low for years. It’s because the Bank of England has reduced interest rates to historic lows, first during the financial crisis of 2008-09, then at the start of the pandemic in 2020. Low interest rates are a tool the Bank uses to try and stimulate the lacklustre economy.

In 2009, the base rate was reduced to below 2% for the first time since the Bank of England began in 1694. In March 2020, rates were cut to a record low of 0.1% in response to the Covid crash.

6. What will happen if interest rates continue to rise?

Many economists think that interest rates will continue to rise as the government tries to bring sky-high inflation under control. And, as interest rates rise, it’s likely the money market funds and some longer-term cash savings accounts will begin to offer more attractive rates of interest.

7. What return would you currently get from money market funds?

Money market funds currently show disappointing returns and don’t offer much higher rates than easy access savings accounts. Here are the five top-performing money market funds for this year so far:

Year-to-date return (Jan to May 2022) | |

0.18% | |

0.12% | |

0.1% | |

ILF GBP Liquidity 3 | 0.1% |

0.08% |

The average short-term money market fund had returns of 0.05% during the past 12 months. It’s nothing to write home about.

Still, with the Bank of England base rate on the rise - up from 0.1% to 1.25% since December 2021 – it is likely that money market funds will soon offer better rates for investors.

8. What return would you get if interest rates return to ‘normal levels’?

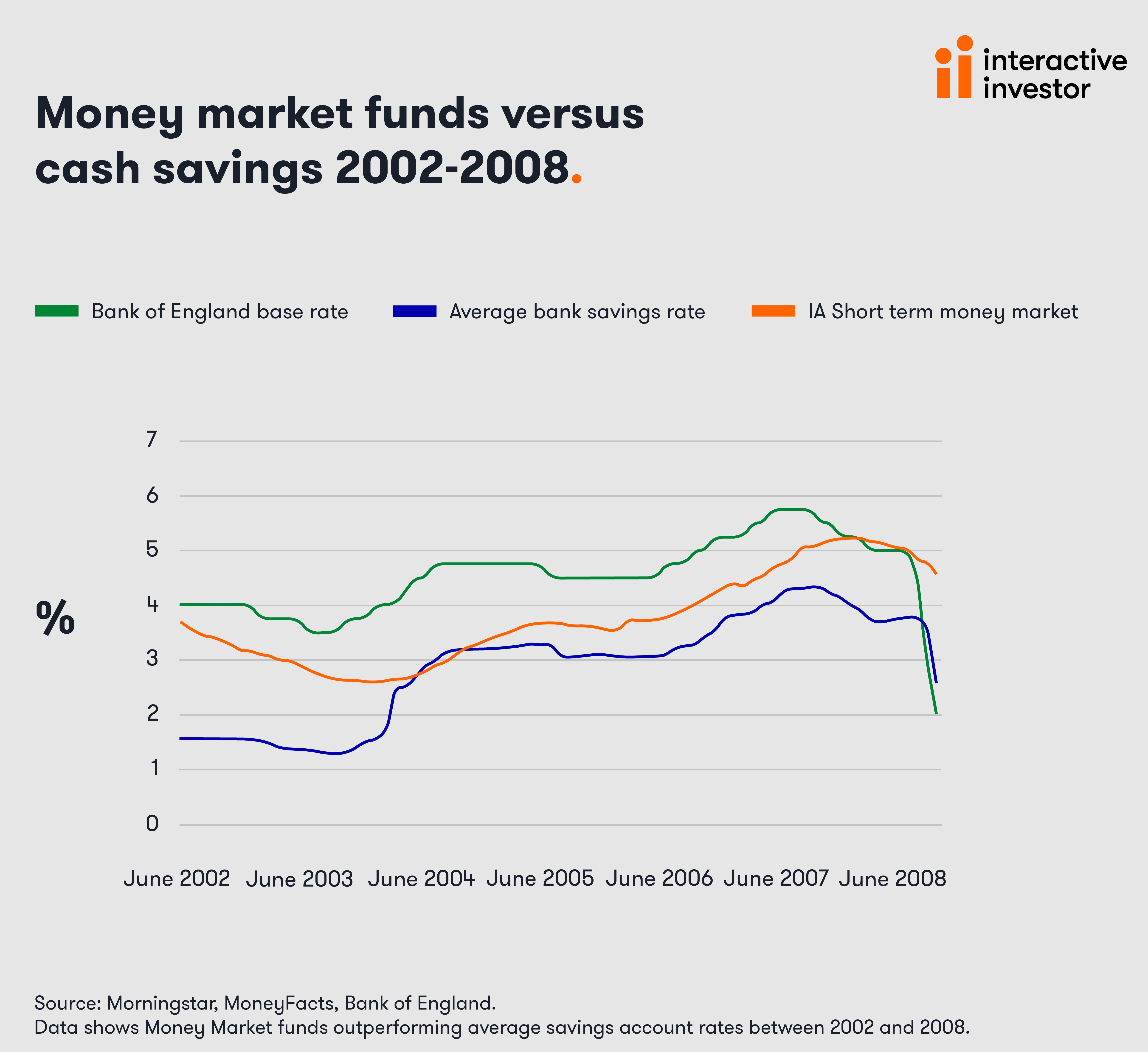

Interest rates have been at historically low levels since 2009, so it’s helpful to look back at times when interest rates were at more normal levels to see what returns we might expect if interest rates continue to climb.

Our data also shows that in times of more normal interest rates, average money market funds can outperform easy access savings accounts.

There is also a lag between changes to the Bank of England Base Rate and returns on money market funds. At the end of 2008, interest rates fell to 2% but money market funds were still paying out an average of 4.56%.

10. Should retail investors use money market funds?

When interest rates are near historical low levels, most money market funds show disappointing returns and don’t match interest rates on some of the best fixed-interest rate savings accounts.

However, it is likely that money market funds will become a more attractive investment as interest rates rise. Fund managers are potentially in a better position than individual investors to spot attractive interest rates and invest in worthwhile short-term bonds.

It might also be worth holding some money within your pension scheme or stocks and shares ISA so that you can take advantage of buying low when the stock market dips.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.