10 shares set for earnings growth

As consumers gear up for a return to normality, this is a sector worth watching.

19th May 2021 15:23

by Ben Hobson from Stockopedia

As consumers gear up for a return to normality, this is a sector worth watching.

Britain’s retail sector was in a state of flux long before Covid arrived on these shores. But over the past year the pandemic has accelerated emerging trends and caused huge stresses in a sector that was already under pressure.

Yet, for all the challenges caused by enforced closures, lockdowns, social distancing and consumer wariness, it hasn’t been a bad year for the prices of many retail shares. In fact, evidence suggests that while many retailers have suffered and even gone out of business, others have used this time to strengthen their businesses. And with restrictions now easing, retail is no longer the investment minefield that it was not so long ago.

According to research by the law firm RPC, 2020 saw a 10-year high in secondary fundraisings by UK-quoted retailers. The value of placings and rights issues reached £1.9 billion, which was 10 times higher than the £187 million raised across the sector the previous year.

Naturally, much of this new money was intended to strengthen balance sheets in the face of huge uncertainty. Businesses across the market took all available routes to ensure their finances could withstand the economic restrictions. But some of that money was also used by firms to take advantage of depressed valuations and buy up complementary businesses.

One of the highest profile merger and acquisition deals involved Boohoo (LSE:BOO), the online fashion retailer, buying the Debenhams brand and website for £55 million. That followed a £198 million fundraise in March 2020. Rival online firm ASOS (LSE:ASC) raised £247 million the following month, part of which was later used to fund the purchase of brands belonging to the stricken Arcadia group.

These deals reflected the growing importance of online retail, which was a vital outlet while many bricks and mortar stores were out of bounds last year. According to RPC, the share of retail sales made online hit 36% last year, up from 21.6% in the same period the year before.

- Richard Beddard: the UK’s Amazon is already in the FTSE 100

- Bill Ackman: I think this could be the Black Swan event of 2021

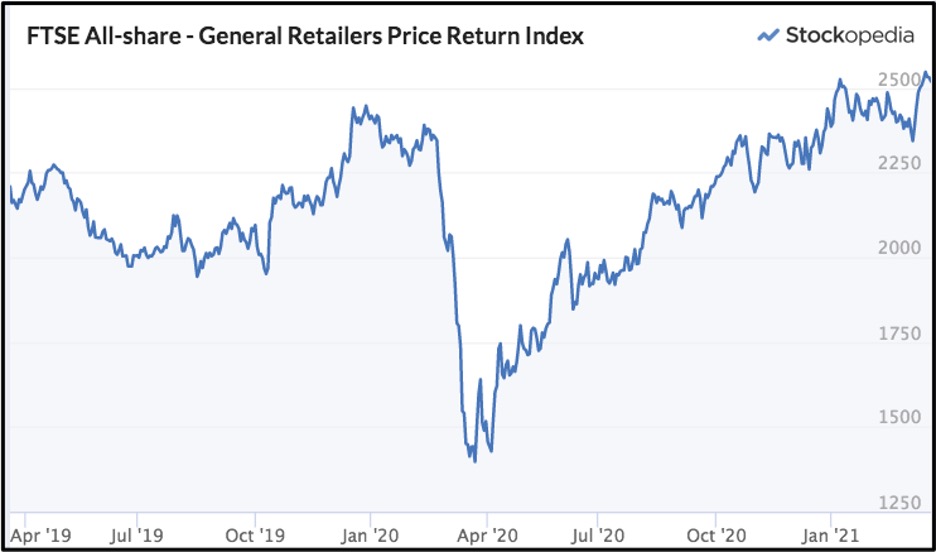

Overall, the recovery in retail has been stronger than one might think. The FTSE All Share General Retailers index has jumped by 41.7% over the past 12 months. At 2,519 points, the index is now ahead of where it was before markets slumped as the pandemic hit.

Past performance is not a guide to future performance.

The question for investors, of course, is which shares potentially offer upside as earnings begin to rebound? With so many companies experiencing depressed sales last year, some earnings forecasts look very strong for the year ahead. For others, already strong trading periods seem set to continue. Here is a look at the list of the strongest earnings forecast growth expected in retail in the year ahead:

| Name | Mkt Cap (£m) | Forecast P/E Ratio | EPS Gwth % Forecast 1y | Relative Price Strength 1y |

|---|---|---|---|---|

| Gear4music (LSE:G4M) | 186.5 | 21.5 | 237.7 | 148.9 |

| Studio Retail (LSE:STU) | 251.9 | 6.64 | 131.2 | 29.3 |

| B&M European Value (LSE:BME) | 5,709 | 14.5 | 122.1 | 49.1 |

| Dixons Carphone (LSE:DC.) | 1,551 | 12.8 | 102.1 | 52.4 |

| Tesco (LSE:TSCO) | 17,922 | 12 | 83.4 | -20.8 |

| Travis Perkins (LSE:TPK) | 3,632 | 17.8 | 69.8 | 31.9 |

| Moonpig (LSE:MOON) | 1,501 | 25.2 | 59.6 | - |

| Boohoo (LSE:BOO) | 4,092 | 30.1 | 41.5 | -23.8 |

| Burberry (LSE:BRBY) | 8,595 | 25.7 | 40.6 | 25.7 |

| Next (LSE:NXT) | 10,825 | 18.1 | 36.5 | 46.1 |

With the exception of Boohoo and the more defensive general retailer, Tesco, all the shares in this list have outperformed the market over the past year. Gear4Music, the online musical instrument retailer, has been one of lockdown’s big winners and earnings there are expected to grow at more than 230% in the coming year.

Interestingly, while most of the names have strong online offerings, an e-commerce presence hasn’t been essential. Discount chain B&M has no online service but its ability to remain open through the year has obviously worked out very well for it.

A question now - as the physical high street opens up - will be whether online-only firms suffer as consumers gradually return to normality. Or has the retail landscape permanently changed our shopping habits?

From an investor perspective - and with so much uncertainty still around - only time will tell who the big winners will be. But what already seems clear is that retail is bouncing back from a hugely disrupted year and it already looks a bit different. With consumers warming up to a return to normality, it will be a sector worth watching.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.