10 shares hitting new highs and which could keep rising

Stockopedia’s Ben Hobson shares a strategy that acts like a gauge of shares bouncing back fastest.

3rd December 2020 10:49

by Ben Hobson from Stockopedia

Stockopedia’s Ben Hobson shares a strategy that acts like a gauge of shares bouncing back fastest.

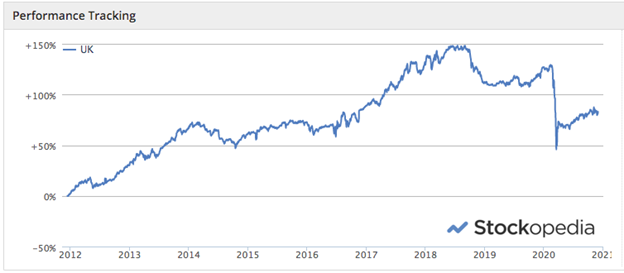

The UK’s main stock market indices have struggled to claw back the losses that swept through prices earlier this year – the FTSE 100 is still down 15% in 2020. With so much uncertainty surrounding the social and economic consequences of the Covid crisis, a lot shares remain depressed - but not all of them…

Amid the confusion this year, some shares have resisted the market malaise and delivered solid returns. In these kinds of unpredictable conditions, one screening strategy that always offers an interesting look at the market is the 52-Week Highs list. No matter what is going on, this screen acts like a gauge of shares that are bouncing back fastest.

Most investors take a passing interest in the stocks that are hitting new highs. It’s the kind of data that can be found in newspapers and on financial websites everywhere. But what makes the 52-week high such an interesting datapoint is the psychology behind it. So whether you’re interested in price momentum and new highs or not, just knowing about how it can affect investors might give you a more objective view about how the market reacts to 52-week highs - and how to profit from them.

Secrets of the 52-week high

Past performance is not a guide to future performance.

On its own, the 52-week high is a fairly two-dimensional number. Yet research shows that stocks hitting new highs often drift higher in price over the following weeks and months.

This upward trend is called “post earnings announcement drift”. It’s an academic name for when investors slowly buy into shares that are already trading around new highs. When earnings news about these kinds of shares is published, particularly if it’s a positive earnings surprise, prices can be slow to react (as market efficiency momentarily goes out the window).

This confused reaction is caused by what the psychologists Amos Tversky and Daniel Kahneman called anchoring-and-adjustment. The idea is that humans form an anchor, or a belief, using a reference point (like a share price). As new information comes to light (like new earnings news) they only adjust their beliefs slowly, before going on to buy the shares at even higher highs.

In investing, the idea of anchoring around events like 52-week highs and earnings surprises is thought to be a big contributor to the ‘momentum effect’.

52-week highs and market conditions

In bearish conditions, when investors suddenly become risk-off and share prices fall across the board, a 52-week high strategy will be vulnerable. This is what we saw earlier this year, when market sold off sharply; the strategy results nose-dived but are now recovering.

But when markets start to recover, this screen is one of the first to show which stocks have withstood the decline and are recovering quickest. Here are some of the companies currently trading around their 52-week highs at the moment. We filtered the overall list for those with a StockRank of at least 80 (out of a possible 100) as a general measure of those with higher exposure to solid quality, attractive valuation and positive momentum.

| Name | Mkt Cap £m | % vs. | P/E Ratio | Stock Rank | Sector |

|---|---|---|---|---|---|

| 52w High | |||||

| Royal Mail (LSE:RMG) | 3,243 | - | 17.8 | 97 | Industrials |

| Airtel Africa (LSE:AAF) | 3,262 | - | 15.2 | 88 | Telecoms |

| Ferguson (LSE:FERG) | 19,290 | -0.6 | 23.2 | 85 | Consumer Cyclicals |

| Ferrexpo (LSE:FXPO) | 1,327 | -0.7 | 4.62 | 99 | Basic Materials |

| Electrocomponents (LSE:ECM) | 3,705 | -0.72 | 26 | 80 | Technology |

| Naked Wines (LSE:WINE) | 431.5 | -0.84 | - | 93 | Consumer Defensives |

| MPAC (LSE:MPAC) | 85.3 | -1.15 | 16.7 | 98 | Industrials |

| KAZ Minerals (LSE:KAZ) | 3,039 | -1.2 | 7.81 | 88 | Basic Materials |

| Tyman (LSE:TYMN) | 630.9 | -1.23 | 19.9 | 95 | Consumer Cyclicals |

| Ashtead (LSE:AHT) | 14,552 | -1.38 | 15.7 | 93 | Industrials |

The main criteria for this strategy is that the shares are trading at - or very close to - their one-year high prices. The higher StockRanks look for superior investment potential within the list. But the results are very varied - and are led by long-term value play Royal Mail (LSE:RMG), which has seen its share price soar through the latter half of the year.

Other large-caps that have recovered in recent months are the construction supplies group Ferguson (LSE:FERG), equipment rental group Ashtead (LSE:AHT), service distributor Electrocomponents (LSE:ECM) and the copper mining company KAZ Minerals (LSE:KAZ). Mixed in are small-caps like Naked Wines (LSE:WINE), MPAC (LSE:MPAC) and the door and window supplier Tyman (LSE:TYMN).

A barometer of the market

Overall, it’s worth remembering that, while the 52-week high seems like quite a straightforward measure, it’s actually got some interesting psychology behind it. The market tends to be wary of bidding up the prices of stocks hitting new highs - but this can actually cause their prices to drift higher over time.

Recognising the likelihood of anchoring in the market - especially as a potential driver of momentum - is useful. Just by knowing that events like 52-week highs can cause irrational pricing means it’s possible to choose to avoid them altogether or use the ‘new highs’ strategy to spot new trends in uncertain conditions.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.