10 AIM shares trading close to record highs

28th July 2021 16:56

by Ben Hobson from Stockopedia

Stockopedia’s market expert picks out the AIM companies that have been on a stellar run recently.

The Alternative Investment Market (AIM) is a happy hunting ground for individual investors. As a home to small companies with the potential to grow fast, it can - and does - deliver some incredible stories.

And while the risks of failure are much higher for the unwary, the performance of AIM over the past year suggests that the quality bar for stocks is really improving.

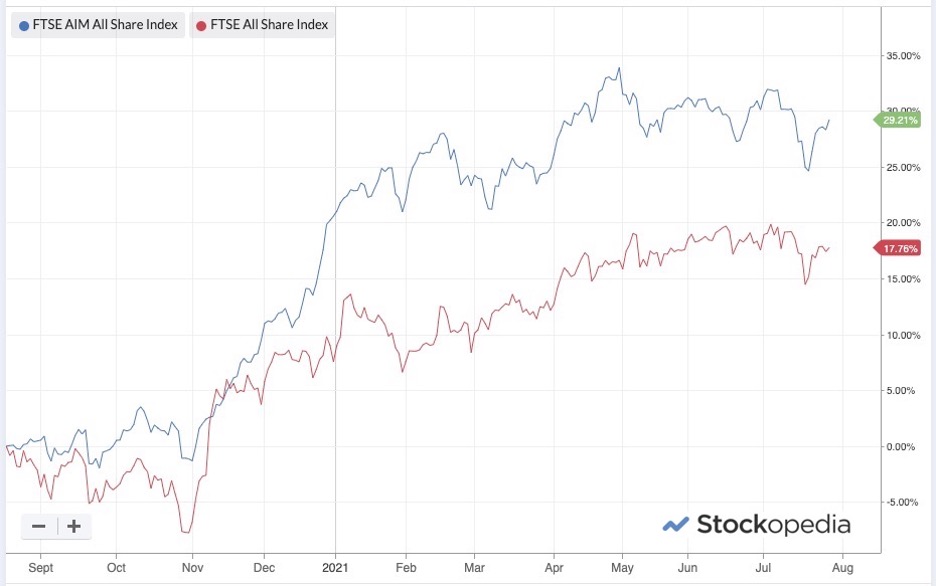

Over the past 12 months, the AIM All-Share index has soared by nearly 30% compared to 18% on the Main Market FTSE All-Share. In some ways, that’s surprising. In previous market recoveries, AIM was almost always the index that lagged. That was because it took much longer for investors to regain their confidence in it.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

Stockopedia: FTSE AIM All-Share versus FTSE All-Share, 26 July 2020 - 27 July 2021

Past performance is not a guide to future performance

This time, AIM has rebounded quickly. In part, this is down to the strong performance of shares in industries that are very much a hallmark of AIM. Industries such as technology, healthcare and even mining are a natural fit for what tends to be a quite speculative market - and they’ve been a sweet spot for returns over the past 18 months.

Yet with so much Covid-related uncertainty around, the task for investors in AIM stocks is not any easier than it ever was. Predicting which companies can bounce back, repair earnings and even flourish as part of an unpredictable recovery is difficult.

In conditions where even large companies are at risk of failure, finding small-cap growth stocks that are racing out of the blocks is no mean feat.

- The AIM shares that are up over 500% in 2021 so far

- Our five AIM tips for 2021 smashing the market at halfway point

- AIM and small-cap hub: get the lowdown on smaller company shares and all that matters on the junior market

For those investors prepared to go looking, one marker worth watching is the 52-week high. This key momentum metric might be one of the most well-known stock market indicators around, but it can be a pretty important clue to where the market sees potential.

We regularly explore the merits of new highs in this column. Part of the appeal is that the one-year high isn’t just an undeniable show of price strength, but it also comes with colossal amounts of psychological baggage for many investors.

So much so that extensive research shows that stocks hitting new highs often drift higher in price over the subsequent weeks and months.

The upward trend is called “post earnings announcement drift”. It’s an academic name for when investors slowly buy into shares that are already trading around new highs.

When earnings news about these kinds of shares is published, particularly if it’s a positive earnings surprise, prices can be slow to react (as market efficiency momentarily goes out the window).

When markets are in recovery mode (like they have been over the past 12 months), the 52-week high can show which stocks have withstood the decline and are recovering quickest.

Here are some AIM-quoted shares currently trading close to their 52-week highs. The StockRank shows a ranking position (where zero is poor and 100 is excellent) that reflects each stock’s overall exposure to solid quality, attractive valuation and positive momentum.

Name | Mkt Cap (£m) | % vs. 52w High | P/E Ratio | Stock rank | Sector |

573.5 | -0.77 | - | 40 | Industrials | |

796.4 | -0.78 | 26.4 | 61 | Healthcare | |

111.8 | -0.89 | 16.1 | 99 | Consumer Defensives | |

716.2 | -0.94 | 15.1 | 93 | Healthcare | |

556.7 | -0.95 | 24.2 | 56 | Healthcare | |

276.3 | -1.15 | 134.7 | 73 | Technology | |

1,423 | -1.15 | 111.4 | 60 | Consumer Cyclicals | |

140.2 | -1.32 | 32.9 | 98 | Consumer Cyclicals | |

143.2 | -1.56 | 62.6 | 77 | Industrials | |

63.0 | -1.66 | - | 56 | Consumer Cyclicals |

The results show that new highs on AIM at the moment are being found in a range of sectors, but notably in healthcare - with names such as EMIS, CareTech and Alliance Pharma - and consumer cyclicals - including YouGov, Sanderson Design and Sosandar.

The rankings of these companies is on average, fairly high, with Wynnstay, the agricultural feeds and fuels business, scoring highest, followed by Sanderson Design and CareTech.

- Richard Beddard: why I like this AIM share with hidden potential

- Check out our award-winning stocks and shares ISA

But it’s also worth noting that the price-to-earnings (PE) ratios of some of these shares are also high.

The question for investors is whether those PE ratios represent genuinely high valuations, or whether lower earnings last year caused by Covid are actually skewing valuations.

It’s certainly the case that strong momentum - which the 52-week high is a measure of - can result in stocks becoming expensive.

So for investors looking at fast-moving shares right now, it’s important to consider how company earnings have been affected and whether that is properly showing up in valuation ratios.

Either way, the 52-week high could be a useful first pointer to those shares that the market is backing.

About Stockopedia

https://www.stockopedia.com/ii/

Stockopedia helps individual investors beat the stock market by providing stock rankings, screening tools, portfolio analytics and premium editorial.

The service takes an evidence-based approach to investing, and uses the principles of factor investing and behavioural finance to help investors make better decisions.

Stockopedia is rated Excellent on Trustpilot and was named Best Research Service and Best Investment Tools Provider at the 2021 UK Investment Magazine awards.

Interactive Investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.