Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as guaranteed annuity rates, lower protected pension age or matching employer contributions. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser.

You could keep more money for your future with our low, flat-fee Personal Pension (SIPP) and enjoy a cashback boost.

Get £100 to £3,000 cashback when you open a SIPP and deposit or transfer a minimum of £20,000. See more details on this offer.

Offer ends 28 February 2026. Terms and fees apply.

Important information: It’s important to take your time before transferring your pension. Make sure to consider what the best option is for you. Don’t transfer just to qualify for the offer, and don't rush any decision to meet the offer deadline. We periodically run offers, and there will likely be other opportunities in the future.

Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as, guaranteed annuity rates, lower protected pension age or matching employer contributions.

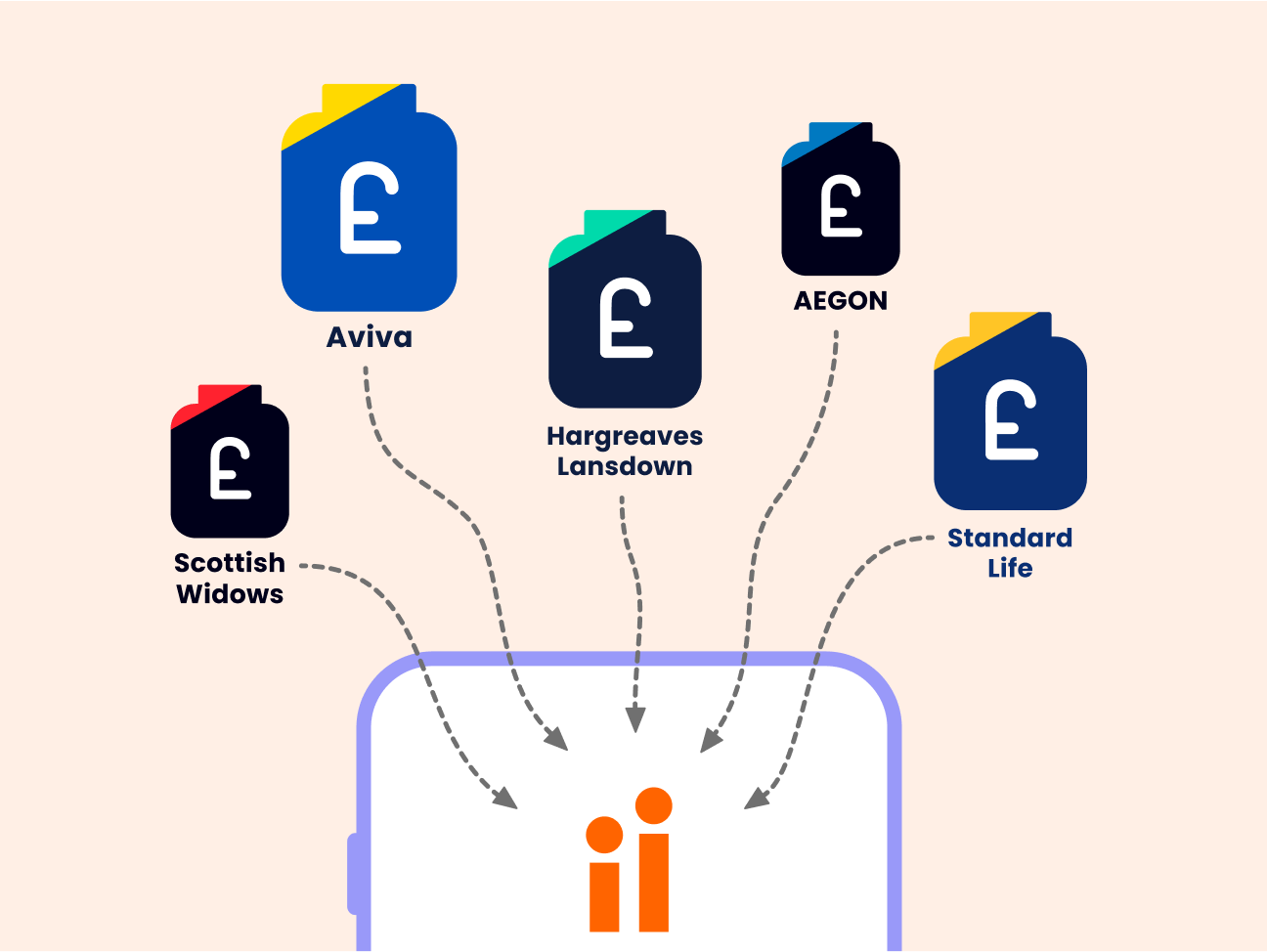

Bring all of your pensions under one roof and see if you could save. Other providers usually charge a percentage of your pot. That means you’ll be charged more as your pension grows. The ii SIPP is different. You can rely on our flat fee and can keep more of what’s rightfully yours.

The ii SIPP offers a wide range of investments and flexible retirement options to suit most people’s needs. More choice doesn’t have to mean more complexity. Our expert picks and SIPP investment ideas can do the hard work for you.

It’s easy to keep track of your pension via our website and secure mobile app. But if you’re ever in need of SIPP support, you can count on us. We’re happy to say that ii has more 5-star Trustpilot reviews than any other UK SIPP provider.

You can transfer pensions of all shapes and sizes to the ii SIPP. From unloved workplace pensions or traditional life company schemes to SIPPs you're paying too much for. Whatever your pension problem, transfer to ii for more control and lower costs.

It’s free to transfer your pensions to the ii SIPP, with our simple online process and the support of our top-rated team.

For the fouth year in a row, independent analysts at Which? have recognised the ii Self-Invested Personal Pension for its industry-leading choice, support and value.

Join over 500,000 ii investors and start prioritising your pension with our award-winning, low-cost SIPP.