Please remember - SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial advisor before making any decisions. Pension and tax rules depend on your circumstances and may change in future.

Explore if you could save with an ii Personal Pension

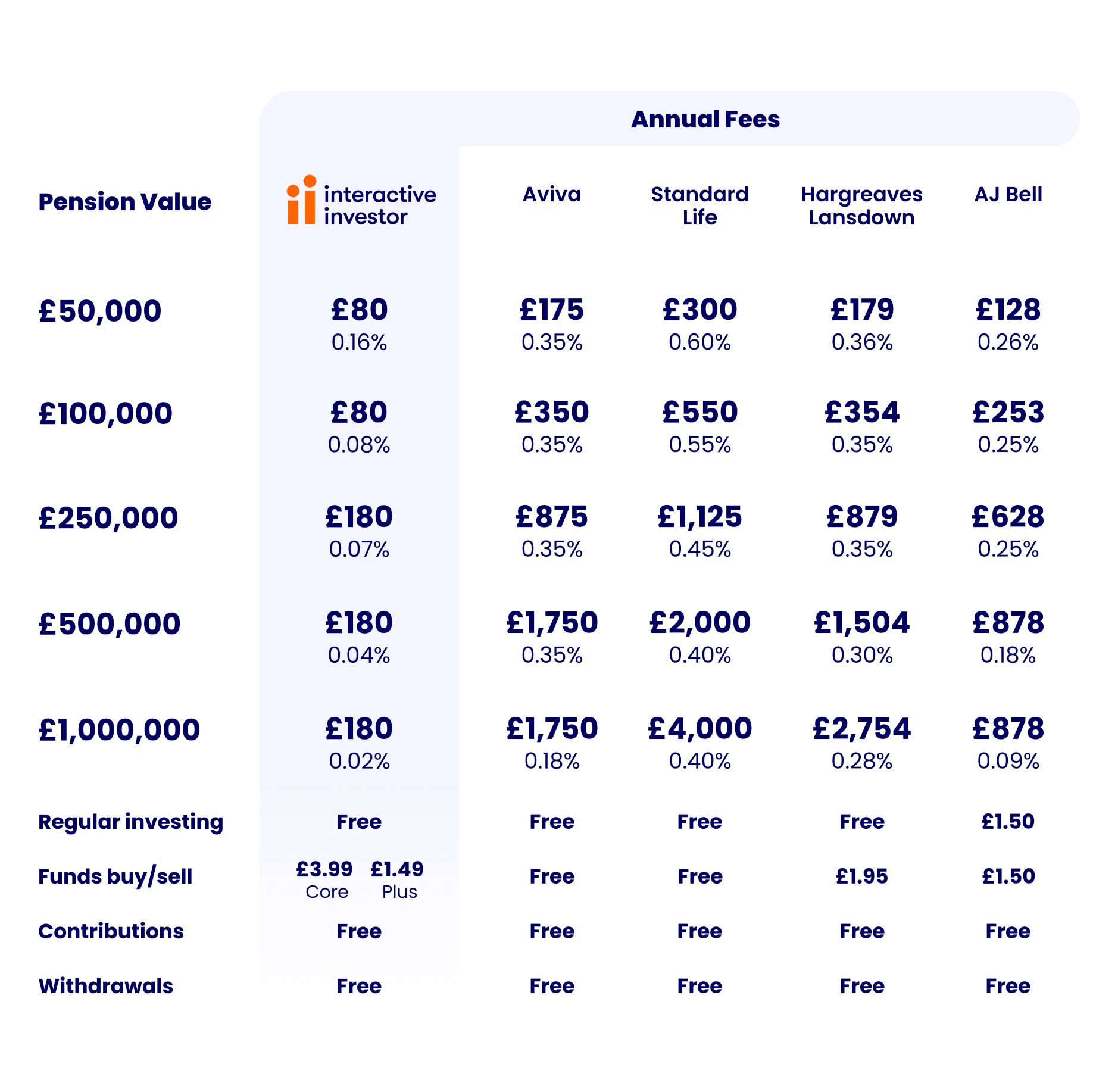

See how much you could save with our low, flat monthly fee Personal Pension compared to other SIPP providers that charge percentage-based fees.

Here's a look at our flat monthly fees:

- £5.99 a month for pensions up to £100,000

- £14.99 a month for pensions over £100,000

With ii, you will always pay a low flat fee - helping you keep more of your money invested for the future.

Comparison information - Annual charge comparisons based on published SIPP charges on 01/02/2026 for Aviva SIPP & Standard Life SIPP (Level 2 Investment Options). Hargreaves Lansdown SIPP charges based on new pricing plan effective 01/03/2026. The calculator compares SIPP charges only – other types of pensions may have lower or higher charges. ii charges assume the cost of adding an ii SIPP (£10/month) for customers on the Investor Plan. Additional charges may differ for customers currently on the ii Essentials and Super Investor plans. Verified as accurate by The Lang Cat.

Assumptions: 100% holding in funds - choosing other assets such as shares and ETFs, may result in lower charges. Two fund purchases/sales. Pension charges only, excludes fund manager charges. Read more about our analysis.

Why transfer your pension to the ii SIPP?

Keep more of what you make

Other providers usually charge a percentage of your pot. That means the more your pension grows, the more they’ll take. The ii SIPP is different. With our simple flat fee, you can keep more of what’s rightfully yours.

Which? Recommended SIPP Provider

As a Which? Recommended SIPP Provider for the fourth year running, we offer one of the widest ranges of investments on the market. That doesn’t mean more complexity, though. We have options for all types of investors.

Trust in our top-rated support

With our Boring Money Best For Customer Service support team here in the UK, you can count on us. There’s a reason we’re rated 4.6/5 on Trustpilot, with more 5-star reviews than two of the other biggest providers combined.

Get up to £3,000 when you switch to our SIPP

You could keep more money for your future with our low, flat-fee Personal Pension (SIPP) and enjoy a cashback boost.

Get £100 to £3,000 cashback when you open a SIPP and deposit or transfer a minimum of £20,000. See more details on this offer.

Offer ends 28 February 2026. Terms and fees apply.

Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028).

Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as, guaranteed annuity rates, lower protected pension age or matching employer contributions. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser. Don’t transfer just to qualify for the offer, and don't rush any decision to meet the offer deadline. We periodically run offers, and there will likely be other opportunities in the future.

Things to consider before you transfer

Please check that you won’t lose any safeguarded benefits if you transfer. This could include guaranteed annuity rates or lower protected pension age than the Normal Minimum Pension Age (rising from 55 to 57 in 2028).

Please also check any transfer-out fees your current pension provider may charge.

Please note that if you plan to hold both drawdown and non-drawdown pots in your ii SIPP, you cannot allocate specific investments to each pot separately. This means that the value of each pot will change in line with the overall performance of all the investments held in your SIPP.

Before transferring, we recommend seeking advice from a suitably qualified financial advisor or free, impartial pension guidance from MoneyHelper or (if you are 50 or over) Pension Wise.