US stock market outlook 2023: American shares become attractive to Brits

22nd December 2022 10:07

by Rodney Hobson from interactive investor

Politicians are taking action to protect the US economy, and even two years of deadlock on Capitol Hill shouldn’t deter investors, argues our overseas investing expert.

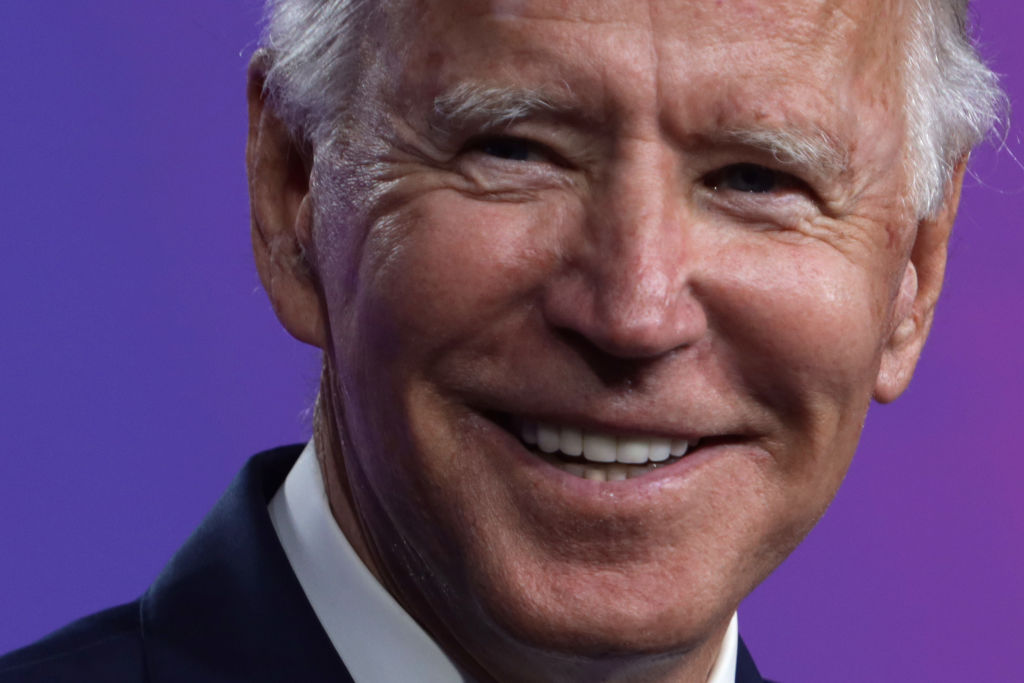

Republicans have scrabbled around to find reasons why they failed to sweep the board at the midterm elections, but perhaps the reality lies in Bill Clinton’s famous riposte: “It’s the economy, stupid.” Under Democrat President Joe Biden and Democrat control of both houses of Congress, the US has rebounded from the pandemic better than all other major economies.

Inflation has naturally reflected global factors including soaring gas and food prices in the wake of the Russian invasion of Ukraine, but it has peaked sooner and at a comparatively lower level than elsewhere. The financial pinch has, for many Americans, been alleviated by muted economic growth and low unemployment.

- Discover more: Buy international shares | Interactive investor Offers | Most-traded US stocks

Now Americans could be destined to find that interest rates will probably not rise as fast or as far as previously feared from what were unnaturally low levels. The half-point rise in December to a 4.25-4.5% range followed four consecutive 0.75% increases, so it represented an easing of the stance of the Federal Reserve Board.

We got a hint of this in minutes from the Fed published in late November, which indicated that a “substantial majority” on the interest rate-setting committee felt that a slower pace of increases was called for to allow members to “assess progress towards its goals of maximum employment and price stability”.

This was a significant change in tone compared with the start of the year, when all the speculation among commentators was about how fast interest rates would rise.

Fed chair Jerome Powell said at the end of November: “It makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down.”

- A share price drop and plenty of goodwill: time to buy?

- 10 top themes for investors to consider in 2023

It was this comment that took the headlines rather than his more cautious addition that “we will stay the course until the job is done”.

Yet Powell went on to warn the markets that interest rates were still likely to peak at a higher level than investors expected and that “history cautions against prematurely loosening policy”. He indicated that there was still some way to go to restore price stability.

December’s rise was likewise accompanied by an indication that the Fed wanted to “slow down to give time to see how the economy is responding to the cumulative impact of the hikes”. However, economists still expect the key interest rate to top 5% early in the new year and to remain above that level throughout 2023.

The trouble with interest rate rises – or the lack of them – is that they can be interpreted by investors in two sharply contrasting ways: they can be seen as a sign that the economy is doing so well that it can stand the extra cost of borrowing, or they can raise fears that the economy will suffer a serious setback. Some economists believe that the US economy and the labour market will not be able to stand a sustained continuation of the hawkish policy of the past few months, so the slightly more dovish tone should go down well with the stock market.

The swift rise in US interest rates compared with other major economies has been a key factor in the strengthening of the dollar against most currencies. In the circumstances, US companies have generally coped well with the reduction in their competitiveness in global markets. American shares have become more expensive for overseas buyers, although existing holders of US stocks have seen a sizeable boost to the value of their holdings when translated into other currencies.

Now that the scale of interest rate rises has started to slacken off, the dollar has eased back, especially against the pound, making US stocks more attractive to British buyers, although the corollary is that share prices have risen on the New York Stock Exchange and Nasdaq. For investors, it is a case of swings and roundabouts.

Meanwhile, President Biden is attempting to press on with measures to help the US economy. His latest package is the Inflation Reduction Act, which despite its name has nothing to do with inflation. It contains $360 billion (£294 billion) worth of subsidies, mainly through tax breaks, for the production of electric vehicles and batteries in the US.

With the Democrat majority in the House of Representatives about to disappear, he is trying to get as much through Congress while the Democrats control both houses as well as the presidency. The new Act is part of a plan to reduce reliance on China that includes the banning of the export of semiconductors to the Asia rival.

- Professional investor poll: biggest risks and market forecasts for 2023

- Five ‘outrageous’ stock market predictions for 2023

The political landscape changes as the US returns to work after the Christmas and new year break. The big imponderable is how Republicans will react to overtures from Democrats seeking political cooperation. The mood in recent years has been increasing polarisation, a movement seized on by former President Donald Trump.

The failure of the Republicans to make sweeping gains in the House of Representatives or to take control of the Senate, plus the comparatively poor showing of many candidates backed by Trump, may bring more moderate voices to the fore or it may encourage the far right to take a more intransigent stance.

Neither outcome is a particular worry for investors. Biden is quite adept at forging compromises and the US will get through two years of deadlock, should that happen, relatively unscathed. The country’s constitution was designed on the principle of checks and balances and even when, as has happened, the government runs out of money, a compromise is always found to raise more.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.