Ecofin U.S. Renewables Infrastructure Trust plc Share Offer

This offer is now closed for applications through interactive investor

Results of the Placing & REX Retail Offer

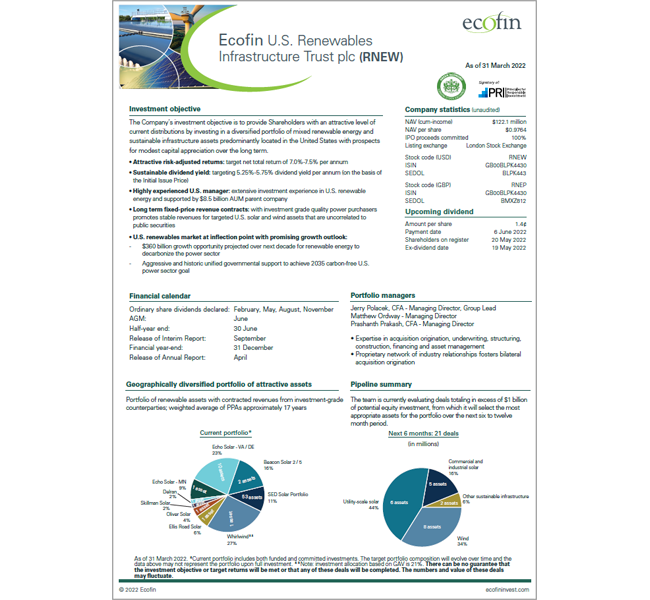

The Issue Price was set at US$1.015 per new Ordinary Share.

The Sterling equivalent issue price has been fixed at 81.64 pence per share, based on the Relevant Sterling Exchange Rate of 1.2432

Ecofin US Renewables Infrastructure Trust plc (RNEW) has successfully raised gross proceeds of $13.1 million through its Placing and REX Retail Offer.

Applications will be made for 12,927,617 new Ordinary Shares to be admitted to trading on the London Stock Exchange's Main Market.

Allocations have been met in full, meaning customers will receive 100% of the amount they applied for, rounded down to the nearest share.

Share allocations and uninvested cash are being credited today (Friday 20 May 2022). Confirmation of allocations will be sent once the shares are showing on accounts.

Please note the allocation policy was set by RNEW and not Interactive Investor.

Offer period

- The Offer Period for the Ecofin U.S. Renewables Infrastructure Trust plc Share Offer closed at 11am on Thursday 19 May 2022.

Trading starts

- Admission and unconditional dealing in the Ordinary Shares is expected to commence at 8am on Tuesday 24 May 2022. There is no conditional dealing period.

- When admitted to trading, the new Ordinary Shares will be registered with SEDOL (Stock Exchange Daily Official List) number BLPK443 and trade under the symbol "RNEW".

- If you buy or sell Ecofin U.S. Renewables Infrastructure Trust plc Shares after admission the relevant share dealing rate will apply.

Key information

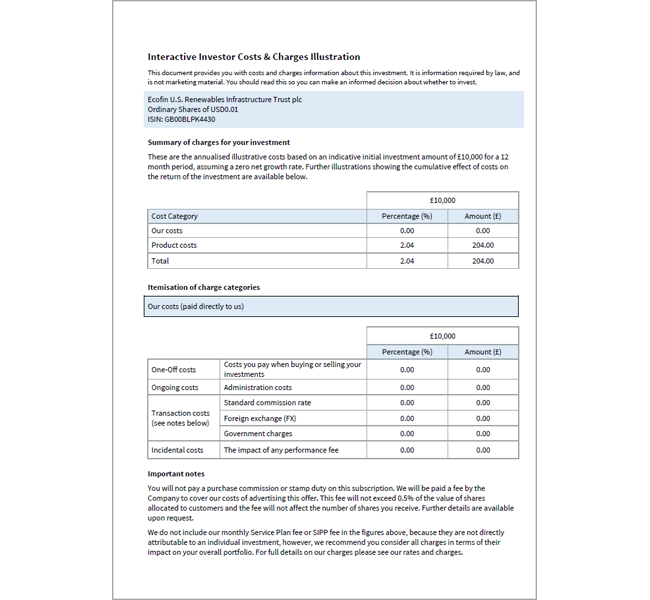

| Issue price per share: | $1.015 |

| Minimum investment: | £1,000 (multiples of £1 thereafter) |

| Stock ticker: | RNEW |

| SEDOL: | BLPK443 |

Expected timetable

| Offer open: | 10 May 2022 |

| Offer close: | 19 May 2022 (11am) |

| Result announced: | 20 May 2022 |

| Unconditional dealing starts: | 24 May 2022 (8am) |

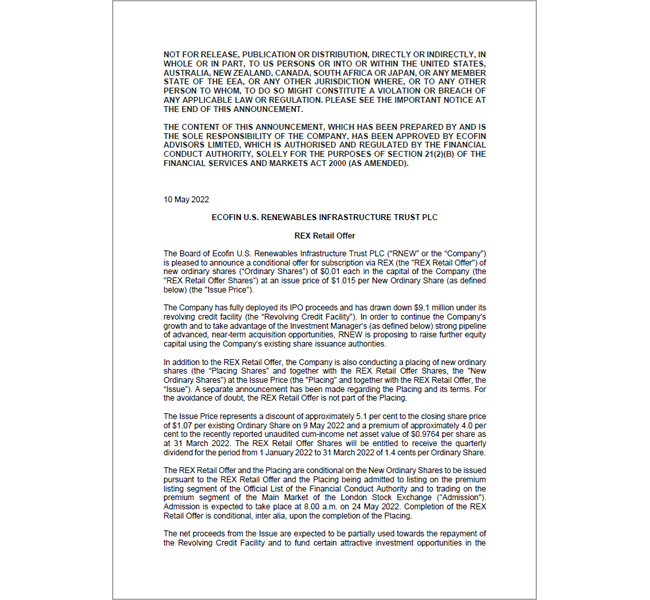

No offering document, prospectus or admission document has been or will be prepared or submitted to be approved by the Financial Conduct Authority (or any other authority) in relation to the Retail Offer, and investors' commitments will be made solely on the basis of the information contained in the announcement of the Company dated 10 May 2022 and headed "REX Retail Offer" and information that has been published by or on behalf of the Company prior to the date of that announcement by notification to a Regulatory Information Service in accordance with the Financial Conduct Authority's Disclosure Guidance and Transparency Rules, the Market Abuse Regulation (EU Regulation No. 596/2014) ("MAR") and MAR as it forms part of United Kingdom law by virtue of the European Union (Withdrawal) Act 2018 (as amended).

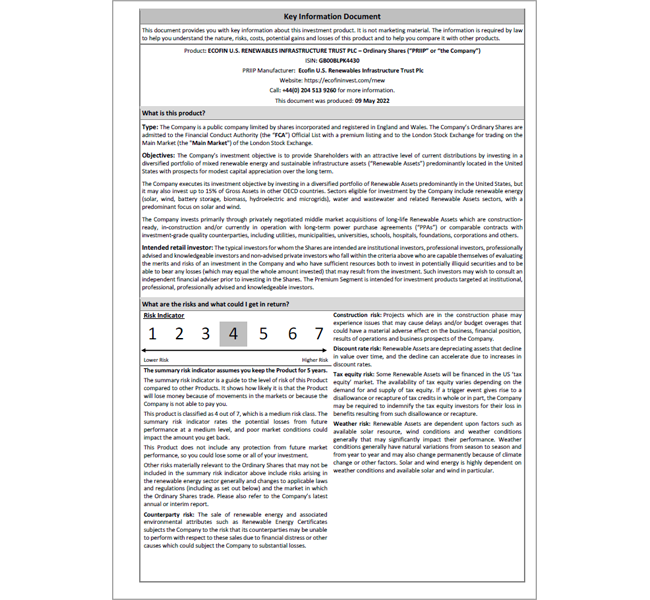

Investing in IPOs carries a high degree of risk. If you are unsure of the suitability of an investment please seek Financial Advice. You are not guaranteed to make a profit, the value of your investments can go down as well as up. You may not get back all the money you invest. Any notification of an IPO on our website is not an endorsement of the issue, nor is it solicitation for interest in the issue. Investment in the Company should not be regarded as short-term in nature. You should consider carefully all of the information set out in the Offer documents, including all the risks attached to investing in the Company before you apply.

"Ecofin U.S. Renewables Infrastructure Trust plc" and the Ecofin U.S. Renewables Infrastructure Trust plc logo are reproduced by kind permission of Ecofin U.S. Renewables Infrastructure Trust plc. All rights reserved.

This announcement has been published by Interactive Investor Services Limited.

This announcement has been prepared and is the sole responsibility of Interactive Investor Services Limited of 201 Deansgate, Manchester, M3 3NW, which is an authorised person for the purposes of the Financial Services and Markets Act 2000.