Important information: As investment values can go down as well as up, you may not get back all the money you invest. Currency changes affect international investments, and this can decrease their value in sterling. If you’re unsure if an investment account is right for you, please speak to an authorised financial adviser. Tax treatment depends on your individual circumstances and may be subject to change in the future. Please note images displayed are for illustrative purposes only.

interactive investor has published its latest instalment of the ii Index, providing data and insights on how the everyday retail investor is performing and positioning their portfolios in this ever-changing market. The ii Index covers all accounts across ISA, Trading Account, and SIPP.

The latest iteration tracks 5 years and 9 months of data, which shows that the average ii investor has seen their portfolio grow by 41.1% — beating the aggregated performance of funds in the IA Mixed Investment 40-85% Shares sector (34%).

The sector can be a useful comparator for private investor portfolios, given its mix of bonds, cash, and shares.

“As our data has shown time and time again, interactive investor customers have a history of great performance – outperforming the IA Mixed Investment 40-85% Shares sector across all timeframes since we started tracking this data in January 2020.

“Even though we’ve seen market volatility over the last sixth months, our customers have seen some brilliant growth in their portfolios, and are a testament to sticking to your knitting and not making any knee-jerk decisions when markets get rocky.

“It’s important to always remember that your portfolio is for the long term – and history shows that these bumps will smooth out over time.”

Camilla Esmund, Senior PR Manager

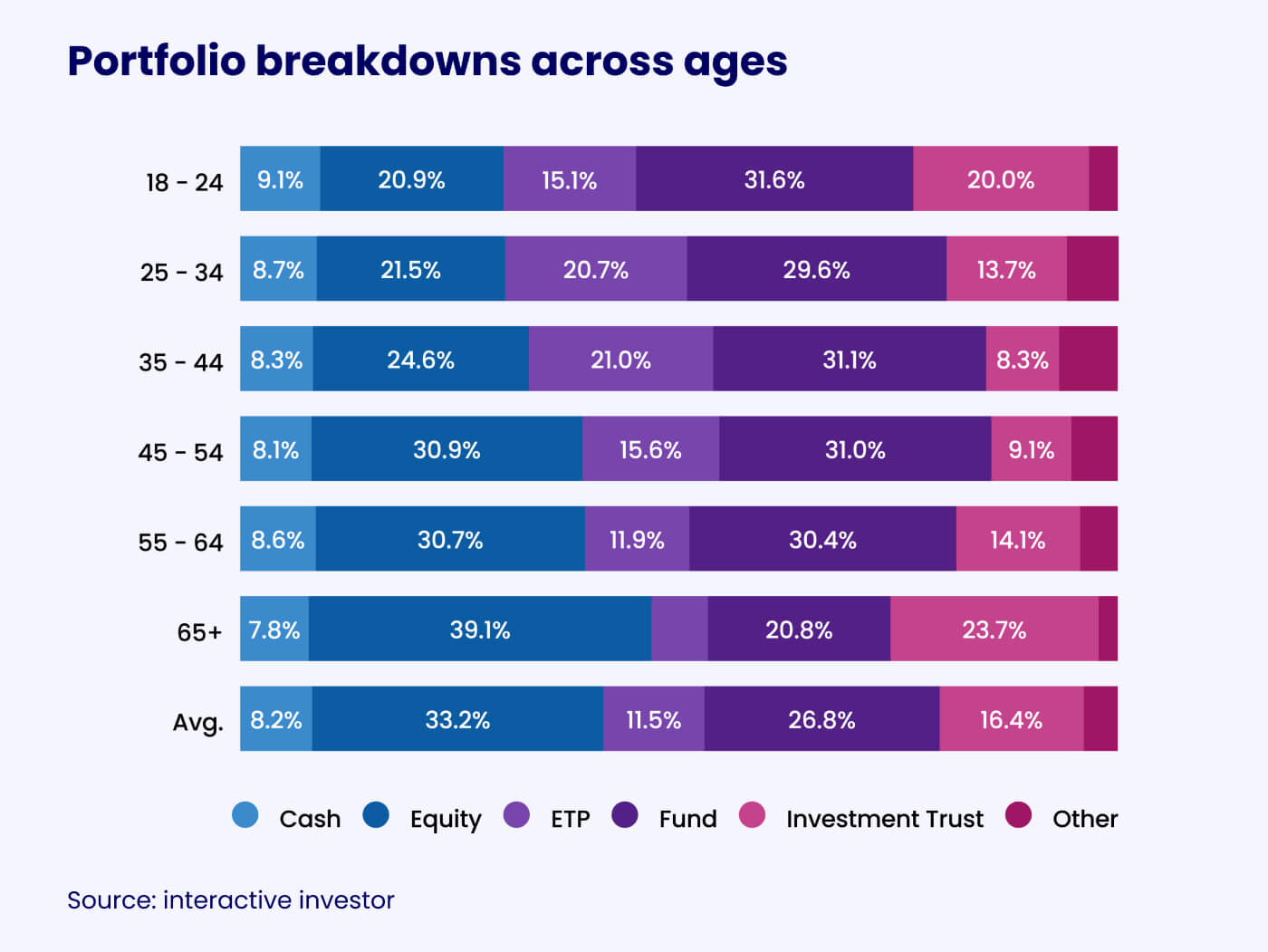

Those aged 35-44 have had a long run of outperforming other age brackets – and the latest data shows that this trend is continuing, with ii customers in this age bracket showing portfolio growth of 46.4% over the five years and nine months of data.

People in this age bracket tend to have a higher weighting to ETPs (Exchange-Traded Products) at 21% and funds at 31.1%, and a lower weighting to investment trusts to the other age groups – only holding 8.3% compared to the likes of those 65+, who hold almost 24%.

ETFs have once again grown in popularity on the platform, with those aged 35-44 now allocating 21% of their portfolios to them, compared to 19% last quarter.

Older investors continue to have a lower weighting to passive funds, with those 65+ only allocating 6% of their portfolio to ETFs.

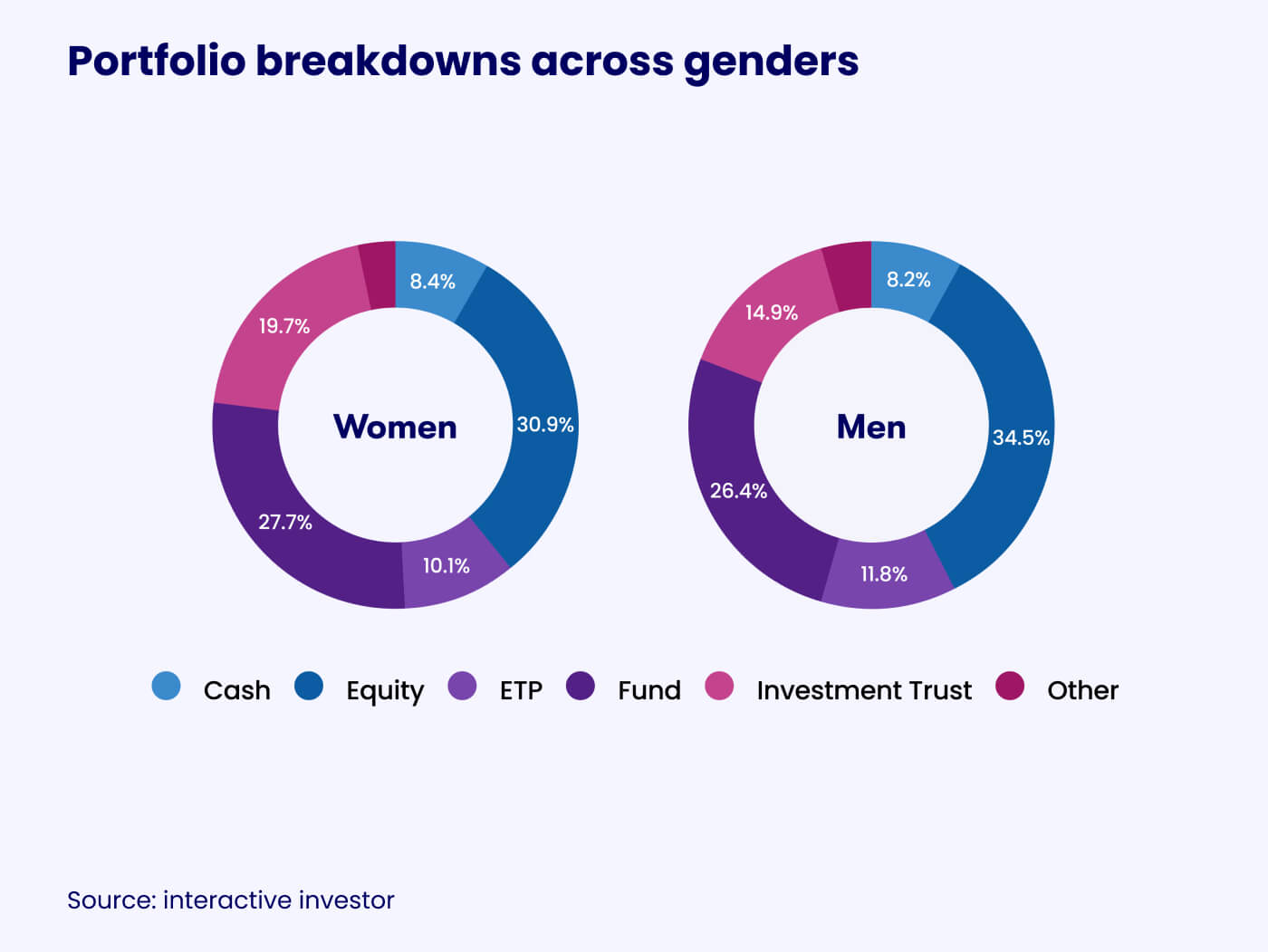

Men and women continue to invest very similarly – with very similar portfolios yielding strong results. Both men and women have great performance, at 41% and 40% portfolio growth respectively. There are very few differences when it comes to how they invest.

Men tend to have a slightly higher weighting to equities (35% versus 31%), where women will have a higher weighting to both investment trusts (20% versus 15%) and funds (28% versus 26%).

In this new section of the ii Index, we highlight that at ii, we have proudly led on shareholder engagement.

We continue to raise awareness of the importance of retail investor votes at AGMs and have implemented a number of initiatives to stop barriers to entry for retail investors.

Thanks to our innovative opt-out rather than opt-in model and also being the first UK investment platform to introduce voting on our app, we currently have 87% of investors opted into voting and have impressive levels of engagement.

In a new section of the ii Index, a new section ‘Market Watch’ covers market insights for the upcoming quarter from interactive investor’s Head of Investments, Victoria Scholar.

For this iteration, Victoria covers the topic of an AI bubble, US and UK markets, precious metals, and emerging markets.

View or download previous instalments of the ii Index.

If you would like to speak to one of our spokespeople or if you would like bespoke content from our expert writers, please contact:

Saffron Wainwright

PR Manager

Email: saffron.wainwright@ii.co.uk