How to build a £1 million pension and ISA portfolio

Craig Rickman crunches some numbers and explains what it takes to amass a seven-figure, tax-efficient pot by the time you reach age 67.

26th March 2024 10:15

by Craig Rickman from interactive investor

Many investors dream of the day that they log in to their online investment account and see a seven-digit sum.

Not only is there the fulfilment that comes with having squirrelled away a million quid, but, unless your lifestyle is particularly lavish, it could be your ticket to financial freedom.

Reaching this milestone is unlikely to happen overnight – unless you receive a sizeable and unexpected windfall – but it’s certainly not out of reach.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

According to estimates, more than a million savers are sitting on seven-figure pensions, while there are over 4,000 individual savings account (ISA) millionaires. Interestingly, around 25% (1,001 to be exact) of them have their ISA savings with interactive investor, making the most of our low-cost, flat fee structure.

Whether you have £1 million in a pension, ISA, or both, it’s an envious position to be in. And using a combination of the two tax wrappers can be prudent. Each offers different tax advantages and access rules, which can give you the best of both worlds when saving and investing for your long-term future.

Let’s explore how you can go about it.

How can I get to £1 million by age 67?

I would argue that with a well-thought-out strategy, most investors with three decades on their side can build a £1 million pension and/or ISA portfolio.

There are, however, several factors that will determine how quickly you get there. These include how much you’ve saved already, your time frame, what you can afford to stick away every year, and how your investments perform. Maximising tax reliefs and third-party contributions are also key, as I explain below.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- How to make the most of your pension allowances before April

So, let’s crunch some numbers and gauge the likelihood if you were to save £500 a month, assuming contributions increase 2% every year to take account of inflation. We’ve also used annual growth of 5% as an attainable target.

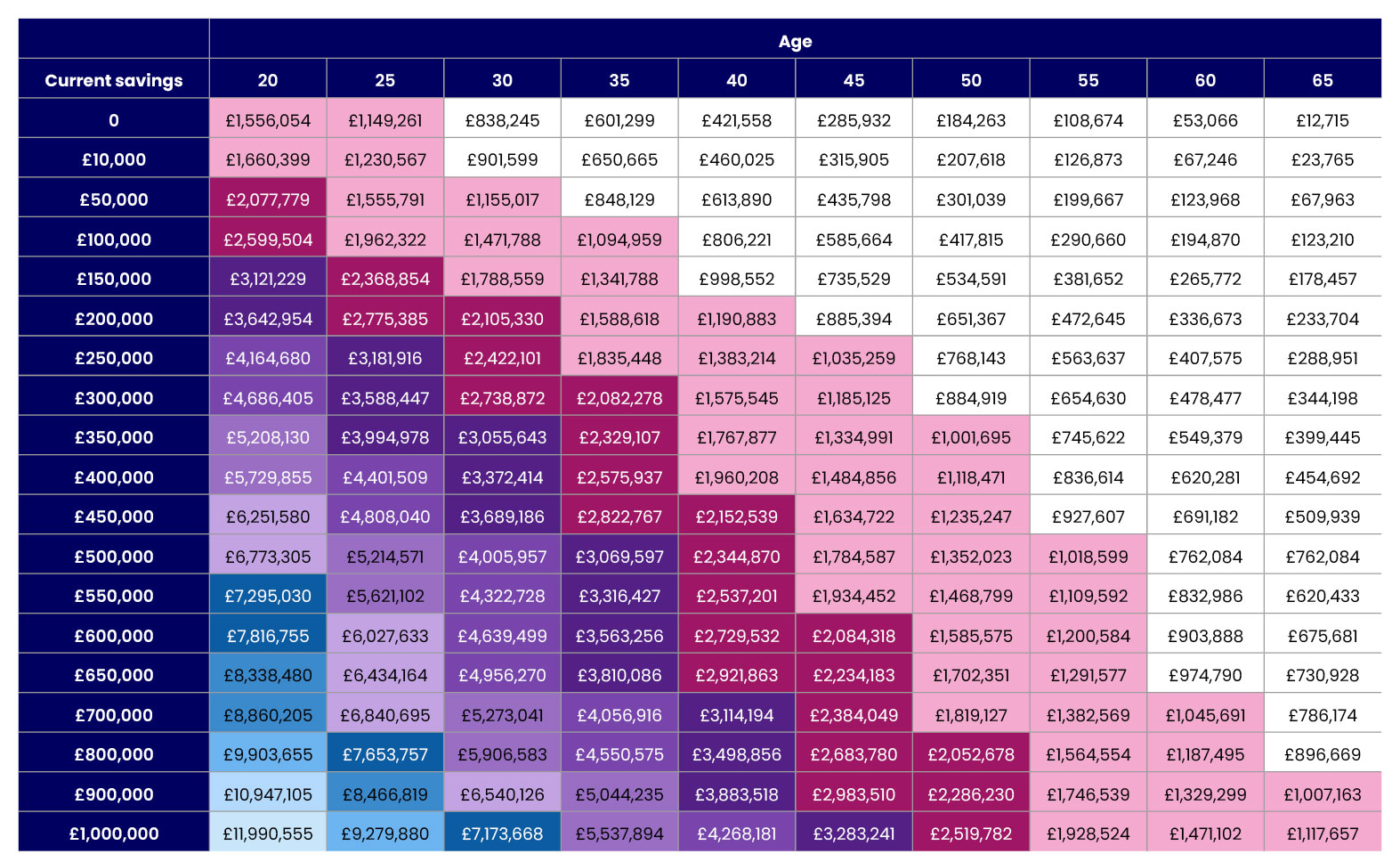

The table below shows whether you’re on track to build a £1 million portfolio by age 67.

Just find your age on the top row, then how much you’ve tucked away already in the left-hand column – the cell where they meet shows the amount you might expect given our assumptions.

Source: interactive investor. Table shows how much you could expect to receive with the pensions and/or ISA savings you have at different ages up to 67. Find your age on the top row, then your current level of savings in the left-hand column. The cell where they meet shows the amount you might expect at age 67. Assumptions: monthly contributions of £500 rising at 2% each year to factor in inflation, with annual investment growth of 5% after charges.

To see the hi-res version, please click here.

I’ve chosen a monthly contribution of £500 as it should be palatable for most investors – either now or in the future. Clearly, affordability is a personal thing, and will change over time. The older you get, it might be that you can afford to increase your contributions.

For those worried that £500 a month is a stretch too far, it’s worth noting that this figure includes money from third parties, such as upfront pension tax relief and employer pension contributions (I explain more about this further down).

The thing that really leaps out from this table is the importance of time. The difference between starting the savings process when you’re age 20 or 30 is a whopping £700,000, highlighting the powerful nature of compound returns.

- Seven pension tips I learned as a financial adviser

- Jeff Prestridge: these funds are robust long-term pillars of an ISA

It also shows the merit of doing what you can to build a healthy savings pot by the time you reach middle age. A 45-year-old who’s already tucked away £250,000 could get to around £1 million in 22 years’ time based on our assumptions.

The table should also offer some optimism to those who feel it’s too late to make a difference. Even if you’ve hit 40 with little to no savings, by committing to £500 a month you could still build a pot of £400,000 by age 67, while a 50-year-old could amass £184,000. These may not be seven figures but will vastly improve your lifestyle in old age.

Make sure you consider inflation

The threat that inflation poses to our money has been illuminated in the past few years. This has been an unusual period, to put things mildly, but over the course of your lifetime even small annual increases in prices can mount up over time.

So, if you’re 20, a £1.5 million pot portfolio at age 67 won’t have the same buying power as it does today. If you’re closer to later life, the less impact inflation will have. But whatever your age, it’s important to factor in future price rises.

What I should I think about when choosing between pensions and ISAs?

Using both pensions and ISAs can be a great way to build a £1 million portfolio, but you don’t have to use them in equal measure. While there are no set rules on how to split contributions, there are a few things to consider.

The value of employer pension contributions

If you’re employed, maximising your company pension can make a huge difference to how quickly you reach your target. Under current laws, if you contribute 5% of salary, your employer must contribute 3% (within certain limits). Some, however, are more generous and will offer to pay in more, although you might have to match their payment.

So, let’s say you earn £35,000 a year, the average UK wage. If your employer offers a 6% matching arrangement, taking the total to 12%, the combined monthly contribution to your pension pot will be £350.

Of this, the cost to you will be just £140. That’s because you get 20% tax relief on your personal monthly contribution, boosting the total to £175, while your employer will pay the other £175.

Get an upfront boost where you can

As noted above, you get upfront tax relief on anything you pay into a pension at your marginal rate, so long as it’s within the lower of 100% of earnings or £60,000. This can provide a big help to propel you towards the seven-figure target.

If you make personal contributions, such as to an ii self-invested personal pension (SIPP), you’ll get an immediate upfront 25% boost from the government, and you can claim back any extra if you pay either 40% or 45% tax.

In short, if you’re a higher-rate taxpayer, a £500 pension contribution will ultimately cost you just £300.

If you’re under 40, you can also consider the Lifetime ISA, as you’ll get a 25% bonus on what you pay in up to a maximum of £1,000. However, if you don’t use the money to buy your first home, you must wait until age 60 to access it.

Use ISAs for access

The upfront tax breaks of pensions are clearly valuable, but there are some things to be aware of.

While pensions and ISAs both sit within the “tax wrapper” banner, they have different rules regarding tax and access. In simple terms, with pensions you get tax relief on the way in but pay tax (on 75% anyway) on the way out. With ISAs, the situation reverses.

The access rules also differ. You can encash ISA money whenever you like, but can’t touch your pensions until age 55 (rising to 57 in 2028).

It’s important to factor these rules into your plan, as there might be instances where you need or want to draw from your investment portfolio sooner.

This may include things such as buying a home, jetting off on nice holidays or supporting children through education.

- Nvidia and Scottish Mortgage made me an ISA millionaire, but now I back these funds too

- ‘I made £80K on an AIM share’ – how an ISA millionaire’s portfolio evolved

We also can’t ignore the unexpected events that life has a habit of throwing up. Things like losing a job or the death of a loved one could trigger a need to access your investments and may also restrict your scope for long-term saving during certain periods. And that’s OK – just get back on track as soon as you can.

The accessibility of ISAs is also key if you plan to retire early.

Let’s say you aim to pack up work at 53. Although you won’t be able to access your pensions at this point, you don’t have to cancel your plans. You will, however, need funds to fill the gap until you can draw from them. ISAs are your friend here.

By the same token, you should dip into your portfolio only when absolutely necessary as the less you draw, the quicker you’ll get to the £1 million holy grail.

What’s the situation with inheritance tax (IHT)?

In short, pensions typically escape IHT - though your heirs could pay income tax if you die after age 75 - while ISAs (unless you invest in qualifying AIM shares and hold them for two years) usually don’t. If you have an IHT problem that you’re looking to solve, this is something to consider. But if you’re years from retirement, growing rather than preserving your wealth will likely be a greater priority.

What should I invest in?

There’s no right or wrong answer when it comes to risk. It’s a personal thing and will depend on how comfortable you are with sharp ups and downs.

When investing for the long term, it’s important to choose investments that offer the best chance of growing your money, without giving you sleepless nights.

If you’re stuck for ideas and would like some steer, you may find these articles from David Prosser,Faith Glasgow, and Kyle Caldwell of assistance.

- ISA tips: how to invest £10,000, £50,000 and £100,000

- Core and satellite funds for a £100K ISA portfolio

There are a couple of key things to remember. First, make sure you spread your investments far and wide, a process known as diversification, as this will avoid hedging your bets on a concentrated part of the market.

And second, reinvest any dividends rather than having them paid into your bank account. The compounding effect can make a notable difference to your eventual pot, especially over long periods.

Should I stick with my strategy or change things as I age?

In general, you should avoid making any knee-jerk decisions as your investments grow. As professional fund buyer Algy Smith-Maxwell noted in a recent episode of interactive investor’s On the Money podcast: “If I had £1,000 or £100 million, I genuinely wouldn’t change what I would do.”

However, sometimes a change of course might serve you well – especially if you’re new to investing and still crafting your preferred style.

If certain funds, investment trusts or shares are consistently underperforming, or you feel that your platform costs are pricey, then switching to alternative investment options or a new provider could be a smart move.

Elsewhere, de-risking as you approach age 67 can make sense for some people, but whether it’s suitable will depend on your goals in later life.

Either way, the good thing about ISAs and SIPPs is that you can switch investments without triggering capital gains tax (CGT), which is especially useful once your portfolio grows to a sizeable amount. If you held this money outside tax wrappers, HMRC could grab up to 20% on any gains as switching funds is deemed a disposal under UK tax rules.

Don’t forget about fees

This one is more important than you initially might think. Even small differences in cost can seriously harm investment growth over time.

Research by the lang cat consultancy found that your choice of platform alone could knock £85,000 off your portfolio over a 30-year period, elongating the time it takes to reach £1 million by a few years.

Focus on your personal goals

While £1 million is a nice round figure to aim for - and one that would likely secure your financial future - I’ve purely used this amount as a gauge to show how you can build future wealth, without sacrificing everything today.

But a more appropriate approach is to focus on and save towards the financial goals you want to achieve during your lifetime, which will be more expansive and nuanced than purely amassing a sum of money to draw from down the line.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.