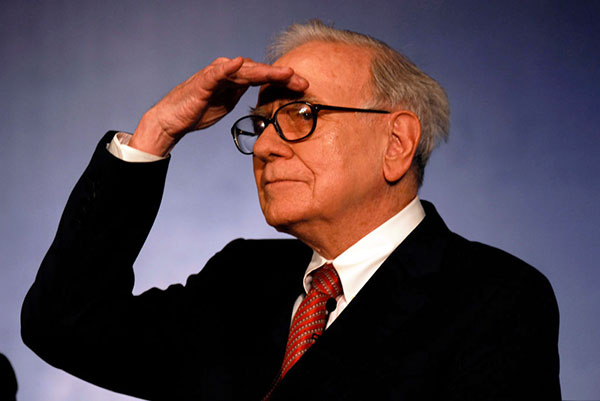

Five ways fund investors can get Warren Buffett in their ISA

Funds that follow the legendary investor’s approach to stock picking are available to UK investors. Sam Benstead highlights a handful of options.

27th March 2024 11:03

by Sam Benstead from interactive investor

Legendary investor Warren Buffett is known for bold bets on “wonderful” companies – those firms that have a moat around their businesses, such as a strong brand, coupled with steady growth, and all at a reasonable valuation.

Investors could look for companies that fit his strict criteria (here five professional stock pickers selected UK firms that Buffett might buy), or they can even own a collective investment that picks shares based on the traits Buffett looks for.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Picking a fund is a lower-risk option, as even the most well-researched stock ideas can go wrong, while a fund spreads risk across lots of positions.

Here are five ways for fund investors to get a slice of Warren Buffett in their portfolio.

CFP SDL UK Buffettology Fund

The clue in the name with this one. Run by Keith Ashworth-Lord by boutique investment firm Sanford DeLand, CFP SDL UK Buffettology Fund seeks to buy and hold businesses that fit Warren Buffett’s definition of an economic “moat”.

To have a wide moat, businesses need to have some sort of edge that keeps competitors at arm’s length, such as a powerful product or brand with a loyal customer base, intangible assets, a patent on proprietary technology or the “network” effect, whereby goods and services become more valuable as more people use them.

Ashworth-Lord says a moat gives them a competitive advantage over rivals and therefore they can deliver better profits over the long term.

- Pros name five UK shares Warren Buffett might put in his ISA

- Nvidia and Scottish Mortgage made me an ISA millionaire, but now I back these funds too

The fund manager says that businesses with wide moats have better than average profit margins. For the portfolio, the gross profit margin is 58.9%, which compares with 40% for the UK stock market.

Ashworth-Lord says the largest position, Games Workshop Group (LSE:GAW), has a gross profit margin of 68.3%. Operating profit margins in the portfolio, which also accounts for staff and marketing costs, are 25.1%, which is above the 15% average of the UK market.

VanEck Morningstar US Sustainable Wide Moat Ucits ETF

This exchange-traded fund (ETF) tracks an index of American shares that have strong moats around their businesses, which should give them sustainable growth and higher than average profit margins.

Investment research and data group Morningstar gives moat ratings and fair value estimates to companies. This is to identify high-quality businesses that are not too expensive.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- How many funds to hold and what to consider when building a portfolio

The Intercontinental Exchange, Walt Disney Company and Ecolab are the top positions. The VanEck Morningstar US Sustainable Wide Moat Ucits ETF is “equal weighted”, meaning that position sizes are all similar, at about 2.5% each.

Technology and financial services are the biggest investment themes in the fund. The index has delivered five-year annualised returns of 13.3%, which is ahead of the 12.2% annualised return for the MSCI World Index.

There is a US dollar (MOAT) and pound sterling (MOGB) share class for the ETF.

Fundsmith Equity

Terry Smith is known as Britain’s Warren Buffett. His £25 billion Fundsmith Equity fund has delivered 15.7% annual returns since launch in 2010 by investing in what he calls “good” businesses.

Such firms have high returns on capital, meaning that they can invest their profits to deliver growth. He also looks for enduring brands that have stood the test of time, as well as firms that have dominant positions in their industries.

His top shares currently are Novo Nordisk, Microsoft, Meta Platforms and L'Oreal . Healthcare and consumer staples are his largest sector bets, at 27.7% and 26.4% of the fund, while technology is just 11%.

Despite an excellent long-term record, the fund has failed to beat the MSCI World index for the past three calendar years.

Smith says this is because he does not follow investment fads and has avoided a number of the “Magnificent Seven” shares that have recently been powering markets higher.

He said: “Brokers who want to get you to do things have wonderful ways of inventing names for things...the BRICS, Magnificent Seven, the FANGs.

“The Nasdaq delivered a 43.4% return last year. These seven stocks accounted for 67.8% of that return. If you didn't own all or most of these stocks, it was close to impossible to outperform.”

Lindsell Train UK Equity

Nick Train is another UK-based fund manager who is often compared to Warren Buffett.

Like Terry Smith, he looks to find high-quality businesses that can grow in any economic backdrop. His focus is on UK shares, with accounting group Sage, and data firms RELX and Experian currently the largest positions in his £3.85 billion Lindsell Train UK Equity fund.

Diageo is another large investment for Train. He says that Warren Buffett’s investment vehicle, Berkshire Hathaway, now owns 2% of the drinks company.

Train said: “We note Berkshire Hathaway has reaffirmed its enthusiasm for the company, by adding to its stake. With the exception of Legal & General Group (LSE:LGEN) and Lindsell Train Limited, there appears to be no other UK institutions among the top 10 shareholders of this exceptional UK-listed business.”

- Nick Train: the UK stock market has a dividend problem

- Nick Train on succession planning and the one share he expects to hold forever

One of the biggest investment ideas is that companies that own unique data will be well positioned to benefit from developments in artificial intelligence (AI).

Train says: “The boom in digitisation in recent decades and the subsequent explosion of data has fuelled another boom – one in the value of companies best placed to aggregate and make sense of this data.

“An important part of this tech advancement is the recent leap forward in artificial intelligence, i.e. the combination of machine learning algorithms and large data sets, which together generate predictions, classifications and insights which enhance problem-solving.”

Among the companies set to benefit, Train cites RELX, Sage, and London Stock Exchange Group.

Berkshire Hathaway shares

Not satisfied with Buffett imitators, investors can get access to the real deal by owning shares in Berkshire Hathaway Inc Class B (NYSE:BRK.B).

Buffett, aged 93, is still chief executive of Berkshire Hathaway, which is his investment holding company where he owns stakes in a wide range of businesses.

As of 2024, his top stock positions are Apple, Bank of America, Chevron, Coca Cola, and American Express. Apple accounts for about half the portfolio.

- Terry Smith on why Fundsmith Equity has underperformed for three years

- Magnificent Seven: time to take profits? Here’s what the pros think

Buffett has made a recent move into Japanese shares and now owns about 9% each of the top five trading firms there: Marubeni, Mitsubishi, Itochu, Mitsui and Sumitomo.

Given the size of the investment company, at a market cap of nearly $900 billion (£700 billion), investments must be in large companies in order to move the dial. This makes it harder to find undervalued opportunities and even Buffett himself has said that Berkshire shares may not do much better than just owning the S&P 500 index.

Berkshire shares have two share class, A and B. B shares trade at $416 compared with $628,390 for the A shares. The latter carries greater voting rights. Both share classes grant access to Berkshire Hathaway’s annual meeting, held in early May each year.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.