Is this attractive share with limited downside a buy?

One of these shares has taken a dip, another is at a multi-year high. There’s also an enticing dividend and comfortable valuations. Overseas investing expert Rodney Hobson reveals what he’d do with them now.

8th May 2024 08:42

by Rodney Hobson from interactive investor

Electric cars have lost a lot of their buzz, with adverse publicity about their mileage range, heavy weight and possibly fire-prone batteries. Perhaps it is time to reconsider traditional car manufacturers despite the ire of the green lobby. They offer a compromise between fossil-fuelled models and an oil-free future.

Ford Motor Co (NYSE:F) has already reported that its sales of hybrid cars were up 42% to 38,421 vehicles in a record first quarter. Given that this type of motor is still in the minority – total sales were just under 450,000 – there is clearly plenty of scope for more of the same. See Keith Bowman’s expert analysis ii view: Ford celebrates record hybrid vehicle sales

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Sensibly, Ford decided at the same time to delay the launch of its larger electric cars by two years to 2027. Development of production sites will continue but without the rush to produce vehicles that few people are likely to buy just yet.

Over 60% of Ford’s sales are in the United States and Canada, and the US Environmental Protection Agency has relaxed its target for two-thirds of vehicle sales to be electric by 2032. Further concessions are likely in a country that has shown little appetite for going green at all costs.

All-electric vehicles (EVs) accounted for less than 6% of total production last year so Ford will not be caught out badly if the market for EVs slips back, as seems likely given the current saturated state of this subsector. Ford made an operating loss of $4.7 billion in its EV division last year and is likely to lose even more in 2024 so this slowdown is as welcome as it is unsurprising.

- Best bits from Warren Buffett’s annual meeting 2024

- Stockwatch: a buying opportunity soon in this Magnificent Seven stock?

- Tesla to speed up ‘affordable’ models amid profits slump

However, it came as a real disappointment when Ford announced a 24% drop in first-quarter net income to $1.3 billion despite a 3.1% improvement in revenue to $41.5 billion. The carmaker is still reasonably optimistic about the full year, though, predicting that profits are likely to edge a little higher, helped by $2 billion of cost reductions in materials, manufacturing and distribution.

Those results took the top off the shares, which have slipped back from $13.60 to $12.50 over the past five weeks. The price/earnings (PE) ratio is a comfortable 12.8 while the dividend looks enticing at 4.8%.

Source: interactive investor. Past performance is not a guide to future performance.

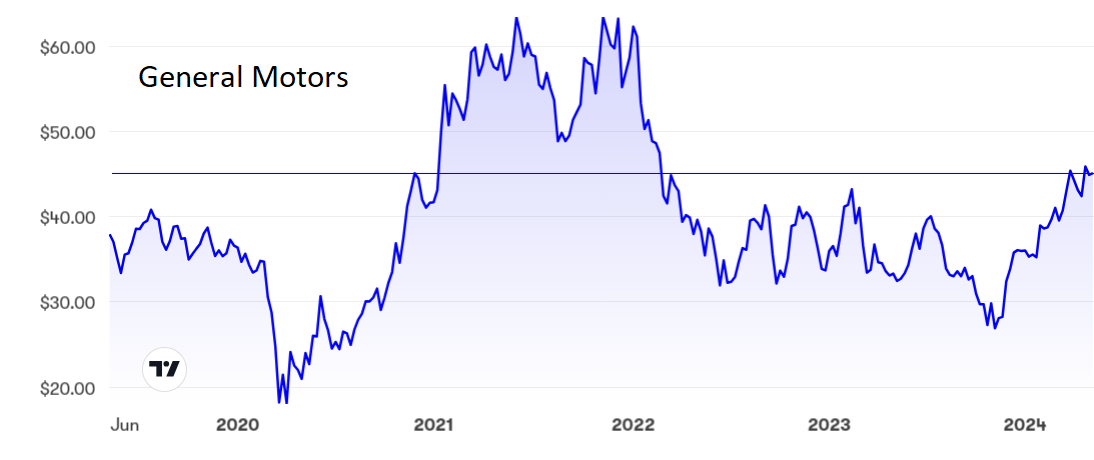

Larger rival General Motors Co (NYSE:GM) had a better quarter, with revenue up 7.6% to $43 billion and net income leaping 24% to just under $3 billion. The figures prompted GM to raise its full-year outlook, though only slightly, with profits seen as landing somewhere within a fairly wide range from $10.1 billion to $11.5 billion.

The shares have had a strong run, from $27 last November to $45 now, still leaving the PE at only 5.5. The yield is pitiful at 0.9%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: Ford shares look attractive after the recent dip. With a solid floor established at $12, where I suggested buying in January, there looks to be little downside. Well worth considering as a buy.

GM is also a potential buy but with the shares near a peak I would be inclined to hold off to see if they test the recent floor at $42.50.

Update: Struggling companies rarely collapse overnight, they usually spiral into oblivion, giving shareholders many opportunities to get out while they can still salvage some value. Thus it has been at exercise equipment maker Peloton Interactive (NASDAQ:PTON), where shares are down from a peak of $160 to $3.5 in little over three years. Now Barry McCarthy, the man brought in to sort out the mess, has quit after two fruitless years, but not before sparking off another round of redundancies. There is no other way to bring spending down to equal revenue, he says. There is also no reason to think this latest measure will do the trick. If you haven’t got the hint yet, you deserve to suffer the further decline in the share price that will inevitably come.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.